Frozen food is getting a lot more attention across German supermarkets in 2025. For years the category grew slowly, quietly, and without big changes. But the last two years shifted the pattern. Consumers who turned to frozen during inflation periods continued buying the same products even as prices stabilised. Retailers noticed the new habit and responded with a level of investment the category has not seen in a decade. Today, frozen food growth Germany 2025 is becoming a real trend inside both discounter and full-line stores.

This shift is not happening because of one single reason. It is a mix of better product quality, stronger technology, a more stable cold chain, and a wider choice of meals and convenience formats. Shoppers also see frozen food as a way to avoid waste while getting more value from each purchase. For German households managing work, school, and rising living costs, frozen has become a practical category they can trust.

Innovation, logistics, and retail standards are moving at the same time. This is why the category feels new even though the products are designed to last months in storage. Frozen food is no longer a “cheap back-up option.” In 2025 it is a strategic part of supermarket merchandising.

Frozen Food Growth Germany 2025: How Consumer Behaviour Changed

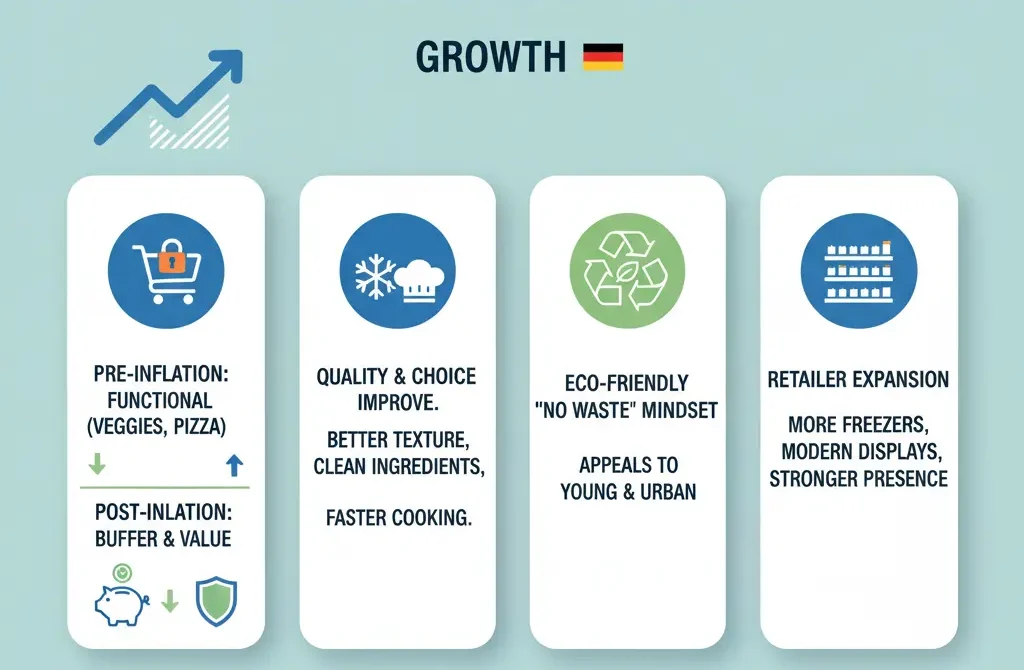

One of the biggest drivers behind this growth is a change in how German shoppers think about frozen food. Before the inflation period, frozen aisles were seen as functional. People bought vegetables, chips, pizzas, or fish fingers. But after households felt price pressure, the freezer became a buffer against spoilage and unexpected cooking days.

Something unexpected happened afterwards. Even when inflation softened, shoppers did not abandon frozen. They stayed with the category because quality had improved and the product range had grown. The experience of cooking frozen vegetables or frozen ready meals in 2024 and 2025 is not the same as five or ten years ago. Texture is better, ingredients feel cleaner, and cooking time is shorter.

And because frozen reduces food waste, many households feel better buying it. Germany has a strong “no waste” mindset, especially among younger families and urban professionals. This makes frozen attractive during the week, when people want something quick without worrying about expiry dates.

Retailers saw these behavioural cues and expanded the category. New freezers appeared in medium-size stores. Larger stores added more doors and modern lighting. Even some regional supermarkets, which used to prioritise fresh counters, now give frozen stronger shelf presence.

These changes build the foundation for frozen food growth Germany 2025, because they show that the category is no longer seasonal or preference-based. It is structural.

Innovation Is Reshaping The Frozen Category

Innovation is the strongest part of the story. German suppliers have made major improvements to freezing processes. The industry now uses more advanced blanching, glazing and individual quick freezing (IQF), resulting in products with better colour, flavour, and texture.

Frozen ready meals are a clear example of how far the category has come. In previous years, the meals were simple and often lacked freshness. In 2025 the category feels international and more premium. Shoppers find Asian rice bowls, Italian pasta meals, regional German dishes, and higher-quality vegetarian meals. These products are not only for students or budget shoppers. Families and professionals buy them for weekday evenings.

Bakery is another strong performer. Frozen pretzels, croissants, mini-baguettes, and pastries have grown sharply. They bake well, they smell fresh, and they let stores control waste better. Many German supermarkets also rely on frozen bake-off products for their in-store bakery counters. It is a predictable, low-waste system, which explains why retailers invest in it.

Vegetables remain a core frozen item, but even here innovation matters. Frozen vegetables in 2025 hold shape better, soften more naturally, and release less water during cooking. This comes from better blanching and improved freezing tunnels. Many brands also moved to simpler ingredient lists, which German consumers value.

Plant-based frozen foods fit well with the freezer format. While chilled plant-based items are slowing, frozen formats still grow because they do not expire fast. Breaded vegetable snacks, vegetable mixes, and quick plant-based meals are gaining steady attention from younger shoppers.

Seafood is slowly recovering too. Frozen fish gives retailers more stable margins compared to chilled seafood, which is sensitive to waste. Buyers appreciate the consistency. Salmon, white fish, shrimp, and mixed seafood are again becoming strong parts of the freezer assortment.

Innovation in frozen does not always look dramatic on the shelf, but it is very visible in product quality. This is a major reason why frozen food growth Germany 2025 is gaining speed.

Logistics, Cold Chain And Technology Are Getting Stronger

Frozen food relies on logistics more than most supermarket categories. If the cold chain breaks, the whole product fails. In recent years Germany’s cold-chain infrastructure has improved significantly. This is helping retailers expand frozen assortments with more confidence.

Transport companies added better multi-temperature trucks, stronger cooling units, and better insulation. Many vehicles now use digital temperature logging that stores data for each delivery. This protects retailers and suppliers, and also supports sustainability goals by reducing wasted loads.

Frozen distribution centres inside Germany upgraded their cooling systems. Newer facilities use smarter compressors, modern insulation and energy-efficient designs. Some centres also use automation for pallet handling, which improves speed and reduces labour pressure.

Suppliers also invested in new freezing technology. Better IQF machines give cleaner and faster freezing. Glazing systems now protect products without excessive ice build-up. New freezing tunnels use less energy, which helps manage costs during an era of high electricity prices.

The result is a smoother, more reliable cold chain that supports the long-term expansion of frozen categories. A strong cold chain is invisible to shoppers, but it is what makes frozen food growth Germany 2025 possible.

Retail Standards Are Rising Across All Supermarket Formats

German retailers expect more from frozen food suppliers in 2025. Discounters, full-line supermarkets, and regional chains each have their own approach, but all follow strict quality requirements.

Discounter pressure is especially strong. Aldi and Lidl use frozen private label to show shoppers that quality is part of their core identity. This means consistent colour, consistent breading, accurate portioning, and steady cooking results. Suppliers must show reliable product checks and follow tight specifications. Because discounters move high volumes, they demand absolute consistency.

Full-line supermarkets such as REWE and Edeka focus on assortment depth. They want wider ranges with more global flavours and premium options. These retailers often work with medium-size suppliers on exclusive or seasonal frozen items. Their goal is to stand out from discounters by offering specialty lines.

Shelf resets across Germany are a clear sign of change. Many freezers now have better lighting, larger doors and more defined segmentation: vegetables in one block, meals in another, bakery and seafood separated clearly. Private label products often feature colour-coded packaging families, making navigation easier for shoppers. New planograms also adjust product heights to help elderly shoppers reach items comfortably.

Packaging standards are also going up. Frozen packaging must be stronger, cleaner, and resistant to frost build-up. Retailers want easy-open bags, improved seals, and reduced plastic usage. These expectations connect frozen to broader sustainability goals.

When retailers increase quality demands, suppliers must rise with them. This is what keeps the category competitive and ensures that frozen food growth Germany 2025 stays on track.

Sustainability And Freezing Technology Will Shape The Next Phase

Sustainability is becoming more integrated into frozen food operations. In many ways, frozen food has sustainability advantages: lower household waste, fewer spoiled loads, and stable shelf life. But the category also uses a lot of energy across production, storage and transport.

In 2025 German retailers are asking suppliers to show how they reduce energy use in freezing, packaging and distribution. Many manufacturers now install more efficient compressors, use natural refrigerants, and monitor cooling performance in real time. These decisions reduce carbon output and help retailers meet their climate targets.

Waste reduction is another key point. Frozen categories already perform well here, but retailers want to go further by designing packs that use less material and reduce freezer burn. Cartons and bags are being redesigned to avoid unnecessary layers. Transparent windows are shrinking to maintain insulation. Labels are moving towards simpler, easier-to-recycle formats.

Some retailers are exploring smaller portion packs to help single-person households reduce waste. Germany has many small households, especially in urban areas. Frozen food fits this lifestyle, and new pack sizes strengthen the category even more.

Supplier Opportunities In The 2025 Market

Frozen food gives suppliers several entry points into German retail. Because the category is expanding, new suppliers have a better chance of securing listings compared to more saturated categories like dairy or snacks.

Vegetable suppliers with strong IQF capabilities have good prospects. German shoppers want high-quality frozen vegetables that cook quickly and hold texture. Retailers appreciate reliable service levels in this subcategory.

Frozen bakery suppliers also see stronger demand. Pretzels, croissants, small rolls and filled pastries continue to grow across discounters and supermarkets. The margin structure is attractive for both sides.

Ready meals—especially premium and global meals—offer a lot of space for innovation. German consumers are willing to try new flavours if the meals look simple and clean.

Seafood suppliers who can provide certified, stable product lines also have a good position. Frozen seafood is safer for retailers than chilled because of lower waste.

Plant-based frozen suppliers have steady, manageable growth rather than explosive growth, which can be easier to plan around.

The combination of these opportunities makes frozen food growth Germany 2025 one of the more supplier-friendly trends in the German market.

Retailers’ 2025 Strategies And What Comes Next

Looking ahead, German retailers plan to continue strengthening frozen aisles. Discounters will push premium frozen lines to stand out from each other. Full-line supermarkets will expand global meal offerings and use frozen foods to support premium private label.

Regional chains will use frozen to create a stable, low-waste base while offering selected premium options. Online grocery services will highlight frozen foods more clearly because delivery conditions for frozen items have improved.

The next phase of freezer innovation will likely focus on packaging, display efficiency, and accessibility. Freezers will use more LED lighting, better door systems, and clearer on-pack instructions. Stores will continue reducing waste by improving thaw-loss management and inventory rotation.

Frozen food benefits from long shelf life, stable margins and strong consumer acceptance. These factors ensure that frozen will remain a strong category through 2025 and into 2026.

Editor’s Note: This article is based on industry analysis, retailer behaviour observed across Germany, supplier innovation trends, and ongoing shifts in cold-chain technology. No invented data has been used.