US FMCG trends 2025 show a market moving under cost pressure, with shoppers watching every dollar while still expecting quality, convenience and reliability from the brands they bring home. The shift feels steady, not dramatic, but it touches every aisle in the store.

People are still spending, but they stop and think before placing an item in the cart. Retailers feel the same pressure. That tension shapes the entire FMCG landscape across supermarkets, club stores and regional chains.

A Retail Market Under Cost Pressure

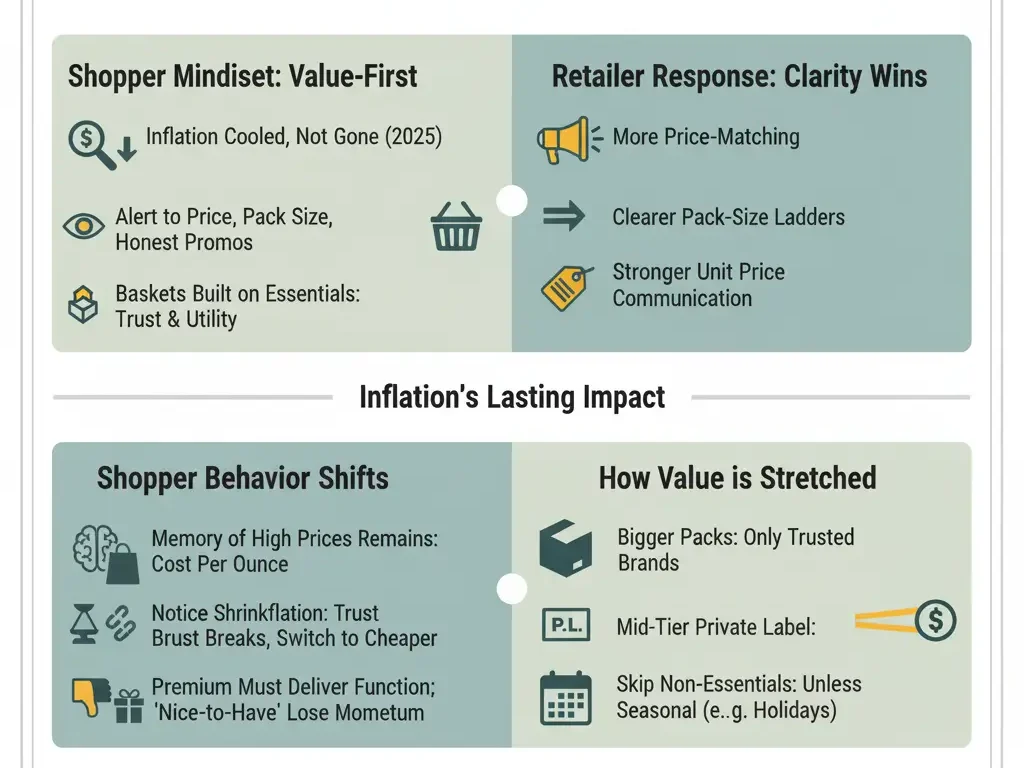

The US grocery market continues to operate in a value-first mindset. Inflation cooled in 2024, but not enough for households to feel relaxed in 2025. Shoppers stay alert to price changes, pack sizes and whether promotions feel honest.

Many baskets are now built around essentials. People avoid unnecessary risk. They buy what they know, what works, and what will actually get used at home. You can see this in almost any store aisle — shoppers compare quietly, then choose the safest option.

Retailers respond with more price-matching, clearer pack-size ladders and stronger communication around unit price. These small calculations guide everything in US supermarkets, from shelf planning to weekly promotions.

Inflation’s lasting impact

Even when the inflation rate slows, the memory of high prices stays. Shoppers keep scanning shelves for cost per ounce rather than the sticker price. They also notice shrinkflation quickly, and once trust breaks, they move to cheaper alternatives.

This behaviour affects all FMCG categories — food, beverages, household, beauty. Premium items still sell when they truly deliver function or clear quality, but “nice-to-have” products lose momentum fast.

How shoppers stretch value

People buy bigger packs only when they trust the brand. They choose mid-tier private label when they want predictable value. They skip non-essential categories unless there is a strong seasonal draw, like back-to-school or holiday meals.

These habits make it harder for brands to push new launches unless the product feels purposeful. Retailers see this clearly and shift shelf space to proven sellers, not experiments. It’s one of the reasons store assortments feel tighter this year.

The Big FMCG Categories in US Grocery

The FMCG market in the US is broad and competitive, but a few clear patterns stand out in 2025. Some categories gain strength. Others flatten. Some rely heavily on promotions just to maintain volume.

Below is a clean, category-by-category view of how the market is moving.

Packaged Foods

Packaged foods stay strong because shoppers want stability. This is the fallback category when money feels tight or daily life feels busy. Items like pasta, rice, canned vegetables, soups, mac and cheese, cereals and snacks continue to move at steady levels.

Convenience plays a major role. Many households rely on ready meals, frozen products or meal kits during weekdays. Clean-label improvements help, but affordability decides the final sale.

Retailers also use packaged foods to build loyalty. Club-size packs, simple price tiers and consistent private-label flavour profiles are core strategies across the channel.

Beverages

Beverages show mixed signals. Functional drinks — hydration boosters, energy blends, electrolyte sticks, vitamin waters — continue rising because they fit into daily wellness routines.

Coffee and tea stay stable. Soda moves slowly unless pricing is sharp or multipacks are promoted. Premium juices and smoothies feel pressure as shoppers reclassify them as extras.

Many people shift to powdered drink mixes to save money, and that small shift influences volume across stores. Retailers respond by giving more room to performance beverages and trimming slow-moving premium lines.

Household

Household products depend heavily on price. Detergents, paper towels, dish liquids, trash bags — all feel expensive to shoppers. People compare unit prices more carefully here than almost anywhere else.

They stick with trusted brands but often downgrade pack sizes or switch to value ranges. Private label grows strongly, especially in cleaning products and paper categories, where many shoppers now say they “can’t really tell the difference.”

Retailers also promote concentrates and refill formats to manage costs and simplify the shelf.

Beauty and Personal Care

Beauty behaves differently from most FMCG categories. People still buy daily beauty essentials even when money is tight — soaps, deodorants, shampoos, moisturisers, toothpaste. These low-ticket items keep demand stable.

Premium beauty slows unless the product delivers clear functional results. Clean ingredient lists help, but distribution matters more than ever for smaller brands.

Mass beauty categories stay strong because they support everyday routines. Retailers refresh shelves with cleaner packaging, simpler ranges and subtle wellness messaging.

Chilled and Dairy

Chilled foods and dairy categories deliver mixed performance. Costs stay high across milk, cheese, yoghurts, butter and chilled meals. Shoppers compare value sharply here.

Yoghurt remains strong thanks to protein and probiotic cues. Cheese depends on price cycles. Milk alternatives grow slowly; some shoppers return to dairy because plant-based prices remain higher.

Fresh produce shows the same price-sensitive pattern seen across the US fresh produce market, where shoppers balance health goals with tight weekly budgets.

Chilled ready meals see weekday momentum, especially single-serve and family-size options. Retailers refine assortments to keep only the best-performing SKUs.

The Shopper Shift in 2025

Shopper behaviour continues to evolve. People don’t want to overspend. They want clarity, fewer choices and products that feel intentional. This shift touches every category and every store format.

Intentional spending

Households cut back on impulse purchases. They shop with lists. They plan meals. They avoid categories that feel optional. You can almost see a “mental filter” forming in the aisle — does this fit the week, or not?

Small brands feel pressure because intentional spending reduces discovery. Retailers respond by simplifying ranges and placing bestsellers in prime positions.

Clean label pressure

Clean label is now expected. Shoppers flip packs to check ingredients on even the simplest products.

They want:

-

fewer additives

-

clearer benefits

-

shorter ingredient lists

This matters most in packaged foods, beverages and beauty. But clean label only wins if the price stays sensible.

Health and wellness patterns

Shoppers continue buying products connected to daily health — protein foods, hydration drinks, low-sugar snacks, probiotic blends. Wellness is now a routine behaviour, not a premium lifestyle.

But people pick mid-priced options unless a premium product gives a strong reason to upgrade. Retailers expand wellness lines inside the grocery aisle to keep shoppers inside their ecosystem.

Private Label’s Growing Role in FMCG

Private label gains more momentum each year. People trust it more now, and retailers invest heavily in design, flavour consistency, and price architecture. What used to feel like a “cheaper alternative” is now a normal part of the weekly basket.

Shoppers like private label because it’s predictable. Price makes sense. Quality is stable. And honestly, when a family buys the same detergent or yoghurt every week, they just want something reliable.

Retailers treat private label almost like its own brand portfolio. They offer value tiers for tight budgets and premium tiers for affordable upgrades. Both perform well in 2025, especially as shoppers continue watching costs closely.

Store brands also expand into more categories:

-

wellness products

-

chilled meals

-

everyday beauty

-

household cleaners

-

snacks

The US has always lagged behind Europe in private label share, but 2025 feels like the year the gap finally narrows. Retailers build more loyalty through these ranges than through many national brands.

Channel Movements

FMCG global trends show the same pattern. In the US, demand is also shaped by where people shop. Shoppers mix formats more often, and each channel plays a different role in the weekly routine.

Club stores

Club stores remain strong. Families trust the value of bulk packs, and the savings feel real. Even small households buy club-size products now because they believe they are getting “the best deal of the month.”

Club stores win in:

-

large pack snacks

-

household essentials

-

beverages

-

seasonal items

Their private label programmes pull shoppers away from traditional supermarkets, especially in household and packaged foods.

Dollar stores

Dollar stores keep steady footfall because they offer predictable low prices. Even though not everything costs one dollar anymore, the idea of “cheap and fast” still holds.

Dollar stores win in:

-

household basics

-

beverages

-

small grocery packs

-

snacks

Location convenience plays a huge role. Many shoppers make quick top-up trips here instead of going to a larger supermarket.

Online grocery

Online grocery stays stable. People use it for heavy items, planned weekly orders, and pantry restocking. The biggest hurdle remains delivery fees, which push some households back to in-store trips.

Online baskets often include more private label because shoppers naturally pick the retailer’s house brand when comparing screens.

Regional chains

Regional grocery chains hold strong ground in 2025. They know their local shoppers well, respond faster to price changes, and adjust assortments quickly. Many suppliers treat regional chains as testing grounds before national rollouts.

Private label innovation often starts here because regional chains can move faster and take more calculated risks.

Category Growth Direction in 2025

Below is a simple direction chart. It’s not about exact numbers — it reflects real movement shoppers and buyers feel in stores.

| FMCG Category | Direction | What drives it |

|---|---|---|

| Packaged foods | Positive | Affordable comfort, strong weekday routines |

| Beverages | Mixed | Performance drinks up, premium juices flat |

| Household | Neutral | Heavy price comparison, private label lift |

| Beauty | Positive | Daily-use items stable, mass beauty strong |

| Chilled & dairy | Mixed | Protein foods rising, plant-based slowing |

This direction influences shelf resets, promotional calendars, and supplier planning. Retailers now focus on what truly moves and quietly trim anything that only performs in short bursts.

FMCG Planning Checklist for 2025

A clear, practical checklist for suppliers and buyers building their 2025–2026 plans.

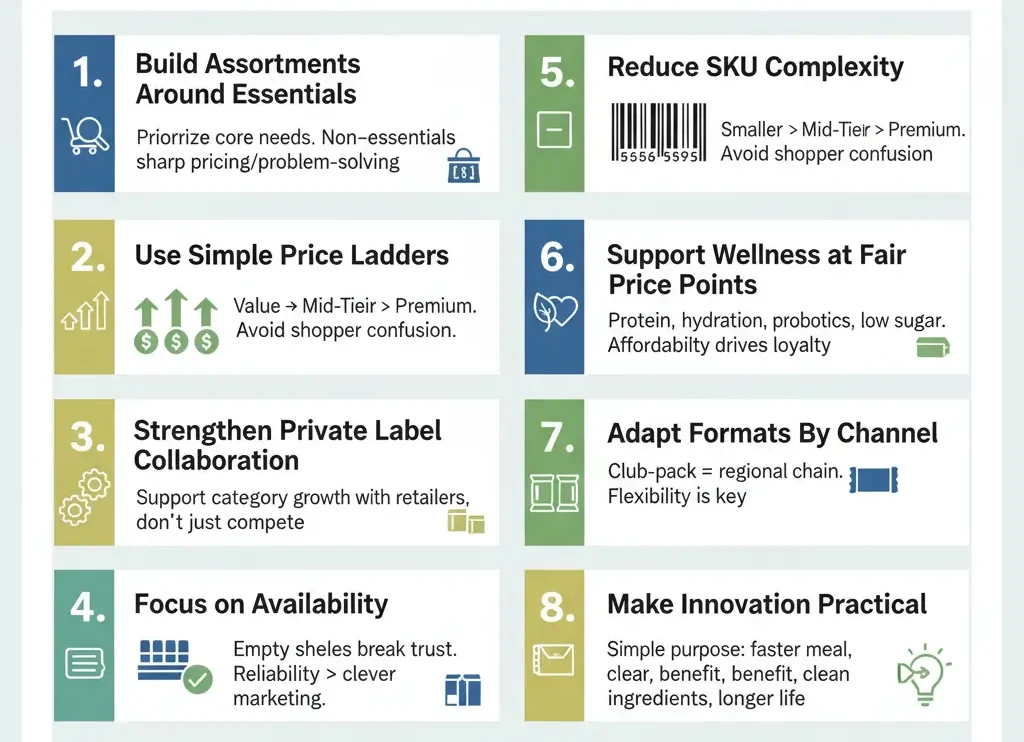

1. Build assortments around essentials.

Shoppers deprioritise non-essentials unless pricing is sharp or the product solves a clear problem.

2. Use simple price ladders.

Value → mid-tier → premium.

If the jumps feel confusing, shoppers skip the whole section.

3. Strengthen private label collaboration.

Retailers rely on private label more than ever. Suppliers who support category growth — not compete blindly — win the shelf.

4. Focus on availability.

Empty shelves break trust instantly. Reliability beats clever marketing every time.

5. Reduce SKU complexity.

A smaller, tighter range often performs better. Shoppers don’t want to compare ten similar options.

6. Support wellness at fair price points.

Protein, hydration, probiotics, low sugar — all matter. But affordability decides long-term loyalty.

7. Adapt formats by channel.

A club-pack SKU isn’t right for a regional chain. Success now depends on format flexibility.

8. Make innovation practical.

New products must have a simple purpose: faster meal, clearer benefit, cleaner ingredients, longer life. Lifestyle storytelling alone doesn’t move units anymore.

This checklist reflects something buyers often say quietly: clarity wins shelves.

Conclusion

The main picture from US FMCG trends 2025 is straightforward. Shoppers still buy, but they buy with intention. They want honesty in pricing, clarity in pack sizes and products that support the rhythms of daily life. Trust matters more than novelty.

Retailers feel similar pressure. They refine assortments, strengthen private label and centre their strategies around value. Some categories gain speed, others flatten, but all of them depend on availability and simple, reliable product stories.

For suppliers, the direction is clear: bring value, bring function, support your retail partners and match the way America actually shops today. Everything else follows from that.