Japan’s FMCG Brands market is one of the most competitive consumer goods environments in the world. Growth is not driven by population expansion or rapid urbanisation. It is driven by brand trust, product innovation, premium positioning, operational efficiency, and increasingly by overseas expansion.

For supermarket buyers, distributors, and suppliers, understanding who controls the largest revenue pools matters. These companies influence shelf standards, packaging formats, private label benchmarks, ingredient sourcing trends, and price architecture across the entire market.

This ranking focuses on Japan-headquartered FMCG companies operating in food, beverage, personal care, home care, hygiene, and beauty categories. Retailers, trading houses, and industrial manufacturers are excluded. Revenue figures are based on the latest available consolidated financial reports from FY2024 and FY2025.

Japan’s largest FMCG groups share several traits:

Strong domestic brand loyalty

High repeat-purchase categories

Global expansion strategies

Heavy investment in R&D and packaging innovation

Tight control over supply chains and cost structures

Together, these companies shape not only Japan’s grocery shelves but also international FMCG competition.

10 FMCG Brands in Japan by Revenue

| Rank | Company | Revenue (Approx. USD) | Latest Fiscal Year | Core Strength |

|---|---|---|---|---|

| 1 | Japan Tobacco | $21.0 Billion | Dec 2024 | Global Tobacco & Foods |

| 2 | Asahi Group Holdings | $19.6 Billion | Dec 2024 | Premium Beer & Soft Drinks |

| 3 | Kao Corporation | $10.8 Billion | Dec 2024 | Personal & Home Care |

| 4 | Meiji Holdings | $7.7 Billion | Mar 2025 | Dairy & Confectionery |

| 5 | Shiseido Company | $6.6 Billion | Dec 2024 | Cosmetics & Skincare |

| 6 | Unicharm Corporation | $6.6 Billion | Dec 2024 | Hygiene & Baby Care |

| 7 | Nissin Foods Holdings | $5.1 Billion | Mar 2025 | Instant Noodles |

| 8 | Kikkoman Corporation | $4.7 Billion | Mar 2025 | Soy Sauce & Seasonings |

| 9 | Yakult Honsha | $3.3 Billion | Mar 2025 | Probiotic Beverages |

| 10 | Toyo Suisan Kaisha | $3.3 Billion | Mar 2025 | Seafood & Instant Noodles |

Revenue note: Figures are converted from Japanese Yen using an average exchange rate of approximately 150 JPY = 1 USD. Rankings are based on consolidated group revenue.

Company Profiles

1. Japan Tobacco, Inc.

Founded: 1985

Headquarters: Tokyo

Japan Tobacco is the largest FMCG-scale consumer group in Japan by revenue. While tobacco remains its core business, the company also operates packaged food and beverage brands that serve everyday consumer demand.

Core product areas:

Cigarettes and reduced-risk tobacco products

Packaged foods and frozen meals

Beverage and processed food brands

Why it ranks #1:

Japan Tobacco’s global footprint delivers scale unmatched by other Japanese FMCG groups. Strong overseas performance offsets slower domestic consumption, while its food division provides diversification beyond tobacco.

Why buyers watch JT:

The company operates one of the most complex consumer supply chains in Japan, with strict regulatory oversight, logistics efficiency, and high-volume production capacity.

2. Asahi Group Holdings

Founded: 1889

Headquarters: Tokyo

Asahi is Japan’s most internationally visible beverage group. It controls major beer brands while expanding aggressively in premium soft drinks and health-focused beverages.

Core product areas:

Beer and alcoholic beverages

Soft drinks and bottled water

Functional and wellness drinks

Why it ranks #2:

Asahi’s international beer acquisitions and strong domestic beer leadership have driven sustained revenue growth.

Why buyers watch Asahi:

The company sets pricing and promotional standards in beverage aisles and plays a key role in category innovation such as low-alcohol and functional drinks.

3. Kao Corporation

Founded: 1887

Headquarters: Tokyo

Kao is Japan’s largest home and personal care group. Its portfolio covers daily household essentials alongside premium skincare and beauty brands.

Core product areas:

Laundry and home cleaning products

Skincare and cosmetics

Hair care and hygiene items

Why it ranks #3:

Kao dominates recurring purchase categories such as detergents and personal care, while expanding internationally across Asia and Europe.

Why buyers watch Kao:

Packaging sustainability, refill formats, and premiumisation strategies from Kao often influence category standards across Japanese retailers.

4. Meiji Holdings

Founded: 1916

Headquarters: Tokyo

Meiji is one of Japan’s largest food and dairy companies, with a strong domestic retail presence and expanding export business.

Core product areas:

Milk and dairy products

Chocolate and confectionery

Ice cream and nutrition products

Why it ranks #4:

Meiji’s combination of staple dairy consumption and branded confectionery creates consistent high-volume sales.

Why buyers watch Meiji:

Innovation in functional dairy, protein products, and premium chocolate segments keeps Meiji at the centre of grocery category development.

5. Shiseido Company

Founded: 1872

Headquarters: Tokyo

Shiseido is Japan’s most globally recognised beauty brand. It operates across mass and premium cosmetic segments.

Core product areas:

Skincare and anti-ageing products

Makeup and fragrances

Professional beauty brands

Why it ranks #5:

Despite slower recovery in China and travel retail, Shiseido remains one of the world’s largest beauty groups by revenue.

Why buyers watch Shiseido:

Product innovation cycles, premium packaging trends, and retail merchandising strategies often originate from Shiseido’s portfolio.

6. Unicharm Corporation

Founded: 1961

Headquarters: Ehime

Unicharm specialises in hygiene products with extremely high purchase frequency.

Core product areas:

Baby diapers

Feminine hygiene

Adult incontinence products

Why it ranks #6:

Essential hygiene categories provide stable recurring demand, even during economic slowdowns.

Why buyers watch Unicharm:

Ageing population trends and material innovation make Unicharm a long-term category leader.

7. Nissin Foods Holdings

Founded: 1948

Headquarters: Osaka

Nissin invented instant noodles and remains the category’s global leader.

Core product areas:

Instant noodles

Frozen meals

Ready-to-eat foods

Why it ranks #7:

Strong overseas performance, especially in North America and Asia, has pushed revenue beyond $5 billion.

Why buyers watch Nissin:

Nissin controls price architecture and SKU innovation in the instant food aisle.

8. Kikkoman Corporation

Founded: 1603 (modern corporation 1917)

Headquarters: Chiba

Kikkoman is synonymous with soy sauce and Japanese seasoning exports.

Core product areas:

Soy sauce

Seasonings and cooking sauces

Beverage products

Why it ranks #8:

Kikkoman’s global household penetration gives it strong international FMCG scale.

Why buyers watch Kikkoman:

Flavor trends and export-driven product development often originate from Kikkoman’s portfolio.

9. Yakult Honsha

Founded: 1935

Headquarters: Tokyo

Yakult operates in the fast-growing functional beverage space.

Core product areas:

Probiotic dairy drinks

Functional nutrition beverages

Why it ranks #9:

Health-driven consumption patterns continue to support Yakult’s global expansion.

Why buyers watch Yakult:

Functional claims and scientific positioning influence the wider wellness beverage segment.

10. Toyo Suisan Kaisha

Founded: 1953

Headquarters: Tokyo

Toyo Suisan is best known internationally through the Maruchan brand.

Core product areas:

Instant noodles

Seafood products

Prepared foods

Why it ranks #10:

Strong growth in the US market has significantly increased group revenue.

Why buyers watch Toyo Suisan:

Its international brand strength gives Japanese retailers insight into overseas consumer demand trends.

Why This Ranking Matters

This ranking highlights how Japan’s FMCG leadership is concentrated in companies that control daily consumption categories. Beer, hygiene products, dairy, instant food, and personal care remain the backbone of grocery sales.

For retailers and suppliers, these companies shape:

Shelf space allocation

Promotional pricing structures

Packaging standards

Sustainability targets

Innovation timelines

Understanding who dominates revenue helps buyers anticipate category shifts and supplier negotiations.

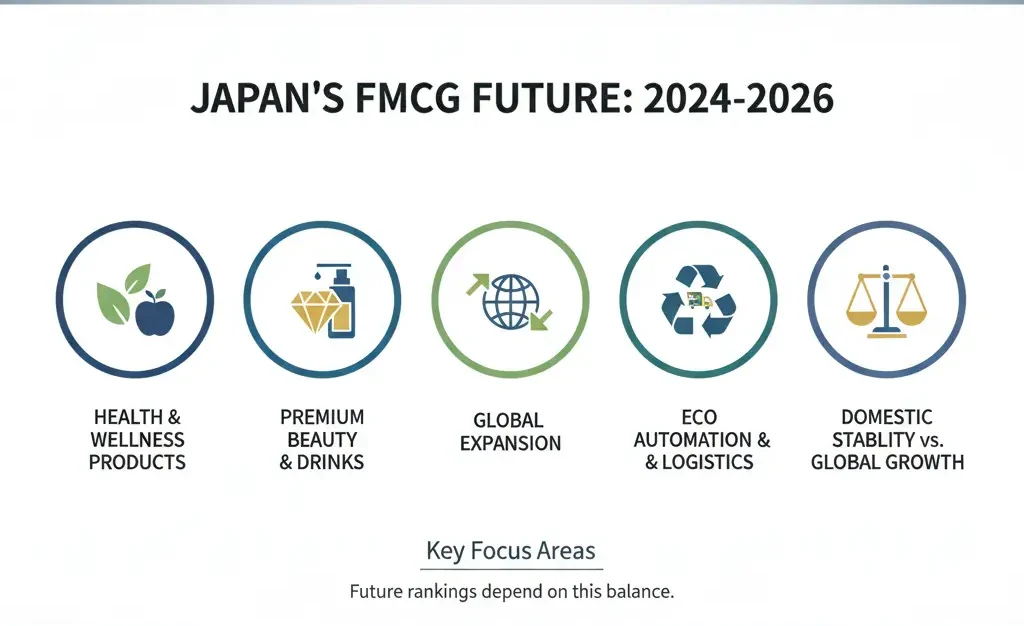

What Comes Next for Japan’s FMCG Leaders

Over the next two years, Japan’s largest FMCG companies are expected to focus on:

Functional and health-focused products

Premiumisation in beauty and beverages

Overseas market expansion

Sustainable packaging formats

Cost control through automation and logistics optimisation

The balance between domestic stability and global growth will determine future ranking changes.

Conclusion

Japan’s FMCG leaders are no longer competing only on brand recognition. They are competing on supply chain speed, product innovation, and packaging performance. From refill formats in home care to lightweight bottles in beverages, Japan packaging standards are now shaping how products move through retail faster and at lower cost.

At the same time, the role of the Japan supermarket sector continues to evolve. Large chains are tightening shelf space, demanding better margins, and prioritising private label alongside premium branded goods. That pressure is forcing FMCG suppliers to deliver stronger value propositions, clearer sustainability claims, and more efficient logistics.

For buyers, suppliers, and category managers, this ranking is not just about revenue size. It is about understanding which companies set the pace of change in Japan’s consumer goods market — and which ones are best positioned to lead the next phase of growth.

Editor’s Note: Revenue figures are based on the latest publicly available full-year financial reports from FY2024 and FY2025. Currency conversions are applied for comparison consistency. Rankings reflect consolidated group revenue.