In most global markets, trade events are built around scale. In Finland, the logic is different. This is a concentrated retail market led by two dominant buying groups — S-Group and Kesko — which together account for the clear majority of national grocery sales.

For suppliers, private label manufacturers, packaging companies, and retail technology vendors, success is not about booth size or visitor volume. It is about access to decision-makers, data credibility, and long-term supply reliability.

Finland’s trade calendar reflects this reality. Fewer events. Higher buyer concentration. Stronger focus on real sourcing discussions.

This guide answers two practical questions:

- Main food trade shows in Finland

- Where grocery buyers meet in Finland

The ranking is based on buyer attendance, supplier relevance, and industry impact.

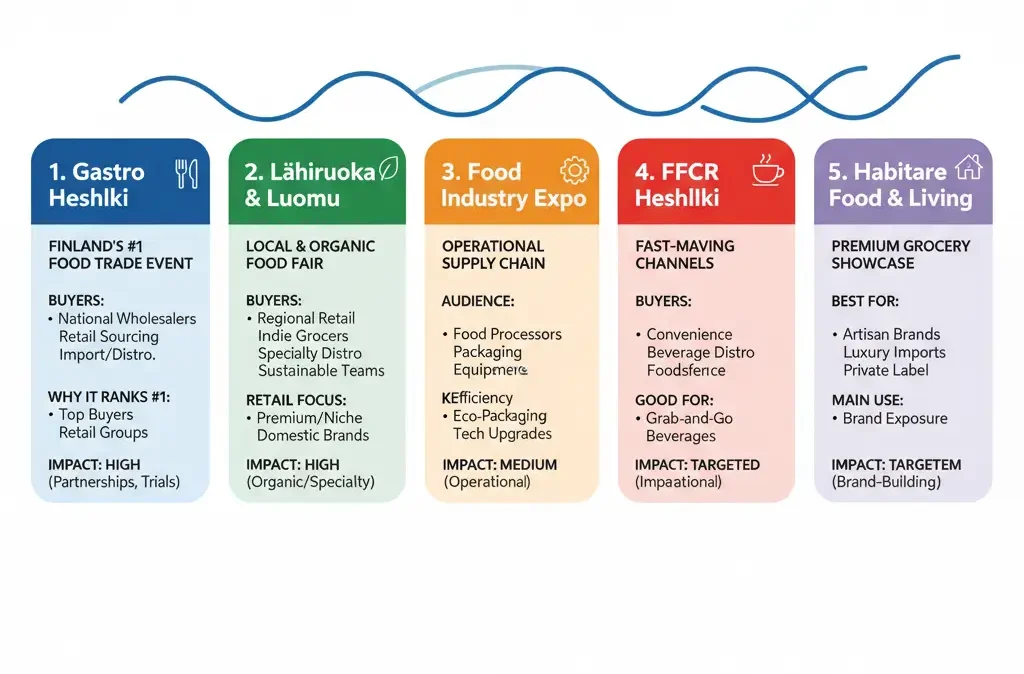

Event Power Ranking Overview

| Rank | Event | Location | Core Focus | Buyer Presence | Industry Impact |

|---|---|---|---|---|---|

| 1 | Gastro Helsinki | Helsinki | Foodservice, wholesale & retail sourcing | Very High | National leader |

| 2 | Lähiruoka & Luomu | Helsinki | Local, organic & specialty retail | High | Niche growth |

| 3 | Food Industry Expo | Tampere | Packaging, processing & production | Medium | Operational |

| 4 | FFCR Helsinki | Helsinki | Convenience, beverage & impulse FMCG | Targeted | Channel-specific |

| 5 | Habitare Food & Living | Helsinki | Premium brands & lifestyle retail | Medium | Brand positioning |

1. Gastro Helsinki

Gastro Helsinki is Finland’s most important professional food trade event. It is held on a biennial cycle, which makes each edition strategically important for suppliers planning long-term retail and wholesale partnerships.

Buyer profile

- National wholesalers

- Foodservice procurement teams

- Retail sourcing managers

- Import and distribution partners

Although the event name suggests a hospitality focus, it functions as a key sourcing meeting point for FMCG suppliers because foodservice and retail procurement teams often overlap in supplier evaluation.

Why it ranks #1

- Highest concentration of national-level buyers

- Strong presence from the country’s main retail buying groups

- Direct access to wholesale distribution partners

Industry impact: High. Many product trials, seasonal listings, and supplier negotiations are initiated here.

2. Lähiruoka & Luomu (Local & Organic Food Fair)

Lähiruoka & Luomu is Finland’s main domestic event focused on local production, organic food, and specialty grocery categories.

Buyer profile

- Regional retail buyers

- Independent grocery chains

- Specialty food distributors

- Sustainability-focused sourcing teams

The event has grown in importance as Finnish consumers show stronger interest in traceability, local sourcing, and clean-label products.

Retail relevance

- Used by retailers to identify premium and niche products

- Important platform for domestic producers entering national distribution

Industry impact: High within organic and specialty retail segments.

3. Food Industry Expo (Elintarviketeollisuus)

The Food Industry Expo focuses on the operational side of the grocery supply chain.

Main audience

- Food processors

- Packaging suppliers

- Equipment manufacturers

- Production and logistics managers

This event is especially relevant for companies working in packaging innovation, automation, and compliance-driven production upgrades.

Why it matters

- Strong focus on processing efficiency

- Packaging sustainability solutions

- Manufacturing technology

Industry impact: Medium. Operationally important rather than retail-facing.

4. Fastfood, Café & Restaurant Expo (FFCR Helsinki)

FFCR Helsinki is the first major food trade event of the year and is more focused on fast-moving channels.

Buyer profile

- Convenience retail buyers

- Beverage distributors

- Foodservice operators

- Impulse category sourcing teams

The event is smaller than Gastro but valuable for brands targeting grab-and-go, beverage, and high-rotation categories.

Industry impact: Targeted. Strong relevance for impulse-driven categories.

5. Habitare Food & Living

Habitare is primarily a design and lifestyle exhibition, but its Food & Living zone has become a platform for premium grocery positioning.

Best suited for

- Artisan brands

- Premium imports

- Concept-driven private label ranges

This event is used more for brand exposure and positioning than for large-volume retail listings.

Industry impact: Medium. Brand-building rather than mass sourcing.

Buyer Attendance Comparison

| Event | Grocery Buyers | Wholesalers | Importers | Retail Category Managers |

|---|---|---|---|---|

| Gastro Helsinki | Very High | High | Medium | Medium |

| Lähiruoka & Luomu | High | Low | Medium | Medium |

| Food Industry Expo | Low | Medium | Low | Low |

| FFCR Helsinki | Medium | Medium | Low | Low |

| Habitare Food Zone | Medium | Low | Low | Medium |

Where Grocery Buyers Meet in Finland

For suppliers targeting national retail listings, most buyer engagement happens at:

- Gastro Helsinki — wholesale and retail sourcing discussions

- Lähiruoka & Luomu — niche and premium product sourcing

- Private meeting rooms and invitation-only networking sessions organised during major fairs

Smaller regional events rarely attract national-level retail decision-makers.

Why Finland’s Trade Event Market Works Differently

Finland’s grocery industry operates on long-term supplier relationships and strict performance standards.

As a result, events prioritise:

- Buyer quality over visitor volume

- Direct business meetings

- Supply chain reliability discussions

- Compliance and sustainability readiness

Preparation matters more than presentation.

What Suppliers Should Prepare

Suppliers entering Finnish trade events should arrive with:

- Retail-ready pricing structures

- Clear private label production capabilities

- Verified sustainability certifications

- Nordic regulatory compliance documentation

- Reliable logistics and distribution plans

Finnish buyers are highly pragmatic and data-driven.

Final Takeaway

Finland is a concentrated but high-value grocery market.

For most suppliers, focusing on Gastro Helsinki for national exposure and Lähiruoka & Luomu for niche category growth provides access to the majority of relevant retail buyers.

Success in this market is driven less by volume of meetings and more by preparation, credibility, and long-term supply performance.