Italy is one of the world’s most influential food markets. Its brands have an unmatched reputation for quality, heritage, taste, and craftsmanship. Italian companies ship pasta, sauces, biscuits, dairy, coffee, cured meats, olive oil, and premium grocery products to every region of the world. In 2026, this part of the food industry continues to change as traditional brands modernise, new players emerge, and global demand for Italian products grows.

This report looks at the top Italian food brands shaping the year ahead. It covers well-known leaders, export-driven companies, private-label innovators, and household names with strong roots in Italian culture.

The goal is simple: help retailers, distributors, and suppliers understand which brands matter most in 2026 — inside Italy and across global markets.

Why Italian food brands matter in 2026

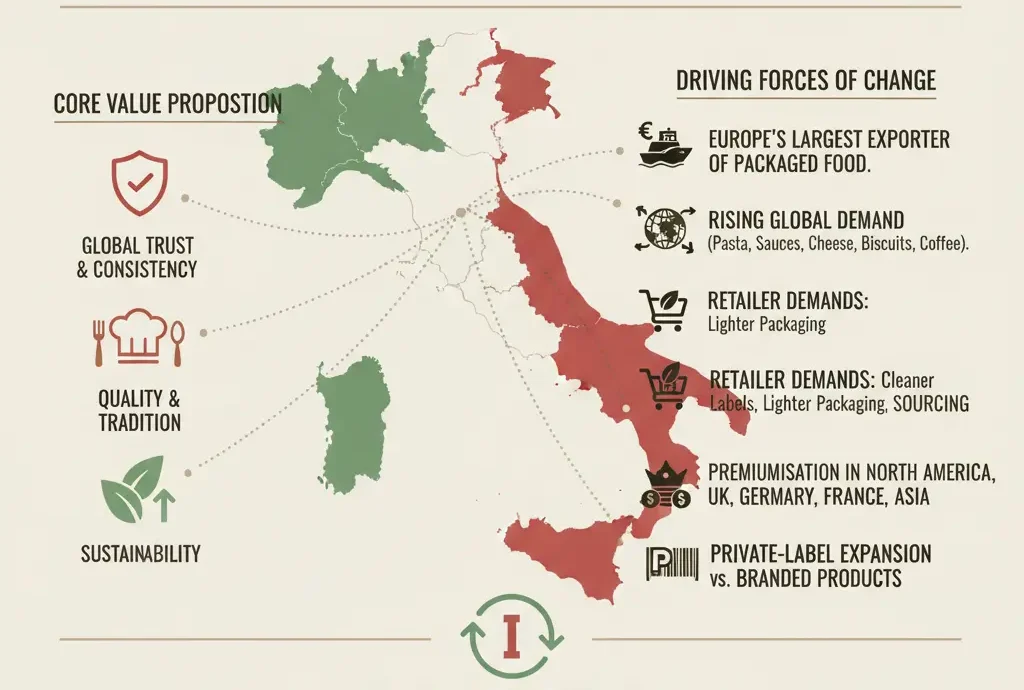

Italian food brands carry a global trust that is hard to replicate. Their value comes from consistency, quality, and long tradition. But the sector is not standing still. Companies now compete on sustainability, export growth, health trends, and digital retail.

Several factors are driving change:

Italy remains one of Europe’s largest exporters of packaged food.

Global demand for Italian pasta, sauces, cheese, biscuits, and coffee keeps rising.

Retailers want cleaner labels, lighter packaging, and reliable ingredient sourcing.

Premiumisation is growing in North America, the UK, Germany, France, and Asia.

Private-label continues to expand but still leaves space for strong branded products.

This mix creates a competitive environment where Italian brands must innovate while staying true to their roots.

Below is a full review of the top Italian food brands to watch in 2026.

Barilla

Barilla is one of Italy’s most globally recognised food brands. Known for pasta, sauces, and bakery products, the group exports to more than 100 countries. The company continues growing its global presence through sustainability, reformulation, and category expansion.

Barilla remains strong in traditional pasta, but also expands into high-protein, whole-grain, and gluten-free lines. The brand benefits from Italy’s reputation for wheat quality and pasta heritage. Its sauces portfolio, including pesto and tomato-based ranges, also grows internationally.

In 2026, Barilla continues investing in lighter packaging, recyclable solutions, and supply-chain transparency. Retailers value Barilla for consistency, shelf presence, and strong shopper loyalty.

Ferrero

Ferrero is a global powerhouse in confectionery, chocolate spreads, and biscuits. The company owns leading brands including Nutella, Kinder, Ferrero Rocher, Tic Tac, and Fresco lines.

Nutella remains one of the world’s most famous food brands, maintaining strong growth in Europe, North America, and Asia. Kinder continues performing well across seasonal ranges and everyday products. Ferrero Rocher keeps its premium appeal, especially in holiday periods when gift demand increases.

Ferrero’s leadership in Italian food branding reflects global distribution, premium quality, and consistent innovation. It remains a key part of Italy’s food industry identity.

Lavazza

Lavazza is one of Italy’s strongest coffee brands, known across retail, foodservice, and hospitality channels. The company has a global presence and continues expanding in North America and Europe.

Lavazza invests in technology for home coffee systems, compatible capsules, and premium blends. It also builds sustainability projects focusing on responsible sourcing and community development in producing countries.

As global consumption of at-home coffee remains high, Lavazza strengthens its position with clear branding, strong retail partnerships, and a reputation for authentic Italian coffee.

Mutti

Mutti is Italy’s leading tomato brand and a respected global supplier of tomato purée, passata, chopped tomatoes, and ready sauces. The company is known for its strict quality standards and long-term relationships with Italian growers.

Mutti continues gaining shelf space across Europe and North America. Retailers rely on the brand for consistent quality and reliability, especially during years of climate pressure in Italy’s tomato-growing regions.

In 2026, Mutti expands its packaging reductions and continues working on water-saving initiatives in farming. Its brand trust makes it one of the top Italian food brands to watch.

Parmalat

Parmalat remains a significant dairy brand in Italy and global markets. The company supplies milk, UHT products, yoghurt, and cream. Parmalat is part of Lactalis Group but maintains strong Italian identity.

Parmalat’s UHT milk has strong distribution, especially in export regions where Italian dairy has premium appeal. The brand also plays a role in Italy’s bakery and cooking categories through its cream and mascarpone lines.

Dairy remains highly competitive in Italy, but Parmalat’s recognition and long-standing market presence keep it central in retail dairy sets.

Galbani

Galbani is another major Italian dairy brand, also under Lactalis Group. Known for mozzarella, ricotta, mascarpone, and sliced cheese, Galbani is one of the top cheese brands in Italian supermarkets.

Galbani’s mozzarella is widely used in pizza, salads, and home cooking. The brand benefits from strong Italian heritage and wide export demand, especially in the UK, France, and Germany.

In 2026, Galbani continues expanding in premium chilled cheese formats and improving packaging sustainability.

De Cecco

De Cecco is one of Italy’s premium pasta brands, positioned above mainstream lines. The company is known for slow drying, high-quality wheat, and durum semolina.

De Cecco performs strongly in export markets, where shoppers look for “authentic Italian pasta.” Retailers often use De Cecco as a premium benchmark alongside private-label offerings.

The brand invests in recyclable packaging and continues highlighting its traditional production methods. De Cecco remains important for premium pasta shelves in 2026.

Rana

Rana is a leading player in fresh pasta and sauces. Its product quality, rapid distribution, and brand strength help it maintain leadership across chilled pasta categories.

Giovanni Rana products, including ravioli, tagliatelle, and filled pasta lines, continue expanding in the United States and Europe. The brand focuses on fresh ingredients, short cooking times, and restaurant-style formats for home use.

In 2026, Rana introduces lighter packaging and develops new ranges aimed at convenience-focused shoppers.

San Pellegrino

San Pellegrino is one of the world’s most recognised sparkling water brands. The company also markets Acqua Panna and a range of flavoured beverages.

San Pellegrino represents Italian premium lifestyle branding, widely used in restaurants, hotels, and retail. It remains strong in Europe, North America, and Asia. The brand’s packaging strategy focuses on recycling, lightweight bottles, and glass-return partnerships in selected markets.

Italian water brands continue performing well because of their quality and image.

A sampling of other influential Italian brands

Italy has hundreds of regional and national brands. Some of the most relevant in 2026 include:

Amica Chips – Strong snack player with wide retail presence.

Balocco – Known for biscuits, wafers, and seasonal cakes.

Bauli – One of Italy’s top seasonal bakery brands.

Rio Mare – A major tuna and canned seafood brand under Bolton Group.

Cirio – Another well-known tomato and vegetable brand.

Zuegg – Fruit jams, juices, and fruit-based products.

Loacker – Wafers and confectionery with global popularity.

Granoro – Well-known pasta brand with strong export activity.

Fratelli Beretta – Cured meats and charcuterie.

Rigoni di Asiago – Organic spreads, honey, and jams.

These brands help shape the food environment inside Italian supermarkets and continue growing outside Italy.

How Italian food brands compete in 2026

Several trends define how Italian brands expand and defend their positions:

Premiumisation: Shoppers in Europe and North America increasingly pay more for authentic Italian food.

Cleaner labels: Brands simplify ingredients to meet expectations for natural, traceable products.

Sustainable packaging: Italy’s food industry moves towards lighter materials, fibre solutions, and monomaterial plastics.

Export growth: Asia, the Middle East, and Latin America drive new demand for Italian premium products.

Private-label competition: Retailers strengthen their own ranges, pushing brands to invest in innovation and identity.

Italian brands respond with innovation, strong category stories, and consistent quality.

Why these brands matter for retailers and suppliers

Retailers rely on Italian brands because they:

Drive footfall in pasta, coffee, cheese, bakery, sauces, and chilled convenience.

Offer strong margins through premium positioning.

Give credibility to Italian-themed promotions.

Support category growth in both branded and private-label sets.

Deliver stable supply across Europe and export regions.

Suppliers and distributors work closely with Italian brands due to their:

-

Reliable manufacturing standards.

-

Long-term sourcing relationships.

-

Clear brand identity and shopper trust.

-

Active participation in trade fairs such as Cibus, TuttoFood, Anuga, and SIAL.

For readers following Italy’s wider events landscape, our overview of Italian food and drink trade events gives a clear guide to the country’s major industry shows.

In 2026, these dynamics make Italian brands essential partners for global retailers.

What to watch next

Italy’s food market moves forward with several changes:

Stronger sustainability commitments.

More recyclable and lightweight packaging.

New premium and health-focused ranges.

Growing digital shelf presence on online grocery channels.

More collaborations between Italian brands and international retailers.

Expansion into plant-based and higher-protein categories.

The strongest brands are those that keep heritage at the centre while adapting to new expectations.

Editor’s Note: This article uses information from company reports, Italian food-industry associations, and verified international trade sources. No invented data is included.