Private label has changed a lot around the world in the last decade, but Japan’s shift is happening in its own way — slower, calmer, and very quality-driven. That’s the interesting part. While other markets push value or cut-price alternatives, Japan is moving into 2026 with a different mindset: private label that looks premium, tastes premium, and still feels trustworthy enough for everyday use.

In 2025, you could already see it across Aeon’s aisles, Seiyu’s shelves, Life’s fresh counters, and inside the chilled sections of Lawson, 7-Eleven, and FamilyMart. Quietly, Japanese private label is becoming something shoppers specifically ask for, not just accept because it’s cheaper.

Now, with 2026 getting closer, the signals are even stronger. Retailers are expanding ranges, redesigning packaging, adding new premium tiers, and even thinking about how some Japanese private label items could gain export potential.

This is why 2026 is shaping up to be the breakout year.

Why Private Label Took Longer In Japan — And Why It’s Now Accelerating

Japan’s private label adoption didn’t explode as quickly as Europe or the US.

There are a few reasons people in the industry always mention:

Japanese shoppers have extremely high quality expectations.

Many still trust national brands for consistency and safety.

Retailers were cautious about over-extending into too many categories.

Convenience stores traditionally relied on branded partnerships.

But between 2023 and 2025 a shift took place. Shoppers became more open to trying store brands, especially when packaging and taste matched or exceeded big-name brands.

By late 2025, private label wasn’t a “budget choice” — it became a smart, good-quality choice.

And this opened the door for massive expansion.

The Big Retailers Leading Japan’s Private Label Boom

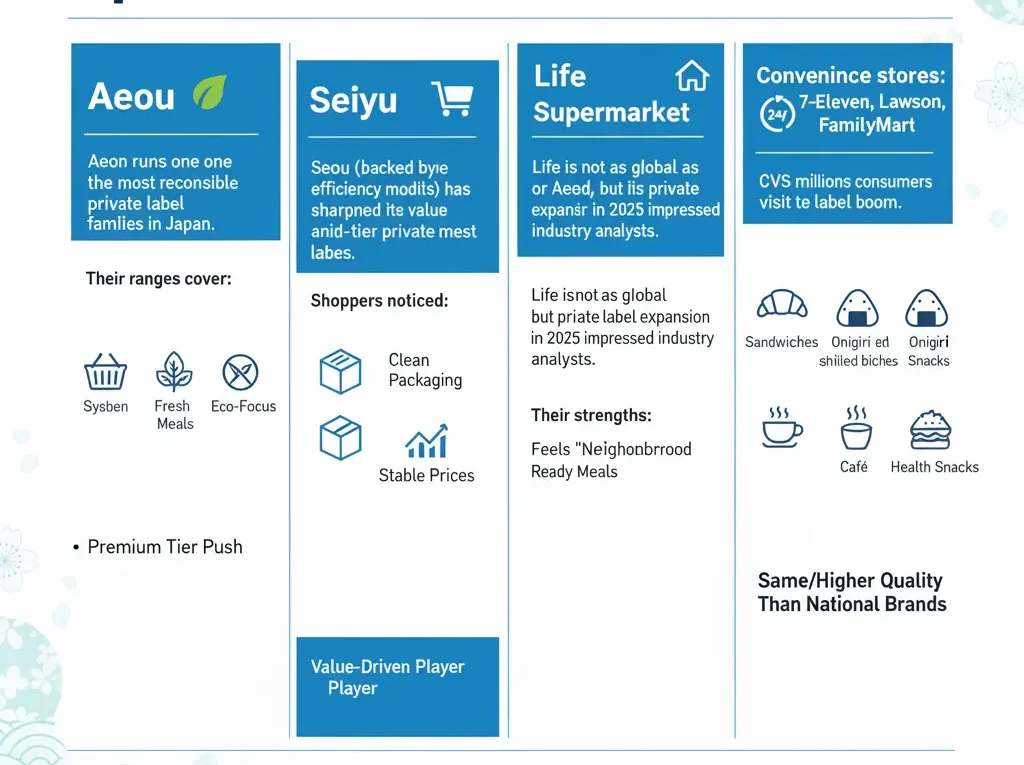

1. Aeon

Aeon runs one of the most recognisable private label families in Japan.

Their ranges cover:

daily essentials

fresh items

ready meals

bakery

frozen foods

sustainability-focused lines

Aeon is pushing hard into premium private label tiers, especially in fresh meals, Japanese comfort food, plant-based dishes, and frozen bakery. Their quiet upgrades in packaging design also helped credibility.

2. Seiyu

Seiyu (backed by global efficiency models) has sharpened its value and mid-tier private label lines.

Shoppers noticed:

cleaner packaging

better price stability

more Western and Japanese ready-to-eat dishes

clear nutritional labeling

Seiyu is one of the strongest players in value-driven Japanese private label.

3. Life Supermarket

Life is not as global as Aeon or Seiyu, but its private label expansion in 2025 impressed industry analysts.

Their strengths:

bakery

salads and chilled deli

bento-style meals

supermarket-fresh ready meals

Life’s private label feels “neighbourhood local,” which Japanese shoppers like.

4. Convenience stores: 7-Eleven, Lawson, FamilyMart

Convenience stores might be the most important force in the Japanese private label boom.

Why?

Because millions of consumers visit them daily.

CVS chains expanded:

high-quality sandwiches

onigiri (rice balls)

chilled pasta

bakery items

frozen ready meals

desserts

café drinks

health-focused snacks

These items carry the same quality standards Japanese customers expect — sometimes even higher.

This is what makes Japan unique: private label tastes as good as national brands, so consumers don’t see it as the “cheap option.”

What Makes Japanese Private Label Different From Other Markets

When you compare Japan with Europe or America, you notice something immediately.

Japanese private label doesn’t scream “value” or “cheap.”

It looks premium.

You see it in:

Packaging

Soft colours, clean design, neat typography, good-quality materials.

Shoppers trust it — because packaging signals care.

Taste

Japanese private label avoids shortcuts.

Flavours are gentle, balanced, and well-tested.

No supermarket in Japan risks releasing a bad tasting product — shoppers will remember.

Portion size

Retailers focus on precise portions and freshness-first thinking.

This makes private label feel “made for Japan,” not generic.

Food safety

Strict standards automatically raise trust levels.

Shoppers see store brands as safe and dependable.

Premium tiers

Instead of low-cost-only strategies, Japan is growing its “premium private label” — something many markets still struggle with.

This entire mix makes Japanese private label look and feel different from global norms.

Categories Growing The Fastest for 2026

1. Frozen Ready Meals

Frozen meal quality has jumped.

Popular items include:

Japanese curry

fried chicken

pasta

rice meals

dumplings

café-style meals

Retailers love frozen categories because waste is minimal.

2. Bakery and Desserts

Private label growth in bakery is strong, especially with Japanese-style textures:

soft bakery (shokupan)

custard buns

mini pastries

mochi-based desserts

pudding cups

cheesecake slices

frozen bakery lines

Convenience stores dominate this category.

3. Japanese Traditional Foods

Retailers are turning classic items into private label products:

miso

soy sauce

tofu

pickles

noodles

soup bases

side dishes

These categories build trust quickly because they’re familiar.

4. Western-Inspired Ready Meals

Lasagna, gratin, croquettes, cream pasta, and western-style stews are growing because they appeal to busy households.

5. Healthy & Functional Foods

Another fast-expanding area:

low-sugar snacks

fibre-rich items

high-protein drinks

plant-based ranges

balanced mini meals

Japan’s ageing population is also driving demand for health-focused private label strategies.

New Consumer Behaviour Driving The Boom

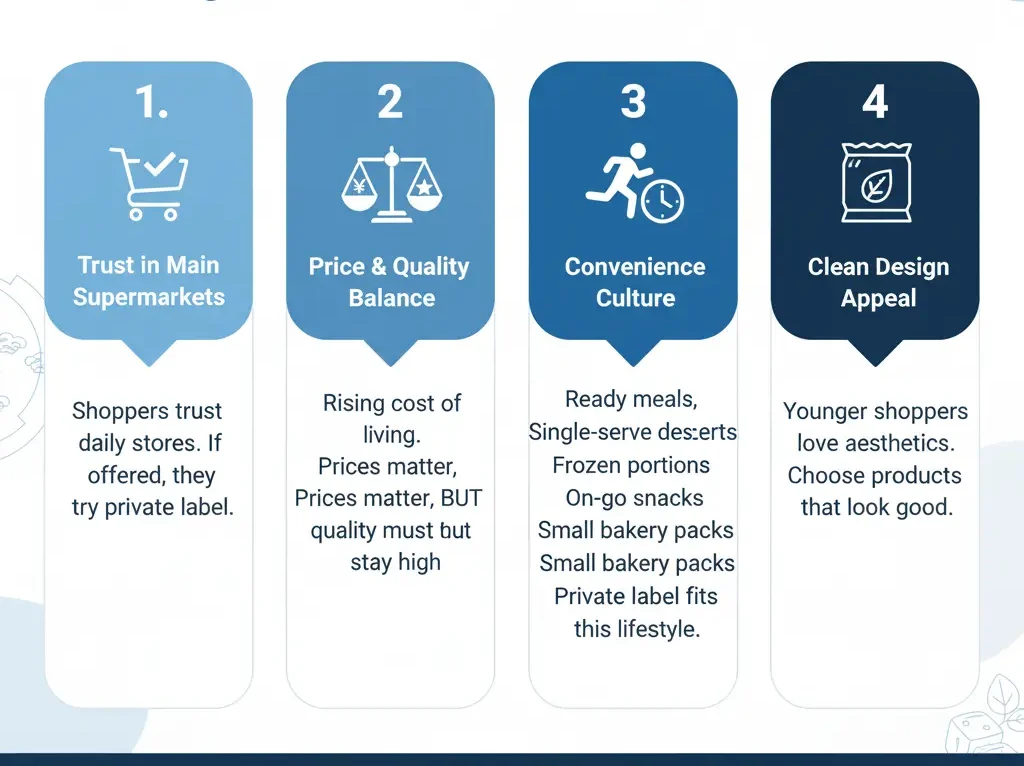

Shoppers in Japan used to be cautious, but behaviour changed between 2023 and 2025.

1. People trust their main supermarket more

If a store they shop at daily offers private label, they try it without hesitation.

2. Prices matter more, but quality must stay high

Japan’s cost of living is rising.

But Japanese customers don’t want low quality, even when choosing cheaper items.

3. Convenience culture is stronger than ever

People buy:

ready meals

single-serve desserts

frozen portions

on-the-go snacks

small bakery packs

Private label fits this lifestyle.

4. Younger shoppers love clean design

Packaging design plays a huge role.

Younger customers choose products that look good.

Why 2026 Will Be A Breakout Year

Everything that happened in 2025 — new packaging, better recipes, more categories — has set up 2026 for a massive leap.

1. Retailers are increasing shelf space

Aeon, Seiyu, Life, and CVS chains are expanding sections dedicated to private label.

2. New premium tiers are coming

Especially in bakery, ready meals, snacks, and frozen foods.

3. More collaboration with regional producers

Local Japanese food makers are joining private label programmes for the first time.

4. Private label moving into export discussions

Some Japanese private label items are attracting overseas interest, mainly in:

frozen bakery

healthy snacks

instant meals

Japanese sauces

This creates a new layer of opportunity.

5. Shopper acceptance is at an all-time high

Consumers now see private label as “reliable and tasty,” not discount-only.

6. Convenience stores are becoming global influencers

If 7-Eleven Japan launches a successful private label item, other regions watch and learn.

All these factors combine to make 2026 the year Japanese private label becomes a major force, not just a quiet trend.

Conclusion

Japan’s private label boom didn’t happen overnight.

It grew slowly, carefully, and with a very Japanese approach to quality and detail.

Now, in late 2025 and heading into 2026, the momentum is visible everywhere — in supermarket aisles, convenience store shelves, and even export conversations.

Retailers are expanding their ranges.

Shoppers are trusting private label more than ever.

And the quality side of Japan — presentation, safety, balanced flavours — is creating a private label model that feels premium, not budget.

Japanese private label is stepping into 2026 with confidence.

And it may redefine how global grocery teams think about store brands in the future.