The Netherlands fresh produce market is small on paper but outsized in influence.

The country has fewer than 18 million people. Yet it shapes how fresh fruit and vegetables move across Europe. What grows in the Netherlands, what passes through it, and what is sold on its shelves all feed into wider European supply decisions.

For buyers, suppliers, and producers, the Netherlands is not just another national market. It is a gateway, a testing ground, and a logistics engine rolled into one.

This article looks at what the Dutch fresh produce market really looks like — and why it matters far beyond its borders.

A Market Built on Two Different Roles

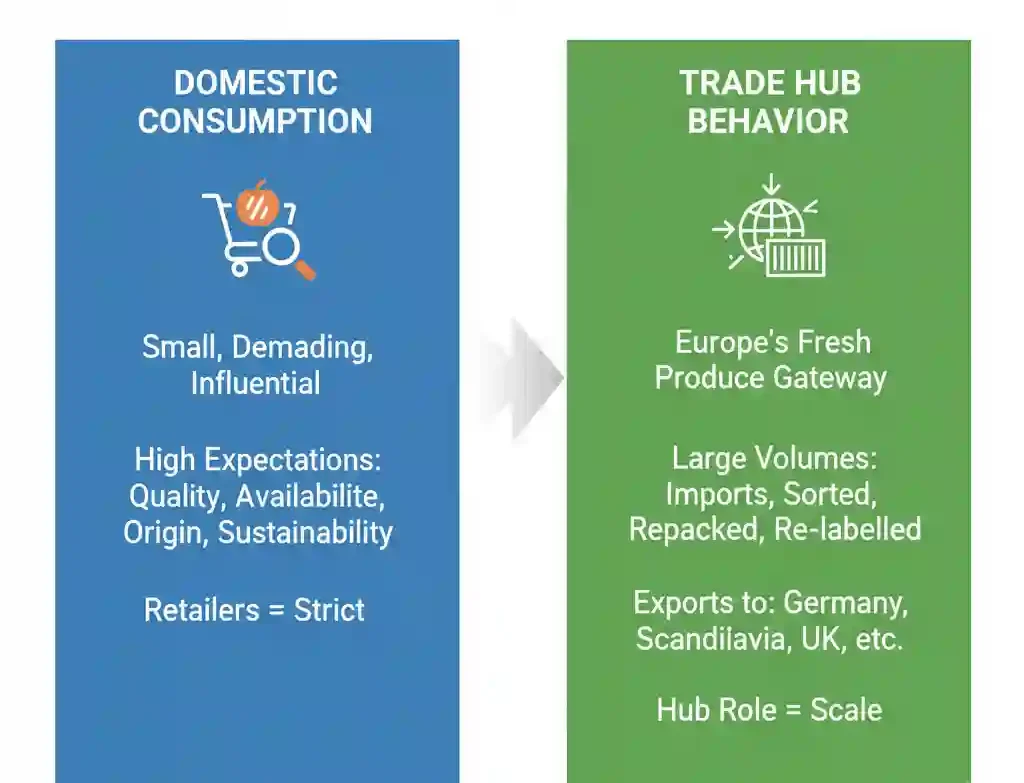

To understand the Netherlands, you have to separate two things that are often mixed together.

- Domestic consumption

- Trade and re-export activity

They overlap, but they are not the same.

Domestic Consumption: Small, Demanding, Influential

Dutch consumers buy less fresh produce in total volume than markets like Germany, France, or the UK. But expectations are high.

Shoppers expect:

-

Consistent quality

-

Year-round availability

-

Clear origin and production information

-

Strong sustainability cues

Organic and environmentally certified produce carries real weight in buying decisions. The Netherlands has one of the highest levels of sustainability awareness in Europe, even if organic share is still lower than in some neighbouring countries.

Retailers reflect this pressure directly onto suppliers.

Listings are tight. Specifications are strict. Delistings happen quickly if performance slips.

Trade Hub Behavior: Where The Real Scale Sits

The bigger story sits outside domestic consumption.

The Netherlands functions as Europe’s fresh produce gateway.

Large volumes of fruit and vegetables:

-

Enter the EU through Dutch ports

-

Are stored, sorted, repacked, or re-labelled

-

Then move on to Germany, Scandinavia, the UK, and beyond

A tomato eaten in Sweden or a pepper sold in Germany may have passed through Dutch hands, even if it was grown elsewhere.

This hub role shapes how the entire supply chain behaves.

Why The Netherlands Matters In European Supply

Three structural factors explain the Netherlands’ position.

1. Logistics infrastructure is unmatched

Fresh produce moves fast, and the Netherlands is built for speed.

Ports, cold storage, road links, and distribution centres are tightly integrated. Turnaround times are short. Losses are minimised. Flexibility is high.

For perishable goods, that matters more than size.

2. Greenhouse production sets European benchmarks

Dutch greenhouse production is among the most advanced in the world.

Tomatoes, peppers, cucumbers, and increasingly berries are produced with:

-

High yields per square metre

-

Tight climate control

-

Lower water and energy use per unit

These systems influence how other European producers invest and modernise. What works in the Netherlands often becomes the reference model elsewhere.

3. Re-export changes how trade data looks

Trade statistics can be misleading if you do not understand re-exports.

A large share of “Dutch exports” are not grown in the Netherlands. They are traded through it.

For buyers, this means:

-

Dutch traders often control access to multiple origins

-

Pricing signals from the Netherlands ripple across Europe

-

Supply shocks elsewhere show up quickly in Dutch flows

The Netherlands is less a producer-only market and more a control point.

Category Examples That Define The Market

Looking at specific categories helps make this clearer.

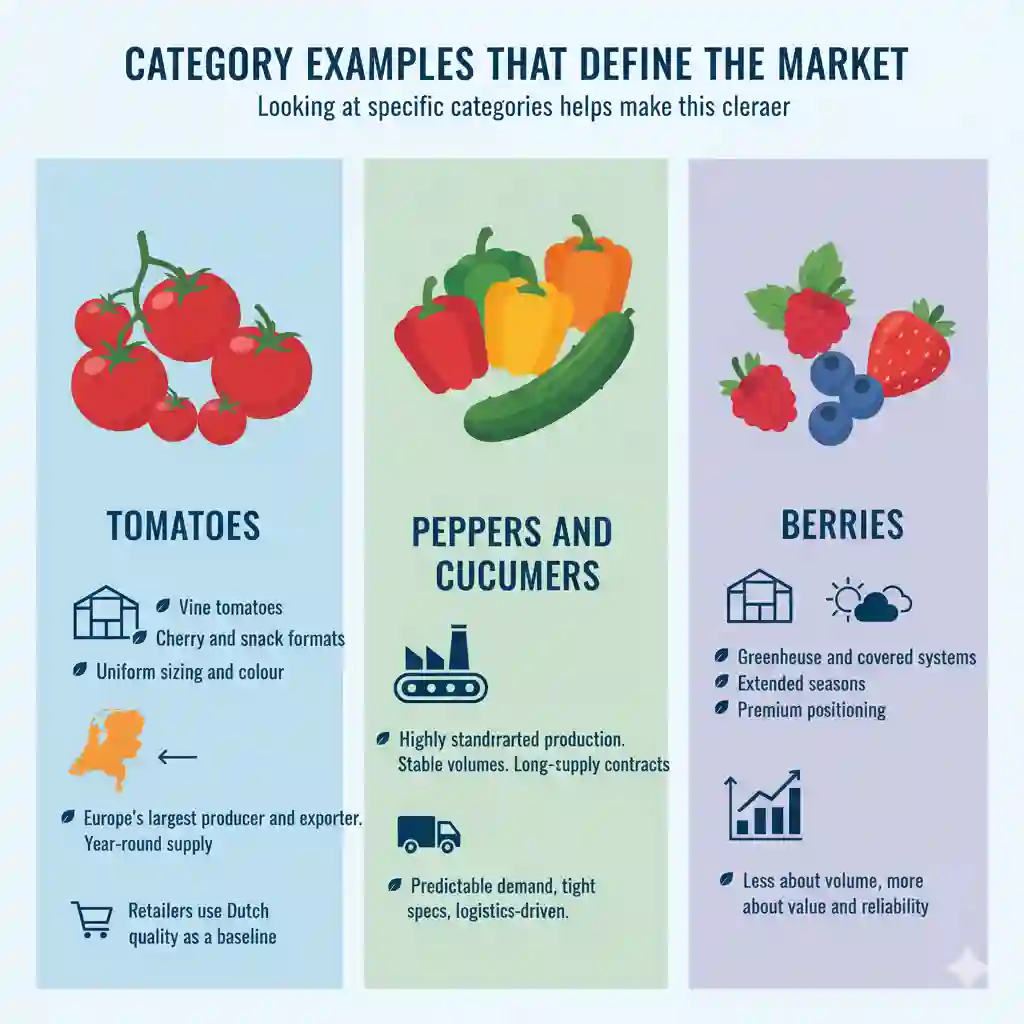

Tomatoes

Tomatoes are the flagship.

The Netherlands is one of Europe’s largest tomato producers and exporters. High-tech greenhouses allow year-round supply, with a strong focus on:

-

Vine tomatoes

-

Cherry and snack formats

-

Uniform sizing and colour

Retailers across Europe often use Dutch tomato quality as a baseline when comparing other origins.

Peppers and cucumbers

Sweet peppers and cucumbers follow a similar pattern.

Production is highly standardised. Volumes are stable. Supply contracts are long-term.

These categories suit the Dutch model well: predictable demand, tight specs, and logistics-driven distribution.

Berries

Berries are a growing focus.

While southern Europe still dominates large-scale berry production, the Netherlands is investing heavily in:

-

Greenhouse and covered systems

-

Extended seasons

-

Premium positioning

This is less about volume and more about value and reliability.

Retail Expectations Shape The Entire Chain

Dutch retailers are among the toughest in Europe when it comes to fresh produce.

They expect:

-

Consistent sizing and grading

-

Clear sustainability credentials

-

Reliable weekly volumes

-

Packaging that meets recycling and waste rules

This pressure flows upstream.

Growers invest more. Packers adapt faster. Importers tighten supplier lists.

Fresh produce suppliers who succeed in the Netherlands often find it easier to win listings elsewhere in Europe afterward.

Fresh Packaging Is Not A Side Issue

Packaging plays a larger role in the Dutch fresh produce market than many suppliers expect.

Requirements around:

-

Material reduction

-

Recyclability

-

Labelling clarity

-

Shelf efficiency

are tightly enforced.

Fresh produce packaging decisions are often influenced by wider Dutch standards, making this market closely linked to fresh packaging innovation and compliance trends across Europe.

This is why fresh produce strategy in the Netherlands cannot be separated from packaging decisions.

Top Fresh Produce Forces In The Netherlands

| Force | What it looks like in practice |

|---|---|

| Demand trends | Quality-led, sustainability-aware, less price-driven than many EU markets |

| Supply model | High-tech domestic production + global sourcing |

| Trade role | Gateway, consolidation hub, re-export centre |

| Retail expectations | Tight specs, fast delisting, strong compliance pressure |

Why Buyers And Suppliers Watch The NL Closely

For supermarket buyers, the Netherlands offers early signals.

Shifts in:

-

Availability

-

Pricing

-

Packaging formats

-

Sustainability standards

often appear here first.

For suppliers, the market is demanding but valuable. Success in the Netherlands builds credibility across Europe. Failure exposes weaknesses fast.

What Happens Next

The Netherlands is unlikely to grow dramatically in population or domestic consumption.

Its importance will continue to come from how food moves, not just how much is eaten locally. This matters especially for Netherlands supermarkets, where fresh produce ranges are increasingly shaped by cross-border sourcing rather than domestic supply alone.

As European supply chains become more complex, and sustainability pressure increases, the Netherlands’ role as a coordination point will only strengthen. That influence is already visible in how private label Netherlands fresh produce is specified, packed, and rolled out across multiple European markets.

For fresh produce professionals, it remains a market you cannot ignore — even if you never sell directly to a Dutch shopper.

Editor’s Note: This article is based on public market analysis, Dutch trade statistics, and fresh produce sector reporting, including official data and industry research used widely by European buyers and suppliers.

FAQ

What products does the Netherlands produce most?

Beyond fresh produce, the Netherlands is a major producer and exporter of dairy products, meat, eggs, processed foods, flowers, and seeds.

In agriculture, it is especially strong in high-value, technology-driven production, rather than bulk farming. This includes greenhouse crops, breeding materials, and agri-technology linked to food production.

What fruits are grown in the Netherlands?

Fruit growing in the Netherlands focuses on apples, pears, strawberries, and soft fruits.

Stone fruits and citrus are not widely grown due to climate limits. Many fruits sold in Dutch supermarkets are imported and traded through the country rather than grown locally, reflecting its role as a European distribution hub.

Which country has the freshest food?

“Freshest” depends on definition.

Countries with strong local supply chains and short farm-to-store distances, such as the Netherlands, often deliver very fresh food in terms of time from harvest to shelf.

However, countries with warmer climates may offer greater seasonal variety. Freshness is shaped more by logistics and retail systems than geography alone.

What is the Netherlands’ famous food?

The Netherlands is best known for cheese (such as Gouda and Edam), along with traditional foods like stroopwafels, herring, and bitterballen.

In a modern trade context, however, the country is more famous for its food system expertise than for a single signature dish.