The US food packaging landscape is changing quickly. Retailers demand simpler materials, stronger sustainability reporting and packaging that works across shelf, warehouse and e-commerce. Shoppers want clearer labels and credible environmental claims. State laws add pressure with new reporting deadlines and recyclability rules. Together, these forces shape US food packaging trends 2025, creating a year where suppliers must adapt or fall behind.

Food packaging in the US now sits at the centre of supermarket strategy. The shift toward responsible materials, curbside acceptance and automation-ready barcodes is accelerating. Retail buyers want packaging they can trust. Regulators want packaging they can measure. Consumers want packaging they can understand. This combination sets a new benchmark for every supplier entering US grocery channels in 2025.

Where US Food Packaging Stands In 2025

Market size

The US remains one of the most influential food packaging markets in the world. North America’s food packaging value reached USD 111.8 billion in 2024, driven by steady supermarket sales, the growth of private label and the rise of online grocery fulfilment.

Industry forecasts show that the broader US food packaging segment is expected to reach USD 143.4 billion by 2033, growing at around 5% annually. Growth is shaped by ready meals, snacks, dairy, produce and chilled foods—categories that rely on packaging for safety, shelf life and merchandising.

Packaging demand also increases as US consumers adopt smaller pack sizes, resealable formats and leak-resistant trays, which support both home cooking and convenience-led eating. E-commerce grocery creates another layer of demand: packaging must survive transport, maintain product integrity and arrive in good condition. These requirements shape design norms for 2025.

Materials

Material preference continues to shift across the US market. PET remains the strongest plastic substrate due to curbside recyclability and retailer acceptance. It dominates beverages, dairy drinks, dressings and several ambient categories.

Flexible packaging is still the largest category in US food packaging, with strong presence in snack foods, frozen meals and bakery. Lightweight formats help retailers reduce logistics costs, but their recyclability concerns push suppliers toward monomaterial PE and PP structures instead of multilayer laminates.

Paper and board formats grow steadily as retailers test fibre trays, carton solutions and kraft-based pouches. Paper-based formats work well for dry goods, bakery, produce and certain chilled foods where structural strength is maintained.

Biobased and compostable materials gain selective use, mainly in premium ranges. National rollout stays limited because US composting infrastructure varies widely by state.

Suppliers entering the US market must align material choices with real-world recycling systems, not theoretical claims. Retail buyers increasingly reject packaging that cannot be processed through curbside streams.

Shoppers Want Clear, Simple Packaging

Transparency

US shoppers want packaging that is easy to read and understand in seconds. This includes:

-

Large fonts

-

Clear ingredient panels

-

Simple nutrition layouts

-

Obvious preparation steps

-

Visible product windows where safe and practical

Consumer research shows more than half of US shoppers favour packaging that explains environmental benefits clearly and avoids vague sustainability language.

Clarity also shapes design choices in ready meals, dairy, snacks and bakery. Clear lids and tamper-evident features build trust, especially for online grocery orders where damage or leakage leads to returns.

Sustainability claims

Sustainability expectations remain high. According to multiple consumer studies:

-

70% of consumers prefer packaging with clear sustainability labels

-

60–70% believe brands should be responsible for packaging sustainability

-

Consumers will pay approximately 9–10% more for sustainably packaged products

Shoppers want packaging that looks responsible and matches everyday recycling routines. This is why fibre trays, paper windows, lightweight bottles and monomaterial plastic pouches perform well.

Environmental claims must be simple and believable. Retailers warn suppliers against overstated claims. Many rely on How2Recycle to guide consumers and ensure uniform messaging across private-label ranges.

Resealability, portion control and waste reduction also influence shopper preference. Smaller, tightly sealed packs help reduce food waste and improve convenience.

Retailer Requirements In 2025

Retail buyers play the biggest role in shaping packaging standards. Each supermarket group sets specific expectations for materials, labelling, sustainability and data reporting. These requirements influence every supplier decision, from film selection to barcode layout.

Walmart

Walmart sets one of the most detailed packaging frameworks in the US. Suppliers must align to:

-

100% recyclable, reusable or industrially compostable private-brand packaging by 2025

-

15% reduction in virgin plastic use

-

Higher use of post-consumer recycled (PCR) content

-

Accurate How2Recycle labelling

-

Shelf-ready packaging dimensions that support fast replenishment

-

Packaging that withstands warehouse automation and e-commerce handling

Walmart’s scale makes these criteria influential across the industry. If a format works for Walmart, it typically meets or exceeds requirements for other national retailers.

Kroger

Kroger’s responsible packaging strategy includes:

-

A goal for 100% recyclable, compostable or reusable “Our Brands” packaging by 2030

-

52% already compliant as of their 2025 report

-

10% PCR content across the owned-brand portfolio

-

Alignment with Ellen MacArthur Foundation frameworks

-

Strict use of How2Recycle labelling

-

Regular data submissions for packaging materials

Kroger’s private-label teams push for simple, recognisable and low-waste packaging across all categories. As private label in US market continues to expanding, packaging performance now influences listing decisions, price architecture and how quickly new products can move through onboarding. Suppliers must demonstrate strong recyclability, clear labelling and reliable data to remain competitive in private-label programmes.

Target

Target’s packaging expectations focus on design clarity, sustainability and circularity. Their commitments include:

-

20% reduction in virgin plastic packaging by 2025 for owned brands

-

Early achievement of five reuse pilots

-

Use of 13% PCR in key ranges

-

Consistent use of How2Recycle

-

Packaging designed for recycling, refill and low waste

-

Rollout of digital product passports to improve traceability

Target emphasises consumer-facing clarity. Clean fonts, simple colour systems and minimal clutter are encouraged. Packaging must communicate quickly and support in-store navigation.

ALDI

ALDI’s packaging targets are some of the strictest in US grocery:

-

100% reusable, recyclable or compostable packaging by 2025

-

15% reduction in packaging material for ALDI-exclusive products

-

How2Recycle on all consumable private label lines

-

Strong preference for monomaterial packaging and lightweight formats

Because 90% of ALDI’s range is private label, supplier compliance is non-negotiable. ALDI expects packaging that is cost-effective, efficient on shelf and aligned with sustainability goals.

EPR & State Rules

Extended Producer Responsibility (EPR) laws change how packaging is funded, reported and evaluated. Several US states now require companies to disclose packaging materials and pay fees based on recyclability. These programmes directly influence how suppliers design packaging for nationwide distribution.

EPR is still new in the US, but retailers and suppliers now prepare for reporting obligations and eco-modulation fees. Packaging that is easy to recycle will cost less. Packaging that is difficult to sort or contains mixed materials will cost more. This dynamic makes packaging decisions more strategic than before.

Below is a high-level overview of the four states shaping policy in 2025.

Oregon

Oregon operates the most advanced packaging EPR programme in the US. Companies selling packaged goods in the state must:

-

Register with the state producer responsibility organisation (PRO)

-

Report packaging materials annually

-

Fund improvements to the local recycling system

The first full reporting cycle begins in 2026, covering packaging placed on the market in 2025. Because of this structure, suppliers must prepare packaging data now. Retailers increasingly expect suppliers to track materials in formats that match Oregon’s reporting categories.

Oregon sets a clear standard: packaging must reflect the real capabilities of the state’s recycling system. Materials that are not widely accepted in curbside programmes may incur higher fees.

Colorado

Colorado’s EPR programme officially begins in 2025. Producers must join the PRO and pay fees based on the recyclability of their packaging. Colorado focuses on improving recycling access statewide and building a more consistent collection system.

Colorado is expected to publish recyclability guidelines that influence packaging design for years ahead. Suppliers working with major supermarkets must ensure their packaging meets these standards. Many are switching to monomaterial plastics or fibre-based formats to avoid penalties.

The programme also requires clear labelling. Vague sustainability claims or non-standard recycling icons are likely to be challenged.

Maine

Maine was the first U.S. state to pass EPR for packaging. Its programme introduces “eco-modulated” fees, where producers pay more for hard-to-recycle materials and less for simple, widely accepted formats.

Maine’s system encourages:

-

Fewer mixed-material packs

-

Lighter packaging

-

Clearer material identification

-

Stronger use of paper, fibre and widely recyclable plastics

Although Maine’s population is smaller than other states, national supermarkets expect suppliers to comply because non-compliant packaging creates administrative issues across product ranges.

California

California’s SB 54 sets some of the most influential packaging rules in the country. Although its full EPR requirements begin in 2027, suppliers must prepare in 2024–2025. Key points include:

-

A 25% reduction in single-use plastic by 2032

-

Mandatory recycled content levels for plastic packaging

-

Strict definitions of what “recyclable” means

-

Requirements that packaging match real-world recycling capacity

California’s rules affect national brands, private-label suppliers and all packaging sold across the state. Many retailers use California’s definition of recyclability to shape their own sourcing decisions.

Together, these state rules create a patchwork environment. But the message is consistent: packaging must be simpler, lighter and fully traceable. Suppliers need strong material data to support retailer expectations and EPR compliance.

What Suppliers Should Prepare For

Retailers and regulators now expect packaging that is simple, honest and easy to measure. Suppliers entering the US market must prepare for deeper transparency and documentation.

Below are the core areas where suppliers must strengthen their capabilities.

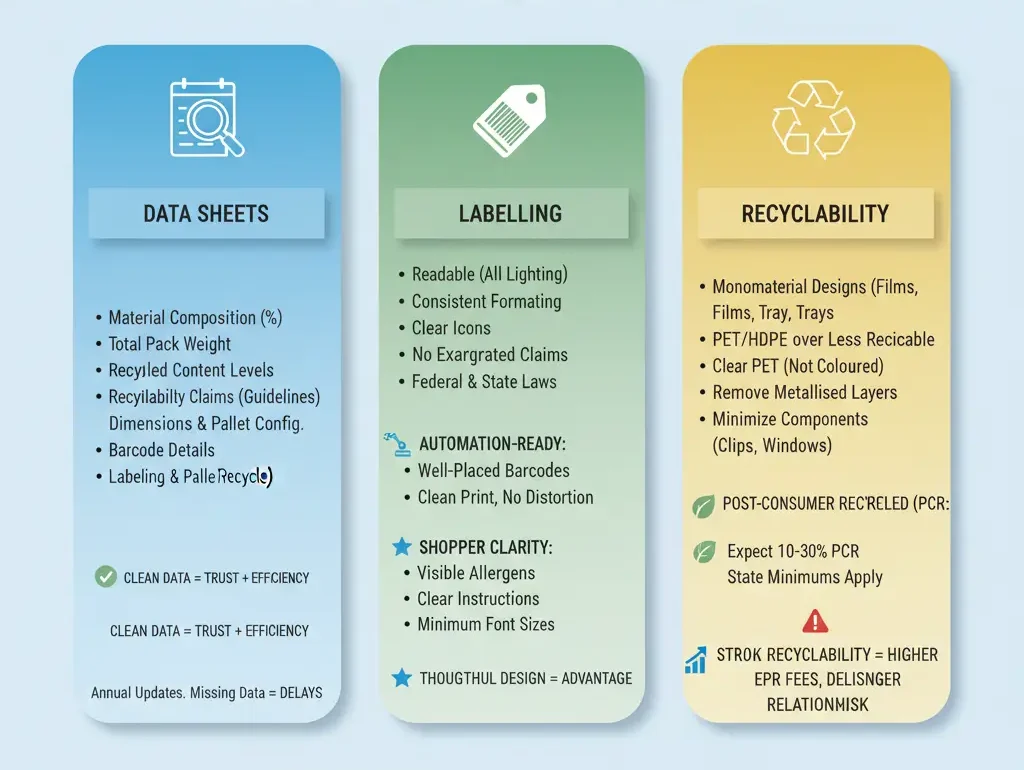

Data sheets

Packaging data accuracy is critical in 2025. Retailers need clear material information to onboard products and confirm EPR compliance. A complete data sheet includes:

-

Material composition by percentage

-

Total pack weight

-

Recycled content levels

-

Recyclability claims supported by accepted guidelines

-

Barcode details

-

Dimensions and pallet configuration

-

Labelling standards (including How2Recycle where relevant)

Some retailers require annual updates to ensure compliance with changing laws. Missing data may delay listings, especially for private-label lines.

Suppliers that build strong internal systems for packaging data often gain an advantage with large retail accounts. Clean data improves trust and reduces administrative friction.

Labelling

Labelling remains a central part of the packaging conversation. Retailers want labels that:

-

Are readable in all store lighting conditions

-

Follow consistent formatting

-

Use clear icons

-

Indicate sustainability without exaggerated claims

-

Match the requirements of How2Recycle when used

-

Meet federal and state labelling laws

Automation adds pressure. Warehouses now rely on machines to scan packs at high speeds. That means barcodes must be well-placed, printed cleanly and free of distortion.

Retail buyers increasingly reject labels that create shopper confusion. Allergens must be visible. Serving instructions must be clear. Font sizes must meet minimum standards. In this environment, thoughtful label design becomes a competitive advantage.

This theme also appears in Retail Tech developments, where packaging must be readable by automation. Clear print quality, sharp contrast and consistent placement make warehouse scanning more reliable.

Recyclability

Recyclability is now one of the most important criteria in supermarket packaging. Retailers track recyclability rates closely. Packaging must align with recognised recycling systems and avoid formats that create contamination.

Suppliers should consider:

-

Monomaterial designs for films, pouches and trays

-

PET or HDPE over less recyclable plastics

-

Fibre trays and board solutions where feasible

-

Clear PET instead of coloured

-

Removing metallised layers where performance remains acceptable

-

Minimising components such as clips, windows or handles

Retailers also encourage the use of post-consumer recycled (PCR) content. Many now expect at least 10–30% PCR in plastic packaging depending on category. Some states already enforce minimum PCR levels by law.

Suppliers who present packaging with weak recyclability face higher EPR fees and risk losing listings in price-sensitive private-label programmes. Strong recyclability performance strengthens supplier relationships and future negotiation power.

Packaging Trends vs Supermarket Impact

| Packaging Trend | What It Means | Impact on Supermarkets |

|---|---|---|

| Monomaterial packaging | Easier sorting and recycling | Higher compliance, lower risk in EPR states |

| Fibre-based formats | Reduced plastic use | Better sustainability communication in aisle |

| Increased PCR content | Circular economy support | Stronger alignment with retailer goals |

| Label simplification | Cleaner shopper experience | Fewer complaints, faster in-store decisions |

| Shelf-ready packaging | Efficient replenishment | Reduced labour costs in stores |

| Smaller portions | Less food waste | Improves shopper value perception |

| Stronger seals & leak protection | Improved transport durability | Fewer online order returns |

| Clear PET use | Higher recycling value | Fits most curbside programmes |

| Digital product passports | Traceability & data sharing | Supports automation and retail-tech initiatives |

| Lightweighting | Reduced material cost | Lower logistics spending |

This table reflects the link between packaging innovation and operational performance. Packaging now shapes not only sustainability outcomes but also store efficiency, warehouse accuracy and e-commerce reliability.

Conclusion

Suppliers entering the US market in 2025 face new rules, rising expectations and stronger accountability. Retailers want packaging that performs across shelf, warehouse and delivery networks. Shoppers want clarity and honest sustainability. Regulators want data and real-world recyclability. These combined forces define the direction of US food packaging trends 2025, creating an environment where packaging is no longer a finishing detail—it is a strategic advantage.

The companies that succeed will be those who simplify materials, strengthen data reporting, improve recyclability and design packaging that works naturally in busy retail environments. This shift sets the foundation for a more transparent, responsible and efficient packaging system across US grocery.