Greece’s grocery and FMCG trade calendar has become more concentrated and commercially focused. Over the past decade, many small regional fairs have faded in relevance. In their place, a limited number of professionally organised exhibitions now carry most of the country’s sourcing activity.

Retail consolidation, private label expansion, export growth, and tighter margin control have reshaped how trade events are used. Attendance is no longer driven by visibility. It is driven by contract negotiations, supplier benchmarking, packaging compliance checks, and category planning.

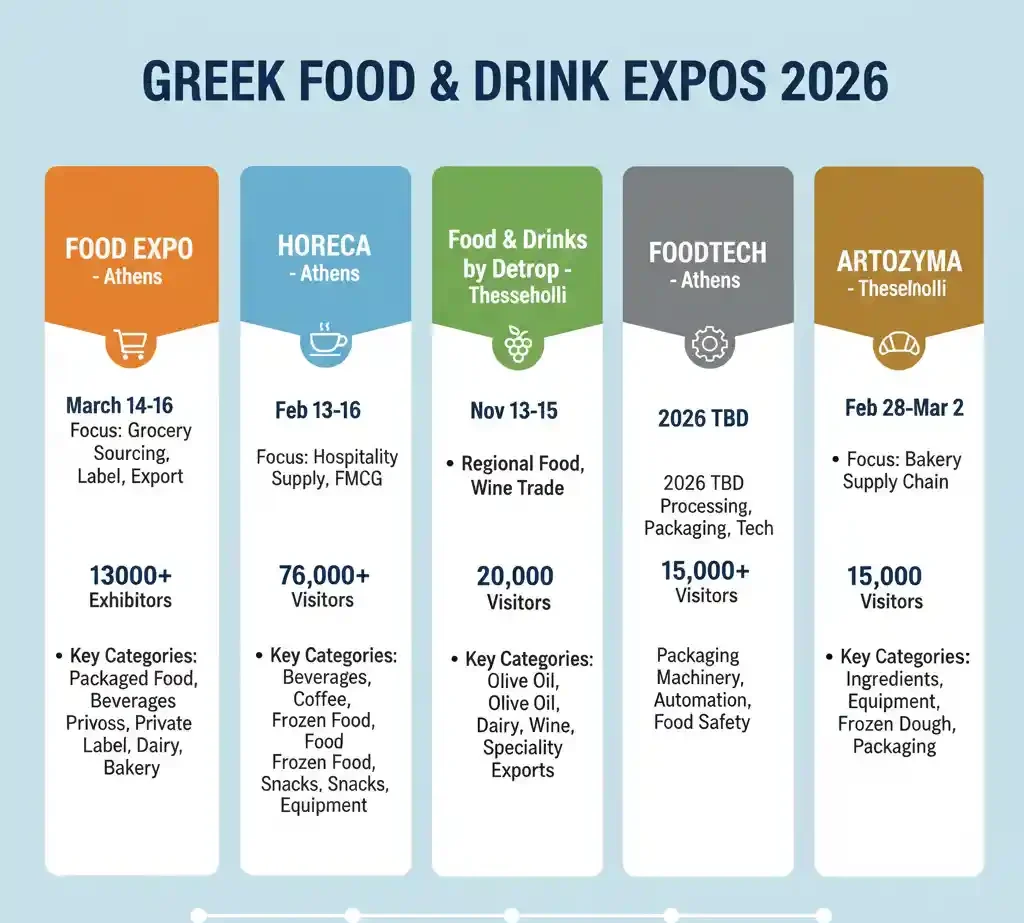

In 2026, five exhibitions clearly dominate Greece’s FMCG trade ecosystem. These events attract supermarket buying teams, wholesalers, import managers, private label sourcing specialists, and production decision-makers.

The ranking below reflects industry relevance and sourcing impact, not visitor size alone.

Event Comparison Overview

| Rank | Event | Core Sourcing Focus | Location | Latest Reported Visitors | 2026 Dates |

|---|---|---|---|---|---|

| 1 | FOOD EXPO Greece | Grocery, FMCG, private label, exports | Athens (Metropolitan Expo) | 34,978 | March 14–16, 2026 |

| 2 | HORECA | Foodservice + FMCG brand overlap | Athens (Metropolitan Expo) | 76,250 | February 13–16, 2026 |

| 3 | Food & Drinks by Detrop (DETROP / OENOS) | Regional food sourcing, wine, specialties | Thessaloniki (TIF-HELEXPO) | ~20,000 | November 13–15, 2026 |

| 4 | FOODTECH | Processing, packaging, automation | Athens (Metropolitan Expo) | 15,661 professionals | TBC 2026 |

| 5 | ARTOZYMA | Bakery production supply chain | Thessaloniki (TIF-HELEXPO) | ~15,000 | Feb 28 – March 2, 2026 |

1) FOOD EXPO Greece — Athens

Founded: 2014

Venue: Metropolitan Expo, Athens

Event focus: Grocery sourcing, private label manufacturing, export trade

FOOD EXPO Greece is the country’s primary FMCG sourcing platform. It is where supermarket category teams concentrate supplier meetings and where manufacturers align product launches with retail buying cycles.

The most recent edition reported 34,978 professional visitors, confirming FOOD EXPO’s position as Greece’s largest dedicated grocery and food trade exhibition. More than 1,300 exhibitors participated across packaged food, beverages, private label manufacturing, and export-oriented production.

Core exhibitor categories

Packaged food manufacturers

Beverage producers

Private label suppliers

Dairy, bakery, frozen food processors

Export-focused brand owners

Market position and scale

FOOD EXPO’s importance is driven by transaction density rather than footfall alone. Retail buyers from national supermarket groups, wholesalers, convenience operators, and import businesses use the event for structured supplier evaluations.

Private label sourcing has expanded sharply. Greek processors increasingly present retailer-brand portfolios alongside branded ranges, reflecting supermarket demand for domestic production capacity and cost control.

Operational relevance

FOOD EXPO directly supports:

Annual supplier negotiations

New product listings

Export partnership development

Packaging and labelling compliance reviews

The 2026 edition will take place from March 14 to 16, again integrating the Oenotelia wine exhibition within the broader sourcing programme.

Strategic direction

The exhibition continues to strengthen its hosted buyer programme and digital matchmaking tools. Export-oriented participation is expanding as Greek food manufacturers target European and international retail markets.

2) HORECA — Athens

Founded: Early 2000s

Venue: Metropolitan Expo, Athens

Event focus: Hospitality supply with FMCG crossover

HORECA is Greece’s largest hospitality exhibition, but its commercial relevance extends well into FMCG categories such as beverages, coffee, frozen foods, snacks, and impulse products.

The 2025 edition officially reported 76,250 professional visitors, confirming the event’s scale and market reach.

Core exhibitor categories

Beverage brands

Coffee and hot drinks suppliers

Frozen food producers

Snack manufacturers

Refrigeration and equipment providers

Market position and scale

HORECA functions as a cross-channel sourcing hub. Distributors serving both retail and foodservice use the exhibition to consolidate supplier meetings. Beverage producers in particular use HORECA as a launch platform for new formats and seasonal ranges.

Operational relevance

HORECA supports:

Beverage distribution agreements

Import sourcing activity

Cross-channel product launches

Promotional planning cycles

The 20th Anniversary Edition, scheduled for February 13 to 16, 2026, is expected to be a landmark event with expanded exhibitor participation and stronger international attendance.

Strategic direction

Premiumisation, beverage innovation, and experiential category development remain central themes. These trends increasingly influence retail assortment strategies.

3) Food & Drinks by Detrop (DETROP / OENOS) — Thessaloniki

Founded: DETROP established in the 1990s

Venue: TIF-HELEXPO Exhibition Centre, Thessaloniki

Event focus: Regional food sourcing and wine trade

DETROP and OENOS now operate under the broader exhibition identity “Food & Drinks by Detrop”, reflecting the event’s repositioning toward integrated food and beverage trade.

The exhibition serves Northern Greece and the Balkan-facing trade corridor. Attendance typically reaches around 20,000 professional visitors.

Core exhibitor categories

Olive oil producers

Dairy cooperatives

Regional food processors

Wine producers

Specialty exporters

Market position and scale

Food & Drinks by Detrop plays a key role in sourcing differentiated regional products. Wine buyers continue to treat OENOS as a core portfolio development platform.

Operational relevance

The event supports:

Regional supplier onboarding

Local assortment expansion

Wine category development

Export matchmaking

The 2026 edition will run from November 13 to 15 at Thessaloniki’s TIF-HELEXPO venue.

Strategic direction

Organisers continue to strengthen international buyer participation and export-facing programming, aligning the exhibition with Greece’s expanding agri-food export footprint.

4) FOODTECH — Athens

Founded: Mid-2010s

Venue: Metropolitan Expo, Athens

Event focus: Food processing, packaging, production technology

FOODTECH is Greece’s main industrial food exhibition. It serves manufacturers, processors, and packaging suppliers rather than brand marketing teams.

The latest confirmed edition recorded 15,661 professional visitors, highlighting strong interest in automation, compliance, and production efficiency.

Core exhibitor categories

Packaging machinery suppliers

Flexible and rigid packaging companies

Automation technology providers

Food safety and quality control specialists

Processing equipment manufacturers

Market position and scale

FOODTECH is increasingly integrated into capital investment planning cycles. Attendance includes engineering teams, operations managers, and supply chain decision-makers.

Operational relevance

FOODTECH directly influences:

Packaging system selection

Sustainability compliance investments

Production line modernisation

Automation adoption

These upstream decisions feed directly into supermarket supply reliability and private label manufacturing capacity.

Strategic direction

While the 2026 calendar date remains to be confirmed, FOODTECH continues to strengthen its position as the technology pillar of Greece’s food manufacturing sector, with growing emphasis on recyclable packaging, energy efficiency, and smart production systems.

5) ARTOZYMA — Thessaloniki

Founded: Early 2000s

Venue: TIF-HELEXPO Exhibition Centre, Thessaloniki

Event focus: Bakery and production supply chain

ARTOZA in Athens operates on a biennial cycle and does not run in 2026. In its place, ARTOZYMA Thessaloniki becomes the primary bakery trade exhibition for the year.

The event focuses on industrial and artisanal bakery production, attracting around 15,000 professional visitors.

Core exhibitor categories

Ingredient suppliers

Bakery equipment manufacturers

Frozen dough producers

Packaging suppliers

Refrigeration and storage providers

Market position and scale

ARTOZYMA plays a central role in bakery supply sourcing across Northern Greece and surrounding export markets. Retail bakery teams and wholesalers attend to evaluate production systems and supplier partnerships.

Operational relevance

ARTOZYMA supports:

In-store bakery modernisation

Production efficiency upgrades

Supplier benchmarking

Product innovation planning

The 2026 edition will take place from February 28 to March 2 at the TIF-HELEXPO venue.

Strategic direction

Automation, labour efficiency, and energy management technologies are becoming dominant themes as cost pressures continue to rise across bakery operations.

Market Structure Impact

Greece’s FMCG exhibition landscape is now highly concentrated.

Trade activity is organised around a limited number of specialised platforms rather than fragmented across dozens of overlapping events. This improves sourcing efficiency and strengthens professional buyer participation.

FOOD EXPO anchors retail sourcing. FOODTECH supports production investment. Food & Drinks by Detrop strengthens regional trade. ARTOZYMA supports bakery supply chains. HORECA captures cross-channel demand.

Together, they form a structured national trade ecosystem.

Category Dominance Trends

Several clear patterns are visible across Greece’s leading trade events.

Private label sourcing continues to expand, particularly at FOOD EXPO, as retailers prioritise domestic manufacturing partnerships.

Beverage innovation remains strong at HORECA and FOOD EXPO, driven by premiumisation and functional product development.

Packaging compliance and sustainability solutions are gaining floor space at FOODTECH, reflecting regulatory pressure and retailer requirements.

Regional sourcing remains commercially relevant at Food & Drinks by Detrop, supporting differentiated assortment strategies.

Industry Direction

Greek FMCG trade exhibitions are increasingly outcome-driven.

The focus has shifted toward structured meetings, export development, supplier evaluation, and operational sourcing. Events that fail to deliver measurable business value are losing relevance.

The 20th Anniversary edition of HORECA in 2026 is expected to further accelerate international participation and cross-border sourcing activity, reinforcing Greece’s role as a regional trade hub.

Structural Change Outlook

Several structural developments will continue shaping the market.

International buyer participation is rising, especially at FOOD EXPO and Detrop.

Athens’ Metropolitan Expo is consolidating its position as the country’s primary exhibition hub.

Sustainability, packaging compliance, and automation will become more prominent themes across all major exhibitions.

Digital matchmaking platforms will increasingly define how supplier meetings are structured.

Conclusion

Greece’s grocery and FMCG trade calendar is no longer defined by event volume. It is defined by relevance and sourcing impact.

FOOD EXPO leads national grocery sourcing. HORECA remains commercially influential due to scale and cross-channel reach. Food & Drinks by Detrop strengthens regional and export trade. FOODTECH anchors production investment. ARTOZYMA supports one of retail’s most operationally important categories.

Together, these five events define how sourcing, manufacturing, and supplier relationships are structured across Greece’s FMCG sector in 2026.

Editor’s Note: This article is based on publicly available organiser statistics, official event disclosures, and published attendance data from recent editions. All figures reflect the latest confirmed information available at the time of writing.