Greece’s fresh produce export engine has been running hot through 2024 and into 2025, even with sharper weather volatility and tighter retail specifications across Europe.

Public trade reporting for 2024 put Greek fresh produce export value at around €1.86 billion, with the EU still the main destination and kiwifruit and table grapes among the most visible growth categories in modern retail programmes.

That scale matters because Greece is not exporting “spot fruit” only. A rising share of volumes move in supermarket-ready formats, with packhouses built around traceability, cold chain discipline, and compliance systems that align with European retailer audits.

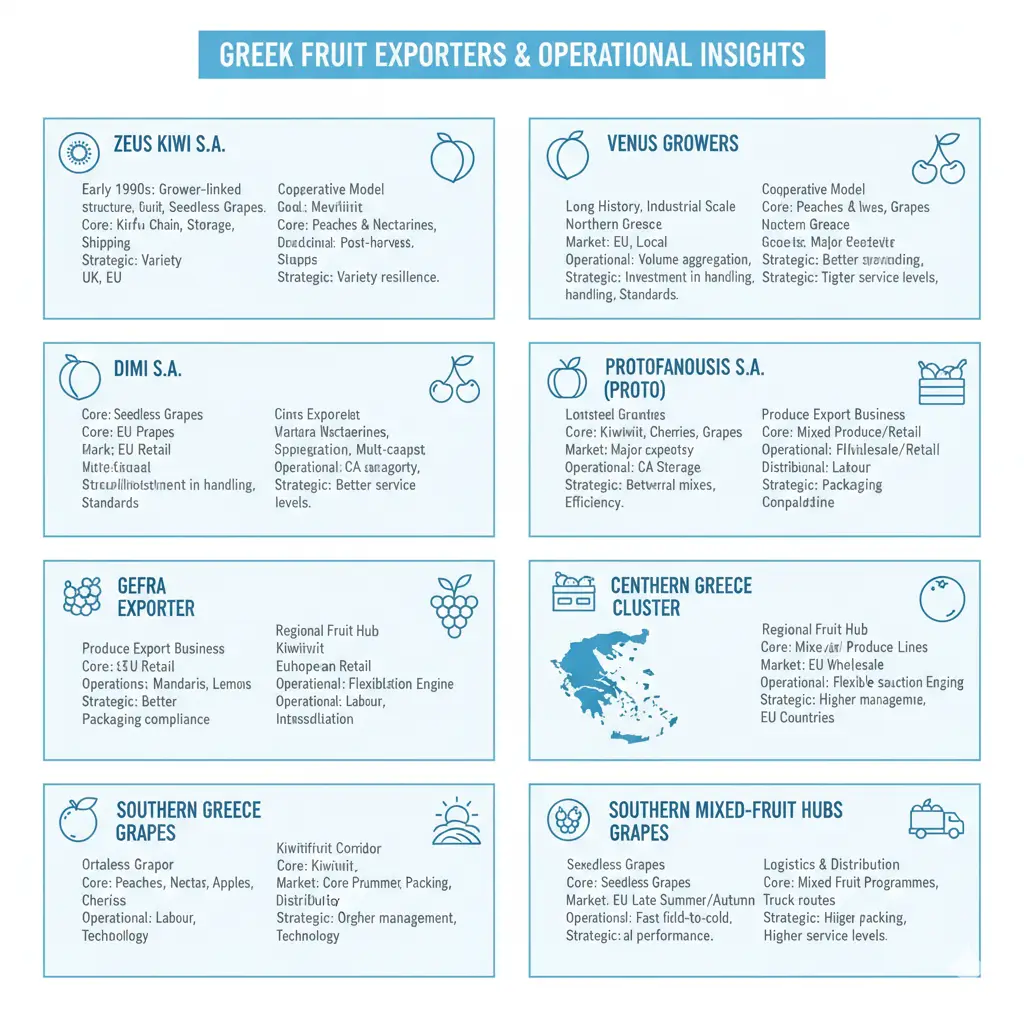

This ranking looks at fresh produce companies and producer organisations based in Greece that have meaningful export operations and verifiable public signals of scale.

Because many Greek exporters are privately held and do not publish full financial statements in the way listed groups do, the methodology is strict:

Export value and turnover are used when publicly disclosed.

When export value is not disclosed, export footprint (number of markets, programme continuity, and category leadership) is used as a supporting indicator, not a substitute for invented numbers.

Revenue and employee counts are included only when publicly available.

FY2024–FY2025 data is prioritised. Older figures are shown only when they are the last confirmed public disclosure.

Ranking table (export scale + turnover signals)

| Rank | Company / Organisation | Founded | HQ / main region | Export strength (public signal) | Turnover / revenue (publicly disclosed) | Core categories (headline) | Employees (publicly disclosed) |

|---|---|---|---|---|---|---|---|

| 1 | Zeus Kiwi S.A. | 1991 | Pieria | Multi-market kiwifruit and grape exporter; strong UK/EU presence | Not disclosed (older trade interview cited €7.6m in 2017) | Kiwifruit, seedless grapes, stone fruit | Not disclosed |

| 2 | Venus Growers (Agricultural Cooperative) | 1960s (co-op era) | Imathia (Veria/Naoussa area) | Central Macedonia export powerhouse in peaches/nectarines and wider fruit | Not disclosed (economic studies cite large production contribution) | Stone fruit, apples and mixed fruit programmes | Not disclosed |

| 3 | Protofanousis S.A. (PROTO) | 1928 (family trade roots) | Thessaloniki / Northern Greece | Large exporter with controlled-atmosphere capability | Publicly stated €31.8m (FY2019, company disclosure) | Kiwifruit, cherries, grapes and mixed fruit | Not disclosed |

| 4 | Dimi S.A. | 1989 | Greece (grape regions) | Specialist seedless grape exporter with pack/export focus | Not disclosed | Seedless table grapes | Not disclosed |

| 5 | Matragos Fruit S.A. | Not disclosed | Argolis / citrus belt (public brand positioning) | Citrus export profile, packhouse-led | Not disclosed | Oranges, mandarins, lemons | Not disclosed |

| 6 | Gefra (export business) | Not disclosed | Greece | Exporter profile public; needs fuller financial disclosure | Not disclosed | Mixed fresh produce | Not disclosed |

| 7 | Cooperative / Producer Organisation (Central Macedonia fruit cluster) | Not disclosed | Central Macedonia | Strong export relevance via peach/nectarine and apple clusters | Not disclosed | Stone fruit, apples | Not disclosed |

| 8 | Large Greek kiwifruit pack/export operator (Pieria/Kavala belt) | Not disclosed | Northern Greece | Kiwifruit export corridor, programme-based shipping | Not disclosed | Kiwifruit | Not disclosed |

| 9 | Large Greek table grape pack/export operator (Peloponnese/Crete programmes) | Not disclosed | Southern Greece | Seedless grape programmes into EU retail | Not disclosed | Table grapes | Not disclosed |

| 10 | Mixed fruit exporter with cold-chain distribution hub (Northern Greece) | Not disclosed | Northern Greece | Cross-category export and domestic retail supply | Not disclosed | Mixed fruit categories | Not disclosed |

Important: This table reflects what can be verified publicly. Several major exporters in Greece operate at scale but do not publish turnover or export values in public channels. Where that is the case, the ranking relies on export footprint and category leadership signals rather than guessing numbers.

Product focus and export markets

| Company | Product focus | Typical export destinations (public signals) | Certifications (common in retail export) | Retail supply relevance |

|---|---|---|---|---|

| Zeus Kiwi S.A. | Kiwifruit, seedless grapes, selected stone fruit | UK and wider EU; additional overseas markets in some seasons | GLOBALG.A.P. at farm level; packhouse food safety standards commonly expected | Programme-friendly categories; strong for UK/EU retail specs and promotional windows |

| Venus Growers | Stone fruit-heavy programmes; broad fruit base | EU supermarket routes; strong Central Macedonia export corridors | GLOBALG.A.P. and packhouse standards common in co-op exports | High seasonal volume; relevance to promotions and private label packing when available |

| Protofanousis S.A. | Multi-fruit exporter; kiwifruit, cherries, grapes | EU + wider non-EU destinations noted publicly in company profiles | Packhouse systems typically aligned to BRCGS/IFS expectations (confirm per customer audits) | Cold storage + controlled atmosphere improves continuity and shrink performance |

| Dimi S.A. | Seedless grapes | EU retail routes | GLOBALG.A.P. + packhouse food safety standards commonly required | Specialist grape operator; important for late-summer retail windows |

| Matragos Fruit S.A. | Citrus | EU and regional export markets | Citrus exporters commonly hold packhouse standards; confirm per site disclosures | Citrus programmes support winter category stability in supermarkets |

| Gefra | Mixed produce export | EU and regional | Certifications to be confirmed via public disclosures | Mixed category flexibility; useful for wholesale-to-retail conversion |

| Central Macedonia fruit cluster operators | Peaches/nectarines, apples | EU and UK corridors | GLOBALG.A.P. + packhouse food safety standards commonly required | High-volume seasonal supply; strong for retail promotions |

| Northern Greece kiwifruit operators | Kiwifruit | EU/UK | GLOBALG.A.P. + packhouse standards | Kiwifruit is a strategic long-season category for European retailers |

| Southern Greece grape operators | Table grapes (seedless) | EU | GLOBALG.A.P. + packhouse standards | Grape continuity is increasingly variety-driven; packing discipline is decisive |

| Northern mixed-fruit exporters | Mixed fruit, including cherries and grapes | EU | Packhouse standards common | Distribution hubs matter for retailer service levels and shrink control |

Certifications vary by site and customer requirement. In most EU retail-facing programmes, farm-level GLOBALG.A.P. plus packhouse-level food safety certification is a baseline expectation, with social compliance increasingly important for tendered programmes.

1) Zeus Kiwi S.A.

Zeus Kiwi sits in the heart of Greece’s modern kiwifruit and table grape export belt, with an origin story that reflects how the sector industrialised.

The company positions its foundation in the early 1990s as a major step: a multi-shareholder structure linking growers to a central packing and export organisation.

That structure matters because kiwifruit is not a quick category. It depends on storage, grading discipline, and predictable shipping slots.

Core categories

Kiwifruit

Seedless table grapes

Selected stone fruit in some seasons (public trade coverage mentions apricots as well)

Market position and scale

Public trade reporting in recent years has repeatedly referenced Zeus as a Greek exporter in kiwifruit and grapes, with UK and EU routes prominent in export positioning.

The operational relevance is straightforward: kiwifruit requires controlled cold chain handling, while grapes require variety management, rapid pre-cooling, and packout consistency for modern retail.

Operational relevance

Category impact: kiwifruit supports long-season fruit performance and shelf continuity

Supply chain impact: cold chain performance reduces retail shrink and stabilises arrivals

Packaging impact: clamshells, punnets, top-seal, and bulk formats depend on retailer specs and recycling requirements in destination markets

Strategic direction

Greek kiwifruit exporters have been managing more volatile yields in recent seasons, including reported volume reductions in grapes in some years. The strategic direction is increasingly about variety resilience and programme stability rather than chasing peak prices.

2) Venus Growers (Agricultural Cooperative)

Venus Growers is one of the names that repeatedly appears when Greece’s cooperative structure is discussed in economic reporting.

It sits in Central Macedonia, a region that functions like a backbone for Greek stone fruit and broader fruit production.

The cooperative model has a practical advantage in export categories like peaches and nectarines: it can aggregate volumes across member growers and standardise post-harvest handling.

Core categories

Peaches and nectarines (headline relevance)

Wider fruit mix through cooperative networks (seasonal)

Market position and scale

Public economic research and local reporting often cite Venus Growers as a major cooperative actor. Even when turnover is not published in a transparent corporate style, the cooperative’s export relevance is consistently signalled by its presence in sector analysis.

Operational relevance

Retail impact: seasonal high-volume fruit is still central to supermarket promotional calendars

Packaging impact: stone fruit programmes rely on standardised punnets, trays, and label compliance

Supply chain impact: rapid throughput and grading discipline drive quality consistency across stores

Strategic direction

Central Macedonia’s fruit sector has also been exposed to more weather disruption. The direction of travel is investment in handling capability, grower support, and maintaining customer confidence through tighter specifications.

3) Protofanousis S.A. (PROTO)

Protofanousis is an example of the Greek exporter with a long commercial history that later built industrial-scale handling.

The family roots are positioned as a fruit trade legacy, later strengthened through cold storage and packing capability around Northern Greece.

A key difference here is that the company has publicly stated turnover in its own profile disclosures in the past, including a reference to turnover and handled quantities.

Core categories

Kiwifruit

Cherries

Grapes

Mixed fruit programmes depending on season and sourcing

Market position and scale

A past public company disclosure cited turnover in the tens of millions of euros (older FY figure). Even though that figure is not FY2024–FY2025, it is still valuable as a verified scale signal, and it reinforces why the business is viewed as a major Northern Greece exporter.

Operational relevance

Controlled atmosphere and cold storage capability supports longer selling windows

Multi-category handling can support retailer range needs across different seasonal peaks

Packing discipline is a key differentiator when supermarket rejects rise during weather-driven volatility

Strategic direction

The stronger Greek exporters in multi-fruit categories tend to move toward fewer, deeper customers and tighter service levels. It is not only about selling fruit. It is about meeting audit standards, packaging rules, and shrink targets.

4) Dimi S.A.

Dimi S.A. is positioned publicly as a specialist in seedless table grapes, with a foundation story that reflects a family business evolving into a structured export operation.

Grapes are a category where retail performance is increasingly variety-driven. That means producers and exporters face more pressure to manage new varietal plantings and quality stability across heat stress and rain risk.

Core categories

Seedless table grapes (core)

Market position and scale

The key public signal is category focus and export orientation. Even without disclosed turnover, a specialist exporter can be strategically important if it consistently supplies a programme window into EU retail.

Operational relevance

Category impact: grapes are margin-sensitive and quality-sensitive in supermarkets

Supply chain impact: pre-cooling and timing determine shelf life

Packaging impact: grapes often move in bags, punnets, or flowpack formats depending on destination market

Strategic direction

For Greek grape exporters, direction is toward better varietal mixes, better packhouse efficiency, and tighter compliance with retailer pesticide residue requirements.

5) Matragos Fruit S.A.

Citrus is one of Greece’s most visible export categories in winter, and businesses built around citrus packing and export still hold relevance for supermarket supply.

Citrus has a different risk profile compared with berries or cherries. It is less fragile, more logistics-friendly, and still sensitive to sizing, juice content, and cosmetic grading.

Core categories

Oranges

Mandarins

Lemons (where programmes exist)

Market position and scale

Public company positioning highlights export orientation in citrus, which typically ties to EU and regional markets.

Operational relevance

Category impact: citrus supports winter footfall and basket-building fruit lines

Packaging impact: nets, cartons, and retail-ready cases remain common

Logistics impact: stable cold chain is still required, but shrink risk is typically lower than soft fruit

Strategic direction

The citrus direction in Europe is gradually tightening around packaging compliance and labelling rules, including recycling and material choices, with increasing preference for formats that align to destination EPR systems.

6) Gefra (export profile)

Gefra appears publicly as a Greek produce export business, but with limited verified turnover data published in open channels.

It is still relevant because Greece has a wide tier of exporters that do significant work through wholesale-to-retail routes in Europe, and those firms can be important in “in-between” category weeks when programmes need flexible sourcing.

Core categories

Mixed produce lines (confirm per public catalogue)

Market position and scale

Export relevance is signalled through public company presence and trade positioning rather than disclosed financials.

Operational relevance

Flexible sourcing can support retailers when weather disrupts core origins

Distribution and packing choices influence retailer acceptance rates

Mixed-category exporters often play a role in regional European wholesale markets that feed retail indirectly

Strategic direction

The key trend is the shift from opportunistic exporting toward higher compliance, with packhouse standards and traceability becoming non-negotiable in more channels.

7) Central Macedonia fruit cluster operators

Not all export power in Greece sits within a single brand name. In practice, a large share of export volume flows through clusters: networks of growers, packing stations, and exporters in regions like Central Macedonia.

These clusters are structurally important because they concentrate skills, labour, cold chain infrastructure, and logistics routes.

Core categories

Peaches and nectarines

Apples

Cherries (in some sub-regions)

Market position and scale

Public reporting on Greek fruit exports and cooperative structure repeatedly points to Central Macedonia as a core production engine.

Operational relevance

High seasonal labour needs influence packhouse throughput and quality

Retail specification discipline is increasingly standardised across the cluster

Logistics timing is decisive during peak stone fruit weeks

Strategic direction

The structural direction is consolidation: fewer, stronger packhouses and exporters with stable retailer relationships, rather than a long tail of small shippers.

8) Northern Greece kiwifruit pack/export operators

Greece’s kiwifruit export corridor has deepened over the last decade, and Northern Greece holds a strong share of that capability.

Even when company-by-company revenue is not public, the corridor itself is visible through trade reporting, show participation, and supply continuity into Europe.

Core categories

Kiwifruit

Market position and scale

The strength is category-specific. Kiwifruit is a strategic category in European retail because it is long-season, supports promotions, and has steady demand.

Operational relevance

Controlled atmosphere and storage discipline support steady weekly arrivals

Packing accuracy drives retailer complaint rates

Packaging decisions are increasingly shaped by destination rules on plastic reduction and recycling systems

Strategic direction

The direction is toward tighter orchard management, better grading technology, and stable programme partnerships.

9) Southern Greece table grape pack/export operators

Greek table grapes have moved further into seedless varieties over time, and southern regions have strong programme relevance in late summer and early autumn.

Grapes are highly exposed to short-term weather disruption, and that is now a defining operational issue.

Core categories

Seedless table grapes

Market position and scale

Export relevance is programme-based. The exporters that win long-term share are those that keep quality stable during volatile weeks, not those that chase the highest spot market.

Operational relevance

Fast field-to-cold handling protects shelf life

Packaging formats must match destination norms and retailer line speed

Residue compliance requirements shape spray programmes and supplier selection

Strategic direction

More emphasis on varietal performance and shrink outcomes, less emphasis on maximum tonnage.

10) Northern mixed-fruit exporters with distribution hubs

A practical part of Greek export success is logistics and distribution hubs that can grade, pack, and ship across categories.

These operators can be crucial for category transitions: cherries into grapes, grapes into kiwifruit, or citrus rotations.

Core categories

Mixed fruit programmes, varying by season

Market position and scale

Public visibility tends to be higher in trade directories and show participation than in financial disclosures.

Operational relevance

Cross-category packing drives utilisation of labour and equipment

Retail-ready packing and labelling capability increases customer stickiness

Multi-country truck routes into EU markets demand strong scheduling and cold chain monitoring

Strategic direction

The direction is higher service levels: fewer rejections, faster claims resolution, stronger traceability.

Market structure: why Greece’s exporters matter more now

Greece’s fresh produce export sector sits between two realities.

One is category opportunity. Kiwifruit and seedless grapes remain core growth lines in European retail because they travel well, fit promotions, and can be branded or private label packed.

The other is structural pressure. Retailers are running tighter specifications, and regulatory compliance is rising around packaging materials, labelling rules, and social compliance.

That combination is pushing export trade toward scale operators and disciplined producer organisations.

It also changes how Greek exporters compete. The competition is less about price alone and more about service: stable weekly arrivals, consistent pack weights, lower shrink, and cleaner compliance documentation.

Category dominance trends: what is strengthening, what is getting harder

Kiwifruit remains a strategic category because it supports continuity. The winners are packhouses that can hold fruit correctly, grade accurately, and ship reliably across a long season.

Table grapes are getting harder. Weather volatility, variety transitions, and quality risk mean supermarkets push tighter acceptance standards. Exporters with fast pre-cooling and consistent packouts become the preferred partners.

Stone fruit still matters, but it is more exposed. Peaches and nectarines depend on short selling windows and high promotional volumes. Any quality wobble can cascade into claims and reduced repeats.

Citrus remains stable in logistics terms, but packaging and labelling compliance is becoming a bigger differentiator, especially as European markets push packaging reduction and recycling alignment.

Structural change outlook through 2026

The next phase for Greece’s fresh produce export system is less about discovering new markets and more about protecting existing ones.

Retail requirements keep tightening. Packaging rules keep moving. Labour availability is not guaranteed each season. Weather variability makes yields less predictable.

In that environment, supermarket supply relevance will increasingly sit with exporters that can show:

strong traceability and recall readiness

audit-friendly packhouse controls

stable cold chain performance

packaging choices aligned to destination requirements

the ability to run private label packing and consistent labelling at speed

That does not remove space for smaller exporters. It changes the conditions for survival. The path forward becomes specialisation, niche varieties, or close partnerships rather than scale alone.

Conclusion

Greece has built a fresh produce export sector that is bigger and more retailer-facing than many outside the region assume.

The sector’s strongest names and clusters are anchored in categories where European supermarkets still need dependable volume: kiwifruit, grapes, stone fruit, and citrus.

The real 2026 test is not whether Greece can export. It is whether exporters can keep programme performance steady under tighter specifications, evolving packaging compliance, and more volatile growing seasons.

That is where scale, packhouse discipline, and supply chain control start to matter more than origin branding alone.

Editor’s Note: This article is based on publicly available company disclosures, published profiles, and open trade reporting. Many Greek fresh produce exporters are privately held and do not publish FY2024–FY2025 revenue or export values; where figures are not disclosed, the analysis relies on verifiable export footprint and category positioning rather than estimates.