Greece’s organised Supermarket crossed a new structural threshold in early 2026. Consolidation, scale economics, and logistics investment have reshaped competitive positions. The acquisition of ANEDIK Kritikos by Masoutis marked the largest domestic retail transaction in more than a decade and re-ordered the national ranking.

At the same time, Sklavenitis extended its leadership gap, Lidl strengthened its discount dominance, and automation investment accelerated across the top five operators.

Total organised grocery turnover is now estimated to exceed €16 billion annually, reflecting both price inflation effects and network expansion since 2023.

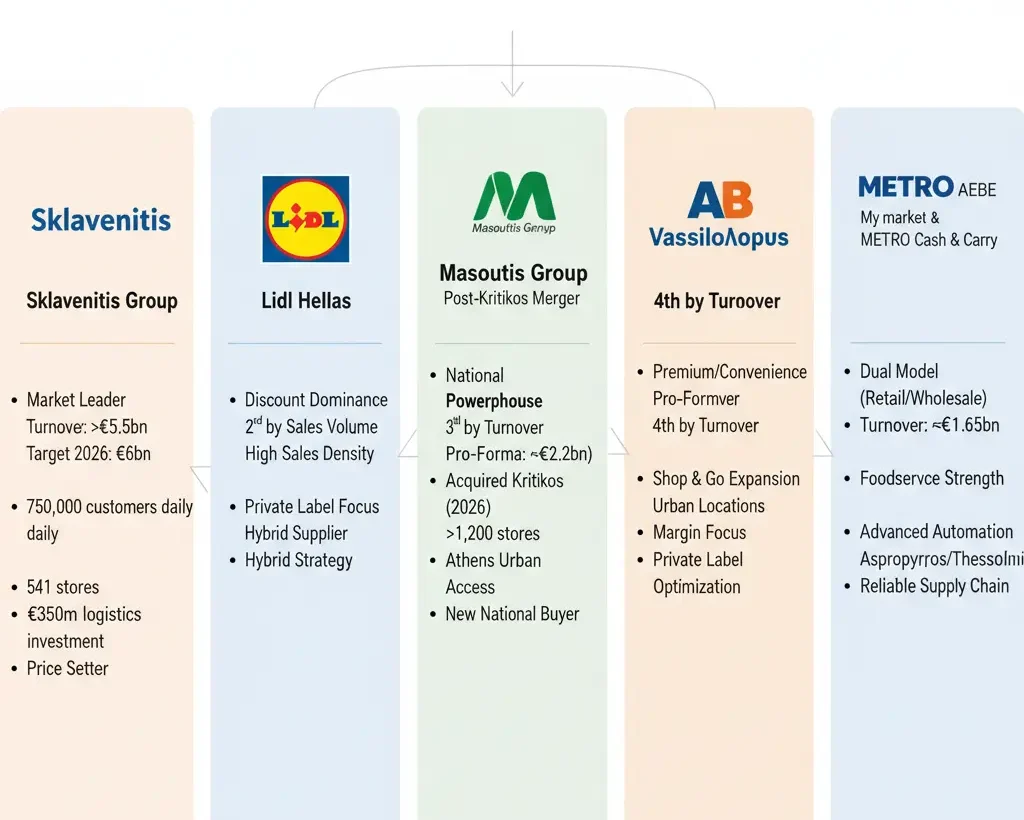

Updated Market Share & Revenue Ranking (2025–Early 2026 Estimates)

| Rank | Company | Estimated Revenue | Market Position |

|---|---|---|---|

| 1 | Sklavenitis Group | €5.6–€6.0 billion | Undisputed national leader |

| 2 | Lidl Hellas | €2.1+ billion (est.) | Leading discount operator |

| 3 | Masoutis Group | ~€2.2 billion (pro-forma) | New national heavyweight |

| 4 | AB Vassilopoulos | ~€1.97 billion | Premium and urban footprint |

| 5 | METRO AEBE | ~€1.65 billion | Retail-wholesale hybrid leader |

Network Scale and Operational Footprint (2026)

| Company | Estimated Store Network | Strategic Footprint |

|---|---|---|

| Sklavenitis Group | ~541 supermarkets | Nationwide coverage + Cyprus |

| Lidl Hellas | ~230 stores | National discount grid |

| Masoutis Group (incl. Kritikos) | 1,200+ points of sale | Largest store network by count |

| AB Vassilopoulos | ~510 stores | Strong urban and franchise presence |

| METRO AEBE | ~280 outlets | Retail + wholesale logistics hubs |

Sklavenitis Group

Founded: 1954

Origin: Athens, Greece

Core product categories

Fresh food and chilled

Packaged grocery

Private label food and household ranges

Non-food essentials

Market position and scale

Sklavenitis is the clear market leader in Greek grocery retail. Consolidated turnover exceeded €5.5 billion in FY2024, reflecting continued network productivity growth and private label expansion. Internal performance targets for 2025–2026 place the group close to the €6 billion revenue level, reinforcing its dominant position.

The company operates 541 supermarkets nationwide and serves an estimated 750,000 daily customers, giving it unmatched transaction volume and category influence across the market.

Operational relevance

Sklavenitis controls the largest share of organised shelf space in Greece. Its logistics footprint supports high-frequency replenishment and national price harmonisation across key FMCG categories.

Distribution infrastructure enables:

Faster stock rotation

Reduced out-of-stock rates

High-volume supplier throughput

The group’s scale allows strong purchasing leverage in core grocery, dairy, beverage, and household packaging categories.

Strategic direction

Investment focus has shifted toward infrastructure. A €350 million capital programme (2026–2027) is being deployed into warehouse automation, distribution capacity upgrades, electronic shelf label rollout, and energy efficiency projects.

Lidl Hellas

Founded (Greece): 1999

Origin: German-owned discount retailer

Core product categories

Private label packaged food

Fresh produce and bakery

Seasonal non-food assortments

Value grocery staples

Market position and scale

Lidl remains Greece’s leading discount supermarket chain and the second-largest retailer by sales volume. Industry estimates place Greek turnover above €2.1 billion, supported by strong store productivity and high private label penetration.

The network includes approximately 230 stores, with national coverage across all major metropolitan and regional markets.

Operational relevance

Lidl’s operating model is based on limited assortment efficiency and private label dominance. Supplier relationships follow a dual structure:

Branded supplier partnerships for traffic-driving categories

Contract manufacturing for Lidl-owned private label ranges

This structure continues to influence supplier pricing models and packaging production volumes.

Strategic direction

Lidl’s current strategy focuses on improving fresh food presentation, expanding Greek-origin private label sourcing, and upgrading store layouts in high-density urban locations.

Masoutis Group (Post-Kritikos Merger)

Founded: 1976

Origin: Thessaloniki, Greece

Core product categories

Fresh food and regional sourcing

Private label grocery

Traditional supermarket assortments

Convenience and small-format retail

Market position and scale

The January 2026 acquisition of ANEDIK Kritikos transformed Masoutis into a national retail heavyweight. Combined pro-forma revenues now approach €2.2 billion, elevating the group to third place nationally.

Store network scale expanded to more than 1,200 points of sale, giving Masoutis the largest retail footprint in Greece by store count.

Operational relevance

The merger solved Masoutis’s long-standing Athens market access limitation. Kritikos’ dense small-format network provided immediate penetration across Attica’s neighbourhood retail zones.

Operational integration now focuses on:

Unified procurement

Distribution route optimisation

Centralised private label sourcing

Logistics consolidation

This creates a new large-scale buying organisation with national supplier leverage.

Strategic direction

Masoutis is prioritising network integration stability, supply chain alignment, and private label portfolio expansion across the combined estate.

AB Vassilopoulos

Founded: 1939

Ownership: Ahold Delhaize Group

Core product categories

Premium grocery assortments

International branded FMCG

Convenience formats

Own-label food ranges

Market position and scale

AB Vassilopoulos remains one of Greece’s most established supermarket brands. FY2024 turnover reached approximately €1.97 billion, placing the chain fourth nationally following the Masoutis-Kritikos consolidation.

The network includes roughly 510 stores, including franchised formats.

Operational relevance

AB maintains strong urban coverage through neighbourhood supermarkets and convenience locations. International group sourcing supports private label development and imported product availability.

Operational focus has shifted toward improving store productivity and margin performance per square metre.

Strategic direction

AB is accelerating expansion of its Shop & Go franchised convenience network, targeting high-footfall urban zones and short-trip shopping missions.

METRO AEBE

Founded: 1976

Origin: Greek-owned retail and wholesale group

Core product categories

Retail grocery (My market)

Professional foodservice supply

Cash & Carry wholesale

Fresh and frozen distribution

Market position and scale

METRO operates a hybrid retail and wholesale business model. FY2024 turnover reached approximately €1.65 billion, supported by both household grocery demand and professional foodservice distribution.

The network includes roughly 280 outlets nationwide.

Operational relevance

METRO holds a structural advantage in professional supply logistics. The company has invested heavily in warehouse automation systems at its Aspropyrgos and Thessaloniki distribution hubs.

This enables:

Multi-temperature distribution efficiency

Faster order processing

Improved cold-chain handling

Strategic direction

METRO continues to expand logistics automation, professional category assortments, and foodservice-focused private label ranges.

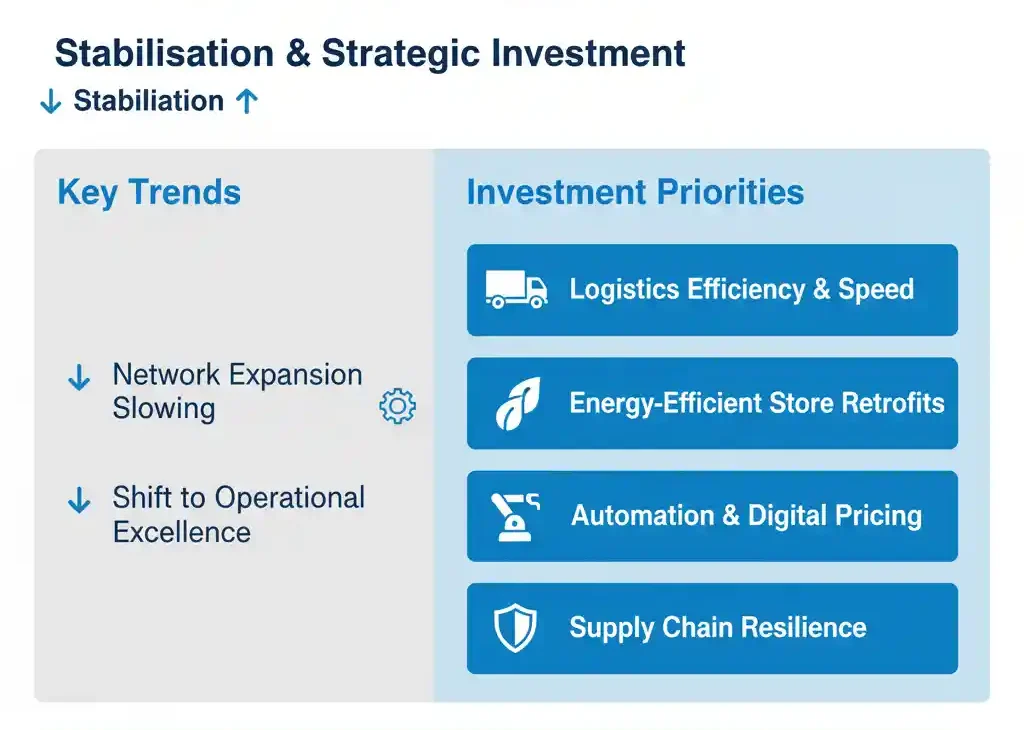

Structural Trends Defining 2026

Consolidation Acceleration

The Masoutis-Kritikos transaction confirms that mid-sized operators face rising capital and logistics pressure. Scale is now essential for margin sustainability, technology investment, and supplier negotiation leverage.

Further consolidation activity remains likely among regional operators unable to finance infrastructure upgrades.

Private Label Expansion

Private label penetration has passed 26.7% of total grocery sales, driven by price sensitivity and retailer margin optimisation.

All top five operators continue expanding own-brand portfolios, particularly in dairy, frozen foods, household cleaning, and value grocery categories.

Digitalisation and Store Automation

2026 marks the sector’s operational technology shift.

Electronic Shelf Labels (ESL), AI-assisted inventory forecasting, and warehouse robotics are being deployed across all major chains. These systems are now core competitive tools rather than experimental pilots.

Structural Outlook

Greek grocery retail has entered a stabilisation phase. Network expansion is slowing. Capital is being redirected toward:

Logistics efficiency

Energy-efficient store retrofits

Automation and digital pricing systems

Supply chain resilience

Competitive advantage is increasingly determined by operational execution rather than store count alone.

Conclusion

The 2026 Greek supermarket landscape is defined by consolidation, scale leadership, and infrastructure investment across the wider Greece FMCG market.

Sklavenitis continues to widen its leadership gap. Lidl maintains discount dominance. The new Masoutis Group has emerged as a national heavyweight. AB Vassilopoulos is repositioning its urban strategy. METRO strengthens its hybrid retail-wholesale advantage tied closely to professional foodservice and wholesale supply chains.

Together, these five operators now shape nearly all organised grocery shelf space, logistics flows, packaging demand, and supplier access across Greece’s modern retail sector.

Editor’s Note: This analysis is based on publicly available company disclosures, financial reporting, and industry sector summaries from FY2024 through early 2026. Revenue figures reflect reported results and widely referenced market estimates where statutory local data is not published. No currency conversion was applied.