Japan’s supermarket sector runs on tight margins, limited labour availability, and dense urban store formats.

This environment has pushed grocery retailers to invest heavily in operational technology. Not experimental tools. Not showcase innovation. Practical systems that keep stores running, reduce labour pressure, improve availability, and stabilise supply chains.

POS infrastructure, self-checkout platforms, automated ordering, cash handling systems, and distribution automation now form the backbone of supermarket operations across the country.

This report ranks the top Japan supermarket technology companies based on their operational relevance to grocery retail, domestic deployment footprint, and FY2024–FY2025 business scale.

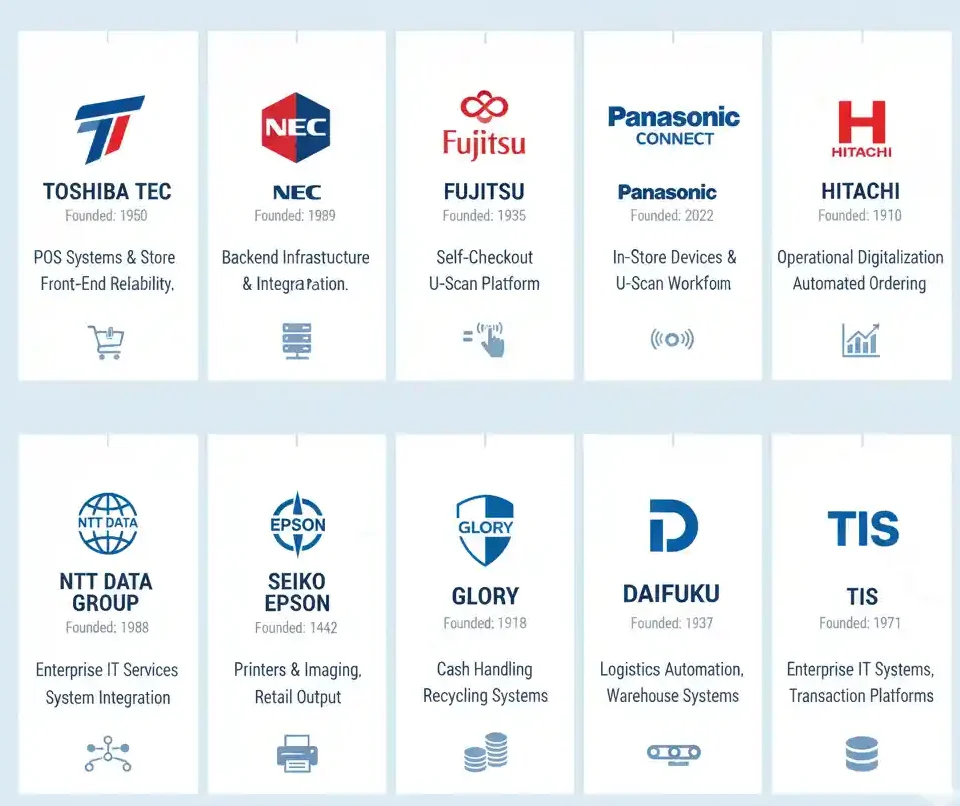

Top 10 ranking table

Revenue figures reflect latest publicly available FY2024–FY2025 group reporting where retail technology is part of wider business segments.

| Rank | Company | Founded | Core supermarket technology focus |

|---|---|---|---|

| 1 | Toshiba Tec | 1950 | POS platforms, checkout systems, store solutions |

| 2 | NEC | 1899 | retail IT platforms, systems integration |

| 3 | Fujitsu | 1935 | self-checkout software, store systems |

| 4 | Panasonic Connect | 2022 | in-store devices, operational technology |

| 5 | Hitachi | 1910 | automated ordering, retail DX systems |

| 6 | NTT DATA Group | 1988 | retail IT platforms, cloud integration |

| 7 | Seiko Epson | 1942 | POS printers, receipt and label printing |

| 8 | GLORY | 1918 | cash handling, cash recycling systems |

| 9 | Daifuku | 1937 | distribution automation, logistics systems |

| 10 | TIS (TIS INTEC Group) | 1971 | retail IT systems, transaction platforms |

Toshiba Tec

Founded: 1950

Toshiba Tec is one of the few Japanese technology companies where retail systems are not a side business.

The company’s core strength sits in POS infrastructure and store execution platforms. Its checkout hardware and retail software are deployed across large supermarket estates, convenience formats, and food retail chains.

For grocery operators, Toshiba Tec is closely tied to front-end reliability. Scanning speed, payment stability, and integration with loyalty and accounting systems are central to store performance. That makes long lifecycle support and predictable rollout capability more important than headline innovation.

Recent corporate restructuring has focused on strengthening profitability and sharpening segment focus. For supermarket customers, this signals continuity in platform support rather than short-term product experimentation.

NEC

Founded: 1899

NEC remains one of Japan’s most established enterprise technology suppliers.

While not a pure retail technology company, NEC plays a critical role behind supermarket operations. Network infrastructure, systems integration, security layers, and platform stability are all areas where large grocery groups depend on experienced domestic suppliers.

Supermarket technology increasingly depends on backend reliability. Payment systems, store servers, warehouse connectivity, and head office integration must operate without disruption during peak trading hours.

NEC’s scale and domestic enterprise presence allow it to operate at this infrastructure layer, supporting multi-store supermarket groups that require national deployment capacity and long-term system governance.

Fujitsu

Founded: 1935

Fujitsu has become one of the most visible self-checkout technology providers in Japan.

Its U-Scan platform supports self-service lanes used across grocery retail environments. The strength of the platform lies not only in hardware compatibility, but in software stability, queue management logic, and exception handling workflows.

Japanese supermarkets face rising labour costs and persistent staff shortages. Self-checkout is now a standard operational tool rather than a premium feature.

Fujitsu’s positioning reflects this shift. The company treats self-checkout as core retail infrastructure, designed to integrate with existing POS environments and evolve alongside store format changes.

Panasonic Connect

Founded: 2022 (operating company structure)

Panasonic Connect focuses on frontline operational technology within Panasonic Group’s business portfolio.

Its relevance to supermarkets sits in in-store devices, authentication systems, sensors, and operational workflow tools. These technologies support tasks such as loss prevention, staff coordination, and operational visibility.

Rather than selling retail software platforms directly, Panasonic Connect contributes hardware and operational components that fit into larger supermarket technology ecosystems.

As retailers redesign store processes to reduce friction and manual handling, these supporting systems increasingly become part of everyday operations rather than optional upgrades.

Hitachi

Founded: 1910

Hitachi’s supermarket relevance comes from operational digitalisation rather than consumer-facing systems.

The company has developed automated ordering and demand forecasting platforms used to stabilise replenishment workflows. These systems aim to reduce manual ordering work, improve forecast accuracy, and lower waste across fresh and packaged categories.

Ordering automation is not highly visible in stores, but it has a direct impact on margin performance and shelf availability.

Hitachi positions these systems as part of retail digital transformation, focusing on operational efficiency rather than experimentation.

NTT DATA Group

Founded: 1988

NTT DATA is a major enterprise IT services provider with strong domestic retail system delivery capability.

For supermarkets, NTT DATA often operates as the integration layer. Connecting POS platforms, loyalty programs, e-commerce operations, accounting systems, and logistics platforms into a functioning retail ecosystem.

Large grocery groups increasingly require long-term transformation partners rather than individual software vendors. System consolidation, cloud migration, and operational standardisation projects are now multi-year programs.

NTT DATA’s strength lies in delivering and maintaining these complex environments at scale.

Seiko Epson

Founded: 1942

Epson’s role in supermarket technology is practical and operational.

Receipt printers, label printers, and back-of-house printing equipment remain essential in grocery environments. Despite digitalisation, physical output still supports compliance, logistics labelling, shelf operations, and checkout workflows.

Printer reliability is directly tied to store uptime. When hardware fails, checkout lanes slow down or close.

Epson continues to supply these critical operational components, keeping itself embedded in daily store operations without positioning itself as a full retail software provider.

GLORY

Founded: 1918

GLORY specialises in cash handling technology.

Cash recycling systems remain widely used in Japanese supermarkets, even as cashless payments grow. These systems reduce staff handling time, improve cash availability at tills, and lower error risk.

GLORY’s machines are commonly integrated into both staffed checkout lanes and self-service environments.

For supermarket operators, cash handling automation improves labour efficiency and operational control while supporting mixed payment behaviour across different customer groups.

Daifuku

Founded: 1937

Daifuku is one of Japan’s strongest logistics automation providers.

Its supermarket relevance comes from distribution centre automation, warehouse handling systems, sorting equipment, and cold chain logistics infrastructure.

As grocery retailers push for faster delivery cycles and tighter inventory control, automation investment in distribution networks has increased.

Daifuku’s systems support high-volume food logistics operations, helping retailers reduce manual handling and stabilise fulfilment performance.

For supermarket groups, logistics automation is becoming a strategic asset rather than a back-office function.

TIS (TIS INTEC Group)

Founded: 1971

TIS provides enterprise IT systems used across retail and transaction-heavy industries.

Its supermarket role includes transaction platforms, retail system development, and data integration projects.

Large grocery operators rely on stable transaction processing, reporting systems, and backend integration to support store networks, promotions, and supplier settlements.

TIS focuses on long-term system delivery rather than short-term application rollouts, aligning with supermarket needs for platform continuity.

Market structure impact

Japan’s supermarket technology market is shaped by stability requirements.

Retailers prioritise long lifecycle platforms, domestic support capability, and operational reliability. Systems that fail during peak hours or require constant retraining are quickly replaced.

This environment favours companies with strong domestic delivery teams, service networks, and integration expertise.

It also explains why large Japanese technology groups remain influential in grocery retail, even when global software vendors compete in niche categories.

Category dominance trends

Three technology categories currently dominate supermarket investment.

Checkout automation and labour substitution

Self-checkout expansion continues, driven by labour shortages and customer acceptance of self-service workflows.

Ordering and replenishment automation

Forecasting systems and automated ordering tools reduce waste and manual labour while improving shelf availability.

Distribution and logistics automation

Warehouse automation and fulfilment efficiency are becoming competitive differentiators for supermarket groups operating national store networks.

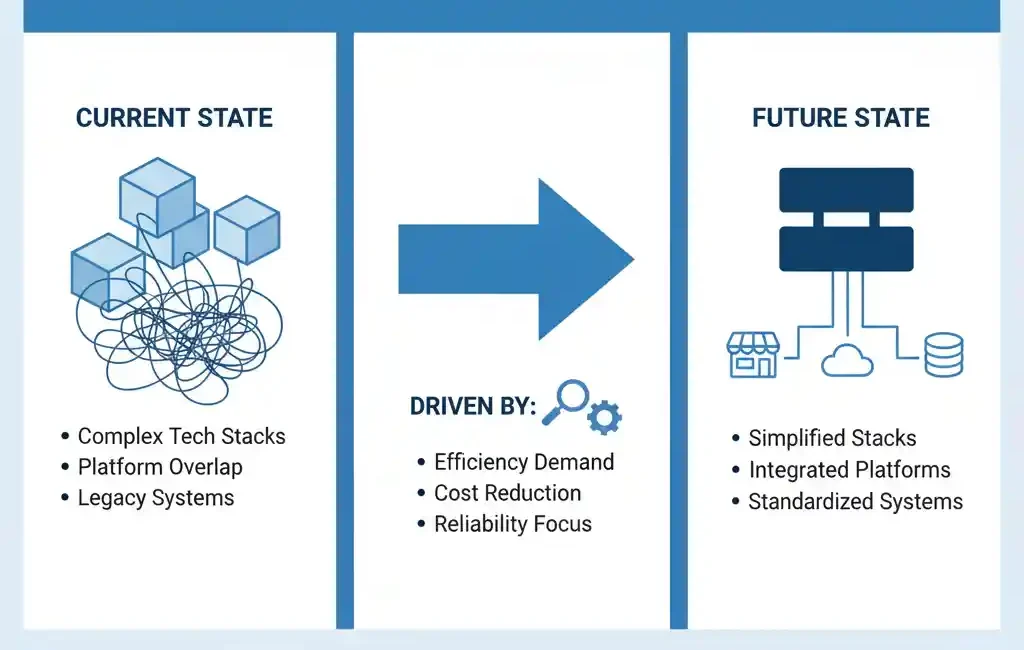

Structural outlook

The next phase of supermarket technology in Japan is consolidation.

Retailers are simplifying their technology stacks. Reducing platform overlap. Standardising store systems. Retiring legacy infrastructure.

This shift favours companies that can provide long-term operational support, scalable integration, and predictable performance.

Technology suppliers that cannot deliver stable, low-disruption deployments will struggle to retain supermarket contracts in the next refresh cycle.

Conclusion

Japan’s supermarket technology landscape is moving away from pilot projects and toward operational infrastructure.

The ten companies ranked here form the backbone of grocery retail operations across checkout, ordering, logistics, and store execution.

Over the next three years, competitive advantage will come not from flashy innovation, but from reliability, integration strength, and the ability to simplify complex retail operations at scale.

That is where Japan supermarket technology companies will continue to be measured.

Editor’s Note: This report is based on publicly available company financial disclosures, corporate reporting materials, and official business segment information from FY2024–FY2025. No currency conversion has been applied unless explicitly stated.