Switzerland is one of Europe’s most advanced private label markets.

More than half of all FMCG sales in Swiss grocery retail now come from own-label products, a higher share than in any other European country.

This position did not emerge suddenly. It is the result of long-term retail strategy, concentrated market power, and a high level of consumer trust in supermarket operators. In 2025, private label Switzerland supermarkets is no longer a value discussion. It is a structural feature of the retail system that shapes pricing, shelf space, supplier relationships, and innovation across categories.

Switzerland’s private label market in context

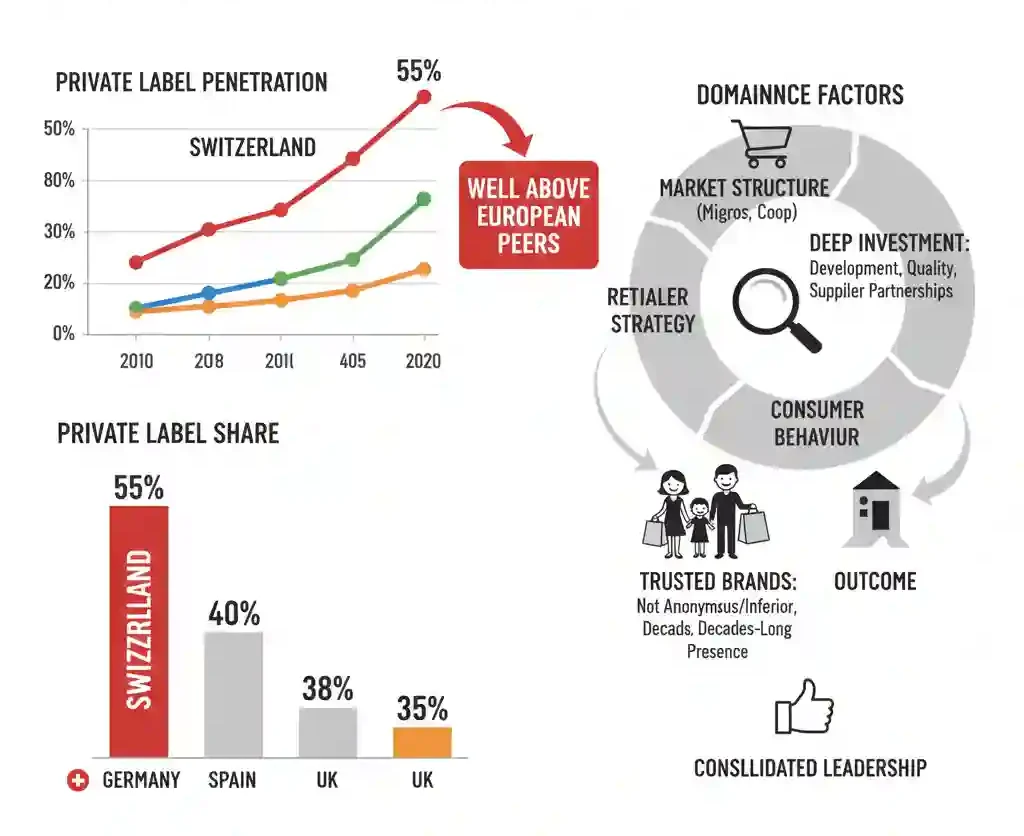

Private label penetration in Switzerland sits well above that of most European peers. While markets such as Germany, Spain, and the UK have recorded steady own-label growth over the past decade, Switzerland crossed the 50% threshold earlier and has continued to consolidate its position.

This dominance reflects the structure of the Swiss FMCG market, where a small number of national retailers control the majority of grocery sales. High concentration allows retailers to invest deeply in private label development, quality assurance, and long-term supplier partnerships.

Consumer behaviour reinforces this model. Swiss shoppers do not view private label as anonymous or inferior. Many own-label ranges have been on shelves for decades and are treated as trusted brands in their own right.

Migros: private label as the foundation, not the alternative

Migros is often cited as the most advanced private label retailer in Europe, and its position in Switzerland explains why.

Unlike many supermarket groups that built private label as a response to price competition, Migros developed its business around own-label from the outset. Branded goods exist, but private label is the default across most categories.

Migros operates a clearly tiered private label structure.

Entry ranges focus on affordability and everyday staples.

Mid-tier ranges emphasise quality, nutrition, and Swiss sourcing.

Premium ranges compete directly with leading A-brands on taste, packaging, and innovation.

A defining feature of Migros is its vertical integration. Through industrial subsidiaries, it produces a significant share of its own food and non-food products. This gives Migros control over quality standards, cost structures, and product development timelines that few European retailers can match.

For suppliers, Migros is less a traditional retailer and more a strategic manufacturing partner.

Coop: segmentation and sustainability at scale

Coop’s private label strategy differs in structure but not ambition.

Rather than a single dominant own-label identity, Coop operates several clearly defined private label families. Each range serves a specific role, customer profile, and pricing position.

Value ranges address price-sensitive shoppers.

Core ranges cover mainstream everyday categories.

Premium and specialty ranges focus on organic, regional, and ethical propositions.

Coop’s Naturaplan range illustrates how private label can become a category leader. Organic products are not treated as niche or promotional. They are embedded into the core private label offer, supported by long-term supplier relationships and consistent standards.

This approach aligns with broader private label strategy across European supermarkets, but Switzerland remains the most mature example of how segmentation can coexist with very high own-label share.

Discounters: private label with Swiss characteristics

Discount retailers play a growing but still secondary role in Switzerland compared with many neighbouring countries.

Aldi and Lidl rely almost entirely on private label, but their strategy looks different from Germany or Eastern Europe. Extreme price competition is less effective in a market where domestic retailers already deliver high-quality own-label products.

Discounters in Switzerland focus on limited assortments, operational efficiency, and acceptable quality benchmarks that meet local expectations. Swiss sourcing and regional references are used more visibly than in other markets to build trust.

While discounter private label is simpler than the multi-tier models of Migros and Coop, it reinforces the overall dominance of own-label in the market.

Impact on A-brands and branded suppliers

The strength of private label creates one of the most challenging environments in Europe for A-brands.

Shelf space is tightly controlled.

Retailers have little incentive to protect underperforming brands.

Price pressure is constant, even in premium categories.

Branded manufacturers operating in Switzerland typically follow one of three paths.

Some position themselves firmly at the premium end, offering differentiation that private label cannot easily replicate. Others focus on niche or specialist categories where own-label penetration remains lower. A third group works directly with retailers as private label producers, trading brand visibility for volume stability.

This reality has reshaped supplier negotiations across categories and is central to discussions around retailer power in private label Switzerland supermarkets.

Pricing, margins, and retailer control

Private label gives Swiss retailers precise control over pricing and margins.

Because own-label pricing is set internally, retailers can respond quickly to cost inflation, currency movements, and supply disruptions. This flexibility has helped Switzerland maintain relatively stable grocery pricing compared with more promotion-driven markets.

Entry-level private label ranges anchor price perception. Premium own-label ranges then capture higher margins without relying on heavy marketing spend. The result is a balanced margin structure that supports long-term investment rather than short-term discounting.

Sustainability as a private label expectation

Sustainability is not a marketing layer in Swiss private label. It is a baseline expectation.

Consumers expect transparency on sourcing, animal welfare, environmental impact, and packaging. Retailers respond by embedding these requirements directly into own-label standards rather than treating them as optional upgrades.

This approach aligns closely with wider developments in sustainable packaging in Swiss supermarkets, where recyclability, material reduction, and compliance are becoming minimum requirements across categories.

Private label gives retailers the control needed to enforce these standards consistently.

Fresh categories and private label dominance

Private label is especially strong in fresh and chilled categories.

In dairy, bakery, meat, and ready meals, own-label products dominate shelf space. Retailers use private label to guarantee consistency, traceability, and alignment with Swiss agricultural standards.

This overlaps directly with how fresh produce in Switzerland supermarkets is sourced, labelled, and priced. Local origin and quality assurance are easier to manage through own-label structures than through fragmented branded supply.

For fresh suppliers, working within private label frameworks is often the only viable route to scale.

Innovation without brand dependency

Private label in Switzerland is not conservative.

Retailers invest heavily in product development, often launching new concepts faster than branded competitors. Plant-based foods, functional products, reduced-sugar ranges, and new packaging formats frequently appear first under own-label.

Because marketing risk is lower, retailers can test innovations quickly and expand successful products nationally. This shifts category leadership away from brands and toward retailers.

Behind the scenes, data and forecasting systems support this efficiency. While Swiss retailers adopt digital tools cautiously, retail technology in Switzerland supermarkets increasingly underpins private label planning, traceability, and range optimisation.

Supplier relationships and long-term planning

Private label dominance has reshaped supplier relationships in Switzerland.

Retailers favour long-term partnerships over transactional buying. Suppliers are expected to meet strict quality, compliance, and sustainability standards, but in return they gain predictable volumes and planning stability.

This model suits a market that prioritises reliability over rapid expansion. It also explains why private label penetration has remained high without eroding consumer trust.

Forecast: how private label will evolve beyond 2025

Private label in Switzerland is expected to strengthen further rather than retreat.

Premiumisation will continue, particularly in health-led, organic, and sustainability-focused ranges. Differentiation will move beyond certification toward measurable impact and clearer storytelling.

Packaging transparency and environmental performance will become more important as regulation tightens and consumer scrutiny increases.

At the same time, retailers are likely to remain disciplined. Range control and quality consistency matter more than aggressive expansion in a market where private label already dominates.

Why Switzerland matters for the wider retail industry

Switzerland offers a clear view of what mature private label markets can look like.

High own-label share does not prevent innovation.

Retail concentration does not eliminate choice.

Private label can support premium positioning when trust is strong.

For international suppliers, packaging companies, and category managers, Switzerland is not an outlier. It is a reference point for how private label can reshape retail economics over the long term.