UK Inflation Holds at 3.8% as Supermarkets Prepare for a Cost-Conscious Christmas

UK inflation stayed at 3.8% in the twelve months to September 2025, unchanged from August, according to official figures from the Office for National Statistics. The broader CPIH measure, which includes owner-occupiers’ housing costs, stood at 4.1%. On a monthly basis, prices were flat.

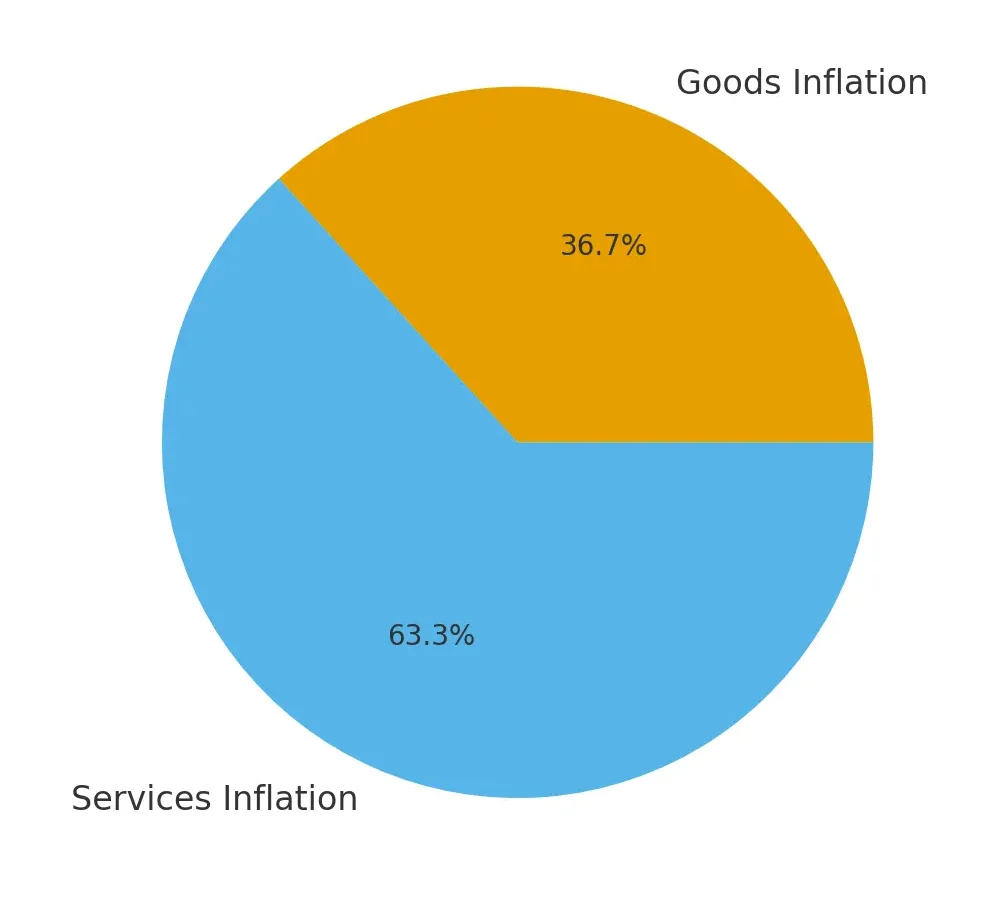

Behind the headline number sits a familiar pattern: goods inflation easing slightly to around 2.9%, while services inflation remains stubborn at almost 5%. The ONS attributes upward pressure mainly to transport costs – especially petrol – partly offset by falls in recreation, culture and some food categories.

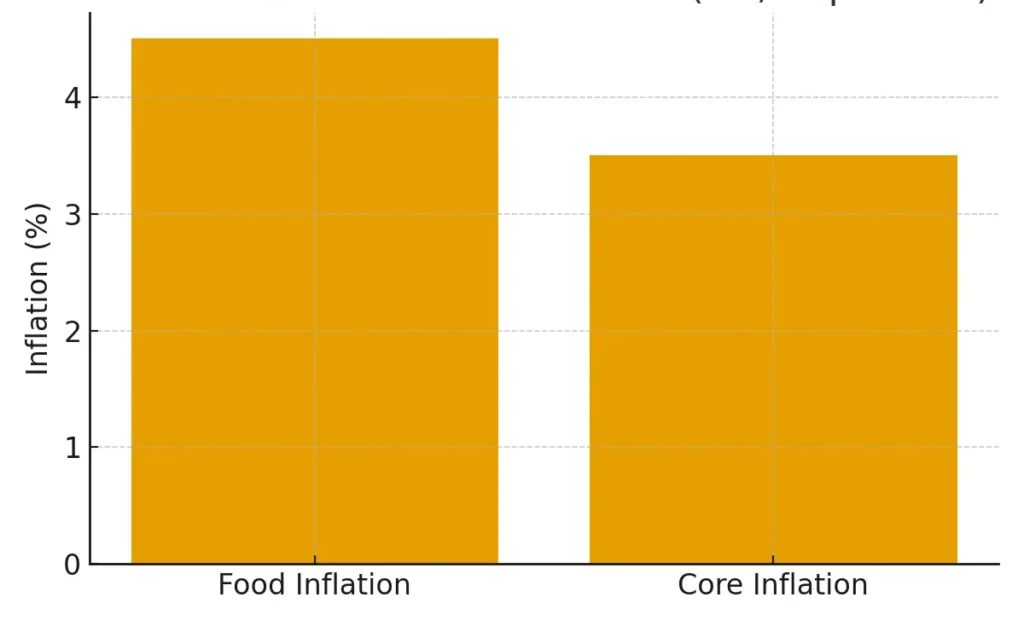

Core inflation, which strips out food, energy, alcohol and tobacco, eased to 3.5%. It’s a marginal move, but for policymakers it signals the first real hint that underlying price growth is slowing. The Bank of England noted this in its latest Monetary Policy Report, though it also warned that inflation is still almost twice its 2 % target. Rates remain high, and will likely stay there until the Bank is certain that inflationary pressure has been contained.

The Grocery Impact

For supermarkets and FMCG suppliers, the stability in headline inflation brings mixed news.

Food inflation – one of the sharpest pressures over the past two years – has finally cooled from 5.1% in August to 4.5%. That easing should filter through to wholesale pricing and manufacturing costs over the next quarter. But the wider picture is less forgiving: services inflation, driven by labour, logistics and energy, is still elevated.

That means store operations, distribution and delivery all remain expensive. Retailers can’t yet relax. Every promotional decision, every shelf price, still has to balance thin margins against the reality of cautious consumers.

Consumers Under Pressure

Across the UK, wage growth has slowed while household bills have stayed high. Even if the inflation rate is steady rather than rising, shoppers still feel the squeeze. Real incomes are under pressure, and people are making different choices inside the store.

Value-tier and own-label products continue to gain share. Supermarkets have widened entry-price ranges, and discounters are seeing higher basket volumes. The more inflation persists, the more normal this behaviour becomes.

Pre-Christmas demand may come earlier this year. When inflation expectations rise, shoppers often bring forward festive spending to lock in prices. Research firms have already reported higher search traffic for Christmas groceries and frozen party food in October than in previous years.

Behind The Numbers

The ONS compiles its inflation index from a detailed monthly price survey of thousands of products and services across the country. Each item’s weight in the basket reflects household spending patterns – from rent and fuel to breakfast cereal and chocolate.

In September’s data, the downward contributions came from recreation and culture, restaurants and hotels, and some clothing lines. The biggest upward pressures were transport and housing-related costs. For supermarkets, that matters indirectly: higher fuel costs raise distribution expenses, while sticky rents and mortgage rates restrict discretionary spending.

Producer-price data released at the same time shows domestic food inputs up nearly 4% year-on-year. Metals and packaging materials have firmed slightly after earlier declines. Those signals suggest that cost pressures for private-label manufacturing and packaging supply chains are easing slowly rather than collapsing.

The Bank of England’s stance

The central bank still views inflation as “uncomfortably high”. Its economists expect CPI to fall close to 3% early next year, but warn that services inflation and wage growth could keep price levels elevated well into 2026. The Monetary Policy Committee voted narrowly to hold the Bank Rate at 4% in October, emphasising that “high enough for long enough” remains its guiding principle.

For retailers, that means borrowing costs stay expensive. Store investment, fleet renewal, and supplier financing all carry higher interest charges. The era of cheap credit that once supported large capital projects hasn’t returned yet.

Supermarkets And Suppliers: Adapting To The New Normal

-

Pricing strategy:

With goods inflation easing, supermarkets can be more flexible on product pricing and promotions. Many will front-load offers in November to capture early spending. The challenge is to stay competitive on visible lines – bread, milk, cheese – without eroding profit on high-service areas such as delivery and convenience.

-

Private label strength:

Own-brand continues to outperform national brands, both on volume and shopper perception. Inflation has accelerated that trend. Buyers are using data from loyalty cards and POS analytics to fine-tune price ladders, ensuring every category has a clear value option.

-

Supplier negotiations:

As raw material prices stabilise, supermarkets are pushing suppliers for cost transparency. Shorter contract review cycles and index-linked clauses are becoming common. The biggest retailers now ask for live input cost data before agreeing to promotional funding.

-

Operational efficiency:

High labour and energy costs are pushing investment in automation and AI-based forecasting. Several UK chains have accelerated trials of energy-saving refrigeration, smarter logistics routing, and night-time restocking systems to reduce overtime.

-

Consumer communication:

Inflation fatigue means shoppers are more cynical about pricing claims. Transparent labelling, “Always Low” guarantees, and plain-spoken value messaging resonate far more than percentage-off stickers.

Pre-Christmas Outlook

Heading into the final quarter, the grocery sector faces a familiar tightrope: support demand with strong promotions, but protect margin from lingering cost inflation.

Analysts expect November CPI data (covering October prices) to hover near 4%. That would mark the third straight month without significant movement. Even if headline inflation begins to fall in early 2026, services inflation will take longer to unwind. For supermarkets, that means a Christmas trading period defined by tactical pricing rather than structural recovery.

Promotions are expected to peak earlier than usual, centred around the last week of November. Retailers will use sharp headline deals to pull traffic while managing depth carefully. Expect visible cuts on confectionery, soft drinks and seasonal bakery, but modest savings on fresh produce and meat where input costs remain volatile.

Online grocery remains the inflation outlier. Delivery slot costs and packaging surcharges continue to rise, reflecting fuel and wage pressures. Several chains are experimenting with flexible delivery pricing – cheaper mid-week slots, premium charges for weekends – to balance volume with cost.

What Happens Next

The next inflation release, due in mid-November, will provide the first clear picture of price behaviour as the festive season builds. A soft print below 3.8% would confirm that inflation has turned; a rise above 4% would suggest persistence.

Either way, supermarkets are unlikely to see an immediate return to pre-pandemic cost structures. Energy contracts, wage settlements, and logistics capacity will keep the cost base elevated. The focus now is stability: keeping prices predictable, maintaining volume, and defending shopper trust.

As one senior retail analyst put it this week, “Inflation is no longer a crisis for supermarkets – it’s an operating condition.”

Editor’s note

This analysis is based on verified data from the Office for National Statistics Consumer Price Inflation release for September 2025, the Bank of England Monetary Policy Report, and industry commentary from retail and FMCG market sources. Figures and interpretations reflect publicly available information at the time of writing.