Private label keeps expanding in 2025, but some products still hold a firm place in the weekly basket. These are the names people buy almost without thinking — the flavours they trust, the brands they grew up with, and the items that feel worth waiting for when promotions arrive. Even with supermarket ranges getting stronger, go-to packaged food brands in major supermarkets continue to guide how shoppers choose, compare and decide what belongs in their trolley.

People rely on these brands because they stay consistent. The taste doesn’t change. The packaging feels familiar. And the product is easy to find in every store format. Retailers depend on them too, because strong brands help drive category performance, support long-term planning and keep shoppers engaged even in a price-sensitive year.

What Makes a “Go-To” Brand Today

A go-to brand earns trust through consistency. It does not confuse shoppers. It does not change flavour unexpectedly. It does not disappear from the shelf. These small things matter more when people are under pressure to choose quickly and avoid waste.

In 2025, a go-to brand usually has:

-

Reliable taste — the flavour matches the shopper’s memory every time.

-

Strong distribution — the product is available in almost every store format.

-

Clear price architecture — small packs, mid-size packs and value bundles all make sense.

-

Real promotional value — discounts feel meaningful and predictable.

-

Useful innovation — new formats or flavours solve problems, not create them.

But the biggest factor is emotional memory.

Shoppers still stick to brands they grew up with. Even when private label becomes stronger, people often stay with the product they trust for key moments — breakfast time, snacks on the go, packed lunches, weekend meals or family gatherings.

Retailers recognise this. A-brands provide momentum in the aisle. They help shape category resets and make seasonal planning easier. A brand with strong loyalty also helps retailers support value tiers, because shoppers compare private label to the branded benchmark.

Where A-Brands Still Lead The Market

Some supermarket categories remain heavily brand-led. These are usually products where flavour, texture or process create a clear difference — something that shoppers can sense immediately.

Soft Drinks

Soft drinks are one of the strongest examples of brand dominance.

Coca-Cola, Pepsi, Fanta, Sprite and energy drinks remain category leaders because their flavours are nearly impossible to copy exactly. The branding is iconic, the packaging is familiar, and promotions are well-timed throughout the year.

Family meals, celebrations and gatherings also play a role here.

People choose what they know will satisfy the group.

Private label colas exist, but most households still return to the global brands.

Chocolate and Confectionery

Chocolate has one of the deepest loyalty cycles in retail.

Cadbury, Kinder, KitKat, Galaxy, Haribo and M&M’s remain extremely strong. The difference in texture, sweetness and melt is highly noticeable. When people want a treat, they pick the brand they already trust.

Seasonal activations matter too.

Easter, Christmas and even Valentine’s Day rely on branded confectionery to drive display performance. These brands also release limited-edition flavours, which keep the category fresh.

Breakfast Cereals

Breakfast is personal.

Families rely on a steady supply of cereals like Kellogg’s, Nestlé Cereals, Cheerios and Weetabix because children often stay loyal to one brand for months or even years. Private label cereals are good, but brand recognition remains powerful, especially in the morning routine.

Packaging also plays a big role.

Branded cereals use strong visual cues that children recognise instantly.

Snacks and Crisps

Snacking remains a brand-led category across Europe and beyond.

Walkers, Lay’s, Pringles, Doritos and regional favourites continue to dominate due to flavour control and texture consistency. Private label snacks are better today, but the loyalty to certain crisp flavours is very strong.

Promotions also support branded snacks well.

People often wait for the two-for deals or bigger multipacks to stock up.

Sauces and Condiments

Taste memory is crucial here.

Heinz ketchup, Hellmann’s mayonnaise, Sriracha and Tabasco remain hard to replace. Small variations in acidity, spice or sweetness make a big difference. Many households stick to one brand for years.

Coffee

Coffee loyalty grows from habit.

Lavazza, Illy, Jacobs and Nescafé have long-term positions because people trust their blends. Coffee routines are ritual-based, and once a household picks a brand, it usually stays for a long time.

Private label coffee is rising, but the branded blends still have deeper flavour identity.

Where Private Label Gains Ground Quickly

Private label expands fastest in areas where products are standardised or where shoppers focus more on price than on flavour differences.

Canned Vegetables and Tomatoes

These items have predictable quality.

Supermarket brands deliver nearly identical performance at a lower price. A-brands try to differentiate through organic or origin claims, but private label remains dominant.

Basic Sauces

Pasta sauces and passata are moving toward private label in many countries.

Consumers often find the supermarket versions good enough for daily cooking. A-brands defend the premium end with cleaner labels or speciality recipes.

Staples

Rice, pasta, sugar and flour sit firmly in the private-label space.

These products are commodity-led, and shoppers rarely feel the need to pay more for a brand. A-brands focus on unique formats or artisanal positioning to stand out.

Frozen Basics

Frozen vegetables, fruit and simple ready meals shift quickly to private label because the quality is consistent and price competition is high.

A-brands focus on premium frozen dishes, snacks or international cuisine to maintain share.

How A-Brands Respond To Strong Private-Label Competition

A-brands know they must protect their space.

They adapt in ways that meet real shopper needs while aligning with retailer expectations.

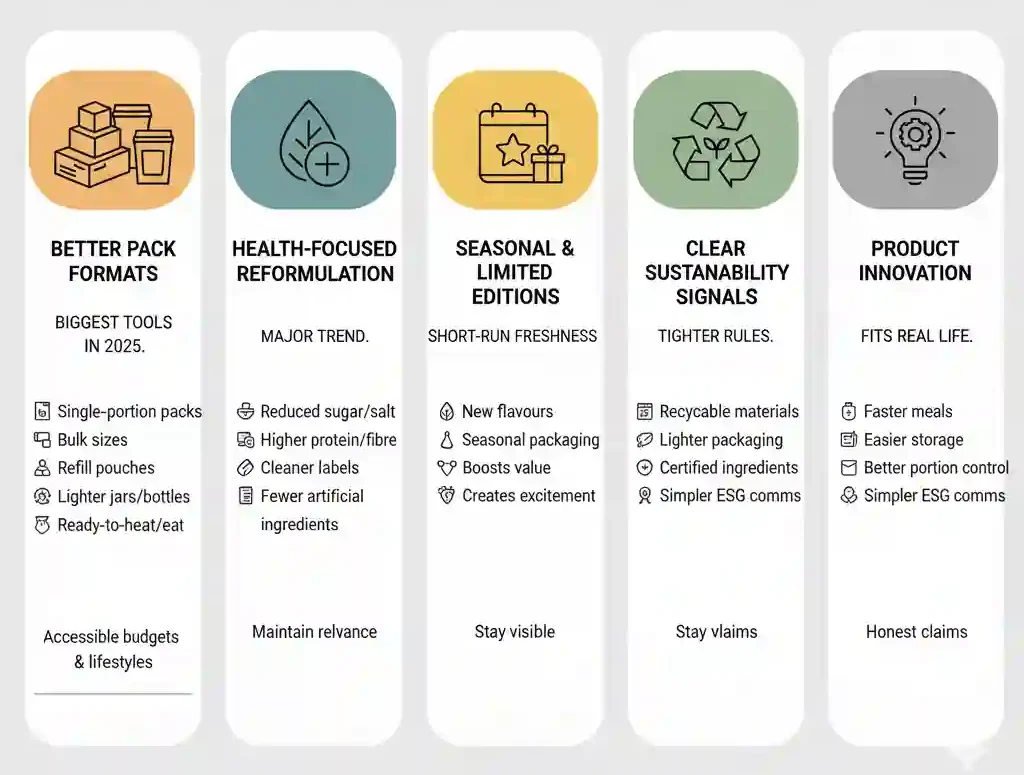

Better Pack Formats

Formats are one of the biggest tools in 2025.

Brands introduce:

-

Single-portion packs for convenience

-

Bulk sizes for value shoppers

-

Refill pouches for sustainability

-

Lighter jars and bottles to reduce cost

-

Ready-to-heat or ready-to-eat formats for speed

This helps brands remain accessible to different budgets and lifestyles.

Health-Focused Reformulation

Health remains a major trend.

A-brands update their products to include:

-

Reduced sugar

-

Reduced salt

-

Higher protein

-

More fibre

-

Cleaner labels

-

Fewer artificial ingredients

These updates help maintain relevance even when private label competes on price.

Seasonal and Limited Editions

Short-run flavours keep the brand fresh.

Seasonal packaging helps brands remain visible during high-traffic periods. This strategy boosts value perception and creates moments of excitement.

Clear Sustainability Signals

Packaging rules are tightening.

A-brands respond with:

-

Recyclable materials

-

Lighter packaging

-

Certified ingredients

-

Simpler ESG communication

Shoppers prefer clear, honest claims rather than complicated sustainability language.

Product Innovation That Fits Real Life

Innovation must solve real-world problems — faster meals, easier storage, shorter cooking time, better portion control.

This practical innovation builds long-term loyalty and helps brands stay ahead of private-label competition.

What Supermarkets Expect From A-Brands

Retailers in 2025 push harder for total category value.

They expect brands to contribute beyond product performance.

Key expectations include:

Stronger Category Insight

Retailers look for data on shopper habits, missions, price elasticity, cross-category patterns and new segment opportunities.

Brands that bring stronger insights influence the direction of the category.

More Transparent Data Sharing

Supermarkets want:

-

Clearer sales reporting

-

Joint business planning

-

Better forecasting

-

More predictable promotions

Brands that support this earn trust and better shelf placement.

Sustainability Alignment

Environmental progress is not optional.

Retailers expect suppliers to match their packaging goals and wider sustainability frameworks.

Omnichannel Strength

Branded products need strong digital presence:

-

Clean product images

-

Clear descriptions

-

Pack sizes that work for delivery

-

Search-friendly naming

This supports online growth and improves click-and-collect performance.

A-Brands And Retailers At Trade Shows

Trade shows play a big role in branded strategy.

Retail buyers evaluate packaging updates, taste improvements, seasonal launches and new product formats. These meetings shape range reviews, promotional plans and long-term category direction.

A-brands use trade shows to demonstrate value, secure retailer alignment, and identify where private-label competition is rising.

How Brands Protect Their “Go-To” Status

To remain essential, brands must defend their place every year.

They focus on:

-

Taste consistency

-

Cleaner ingredient lists

-

Flexible pack sizes

-

Transparent sustainability claims

-

Practical innovation

-

Digital readiness

-

Strong seasonal execution

-

Clear value on promotion days

A brand that supports the whole category — not just itself — stays relevant in retailer planning.

Conclusion

A go-to brand stays strong because it delivers trust, flavour and reliability.

Even with private-label expansion, many supermarket categories still rely on branded products to shape shopper behaviour and support long-term performance. Soft drinks, snacks, chocolate, cereals and coffee remain brand-led. Staples, frozen basics and simple sauces move more quickly toward supermarket-owned ranges.

The brands that succeed in 2025 are the ones that adapt — better formats, cleaner labels, stronger sustainability communication and more practical innovation. Retailers will always make room for strong category leaders, but expectations are rising and the competition between brands and private label is becoming sharper every year.

These shifts continue to shape how food brands hold their place in major retailers, and how shoppers decide what feels worth paying for in a value-focused year.