Germany’s retail industry is transforming how it thinks about packaging.

In 2025, sustainability, circular design, and refill systems are no longer niche experiments — they are mainstream expectations.

The push comes from consumers, policymakers, and companies determined to meet the requirements of the Packaging Act (VerpackG), which defines how packaging should be designed, recycled, and reused in the country.

Across supermarkets, private-label suppliers, and packaging manufacturers, the trend known as packaging innovation Germany 2025 has become a shared mission — to reduce waste, replace materials, and close the loop on packaging.

Packaging Innovation Germany 2025: Circular Design And Recyclability

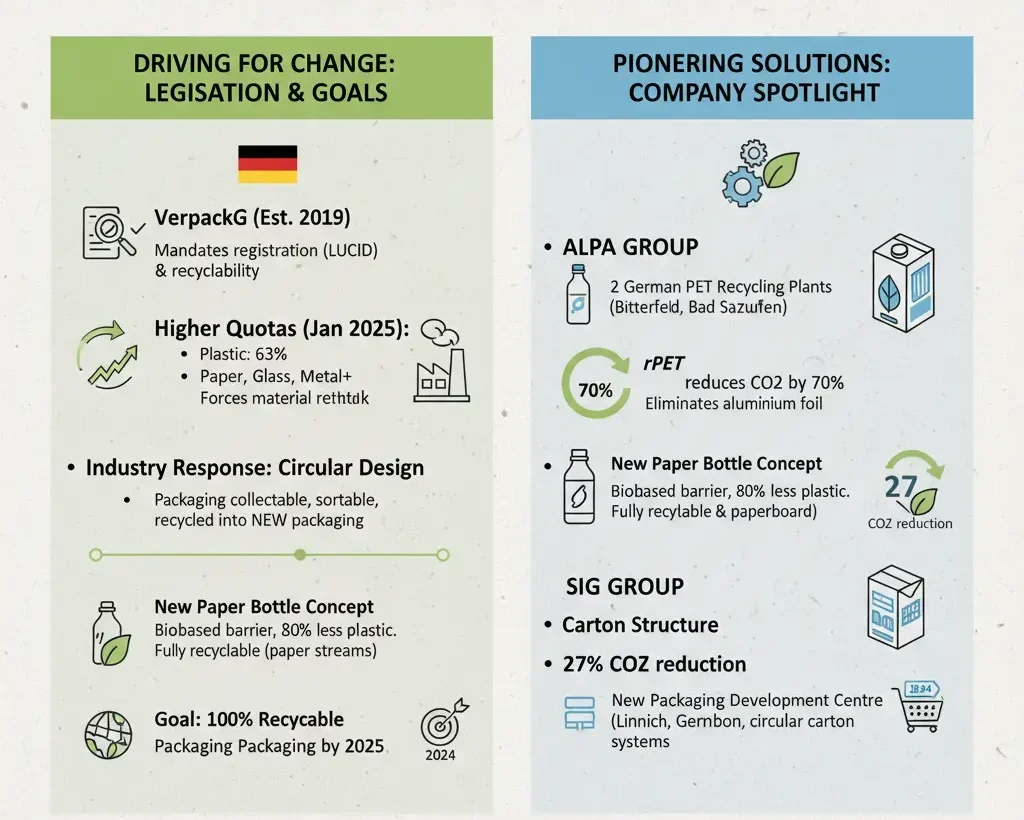

According to Germany’s Central Packaging Register (Zentrale Stelle Verpackungsregister – ZSVR), the VerpackG requires all companies placing packaging on the German market to register with the LUCID database and ensure that packaging can be recycled or reused.

From January 2025, higher recycling quotas apply: for plastic, at least 63 %; for paper, glass, and metals, 90 % or more.

This has forced packaging companies to rethink material composition and product design.

According to ALPLA Group, one of Germany’s most active packaging manufacturers, circular design means creating packaging that can be collected, sorted, and recycled back into new packaging — not down-cycled.

ALPLA operates two PET recycling plants in Germany — in Bitterfeld-Wolfen and in Bad Salzuflen — where it converts used PET bottles into high-grade recyclate for new bottles.

The company states that its rPET (recycled PET) reduces carbon emissions by up to 70 % compared to virgin material.

ALPLA has also developed a new paper bottle concept using a thin barrier layer made from biobased material.

According to company reports, this design achieves full recyclability within standard paper streams and reduces the plastic content by 80 %.

These innovations are part of the company’s goal to reach 100 % recyclable packaging by 2025, supported by major retail customers in Germany and Austria.

At the same time, SIG Group, which produces aseptic cartons, has introduced a metal-free carton structure that eliminates aluminium foil.

According to SIG, the switch reduces carbon emissions by 27 % and simplifies recycling since the entire pack is made of polymers and paperboard.

SIG’s new Packaging Development Centre in Linnich, Germany, opened in 2024, is dedicated to creating low-carbon, fully circular carton systems for Europe’s beverage market.

This shows how German innovation is moving from concept to scale, aligning technical design with recyclability.

Retailers’ Packaging Reduction Targets

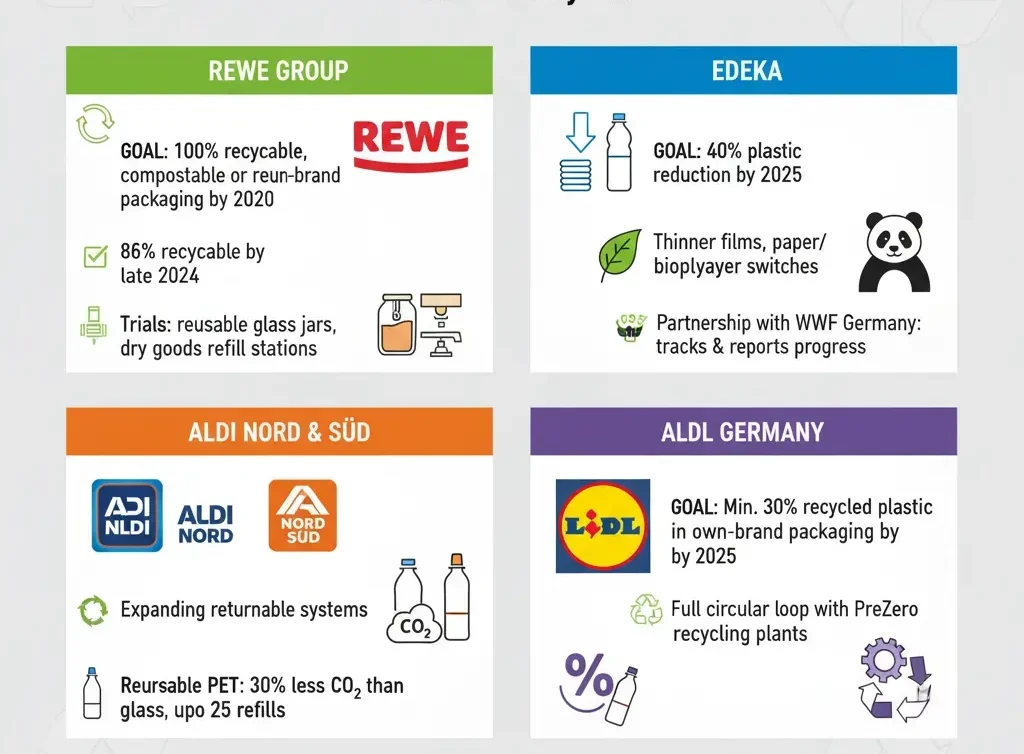

Packaging innovation in Germany 2025 is not limited to suppliers — supermarkets are equally committed.

According to REWE Group, the company aims to make all own-brand packaging recyclable, compostable, or reusable by the end of 2030.

By late 2024, it had already reached 86 % recyclable packaging across its private-label range.

REWE is also trialling reusable glass jars for sauces and spreads and refill stations for dry goods in selected stores.

EDEKA has set similar goals.

According to its sustainability report, EDEKA’s packaging strategy focuses on reducing plastic use by 40 % by 2025, using thinner films and switching to paper or biopolymer solutions.

In partnership with WWF Germany, EDEKA tracks packaging reductions annually and reports progress publicly.

Meanwhile, Aldi Nord and Aldi Süd are expanding returnable systems.

Both companies have increased the share of reusable PET bottles in their beverage assortments.

According to Aldi, reusable PET emits around 30 % less CO₂ than glass bottles, and the bottle can be refilled up to 25 times before recycling.

These retailer commitments make packaging innovation part of the competitive landscape — not just environmental compliance.

Even discounters like Lidl have become active innovators.

Lidl Germany announced that by 2025 it will use at least 30 % recycled plastic in all own-brand plastic packaging.

The retailer’s logistics partner PreZero, a subsidiary of the Schwarz Group, operates advanced recycling plants that feed material directly back into Lidl’s supply chain, creating a full circular loop between consumer and shelf.

This combined retailer pressure is pushing suppliers toward lightweight, mono-material, and refillable designs that satisfy both regulation and supermarket performance standards.

Material Innovations And Smart Labelling

Packaging innovation Germany 2025 is defined by the next generation of materials and digital traceability.

According to Gerresheimer AG, the Düsseldorf-based packaging specialist, the company is expanding its portfolio of rPET and rPP containers for cosmetics and food applications.

Gerresheimer’s collaboration with natural-cosmetics brand 4peoplewhocare GmbH resulted in a fully recyclable cream jar made from 100 % post-consumer recycled plastic, designed and produced in Germany.

The company also reports strong demand for refill-ready packaging systems, particularly in personal-care and pharma-adjacent products sold in supermarkets and drugstores.

Meanwhile, SCHOTT AG, one of Germany’s oldest glass manufacturers, is leading the transition to low-carbon and circular glass.

In 2025, SCHOTT introduced a Product Carbon Footprint (PCF) guideline for all its specialty glass categories, helping customers compare material emissions.

The company’s sustainability division highlights three priorities: eco-design, decarbonised melting, and circular reuse of glass cullet in production.

By integrating these principles, SCHOTT enables retailers and brands to source verified low-impact glass packaging for food and beverage lines.

Digital technology is also becoming part of packaging.

SIG Group has introduced connected carton solutions using QR codes that allow consumers to scan products for recycling instructions and traceability data.

This “smart labelling” approach supports Germany’s extended producer-responsibility goals, providing transparency for recycling and reuse rates.

According to ALPLA, data-driven packaging design will be a core focus in the coming years, combining physical circularity with digital tracking for collection and sorting.

These systems could allow supermarkets to monitor packaging flows and report real recycling performance under the VerpackG framework.

The Role Of The German Packaging Act (VerpackG)

According to official information from the Central Agency Packaging Register (ZSVR), the German Packaging Act defines clear responsibilities for all market participants.

Manufacturers and importers must license packaging with a “dual system,” ensure recyclability, and report volumes through the LUCID Register.

The latest 2025 amendment tightened obligations for online retailers and refill systems, creating a more transparent, data-based framework.

For companies in the FMCG and supermarket sector, compliance has moved beyond paperwork.

It now drives innovation.

To meet collection and recycling quotas, packaging must be designed for existing infrastructure.

That is why German companies such as ALPLA and SIG have aligned R&D directly with these legal targets.

The Act has also created market incentives.

Producers who use eco-friendly or mono-material packaging may qualify for lower licensing fees in the dual systems.

As a result, many manufacturers now see recyclability not as a cost, but as a saving — an idea that underpins much of packaging innovation Germany 2025.

How Refill Models And Glass Return Systems Are Expanding

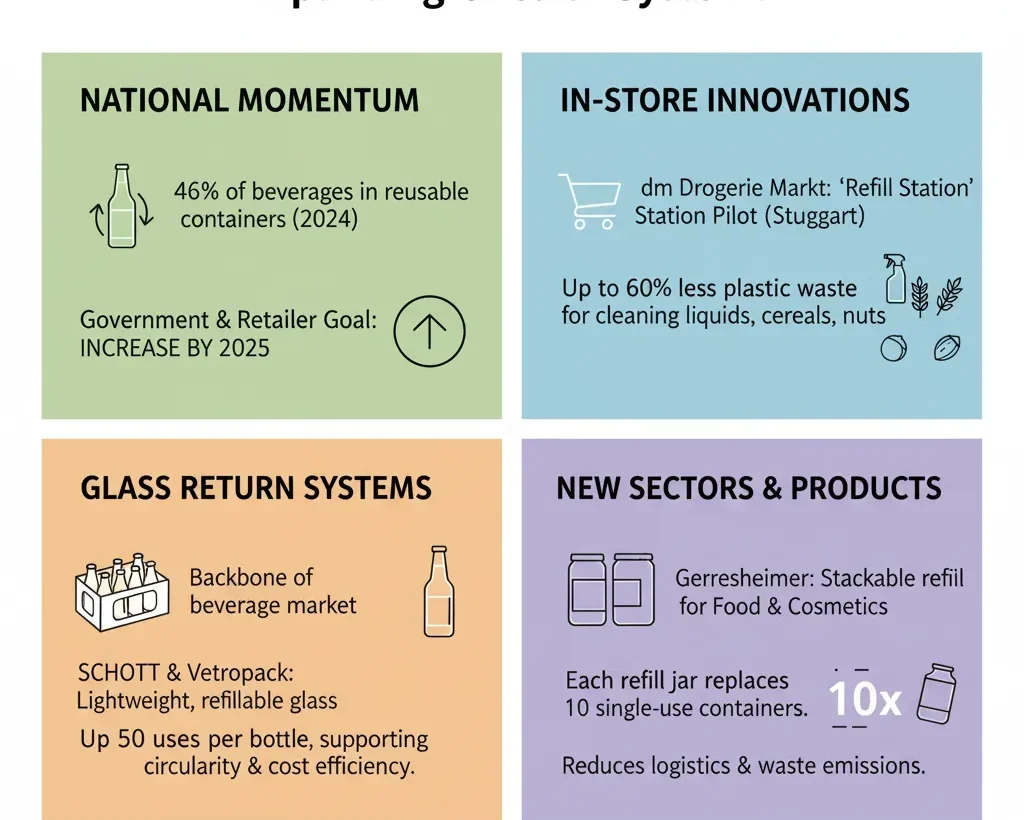

Refill and reuse models are gaining momentum across Germany.

According to Environmental Action Germany (DUH), about 46 % of beverages in Germany were sold in reusable containers in 2024.

The government’s goal is to increase that share further by 2025 through retail partnerships.

Retailers are experimenting with in-store refill options for products like cleaning liquids, cereals, and nuts.

According to dm Drogerie Markt, its “Refill Station” pilot in Stuttgart reduced single-use plastic waste by up to 60 % for selected product categories.

Glass return systems remain a backbone of the German beverage market.

SCHOTT AG and Vetropack Germany both report increased demand for lightweight, refillable glass bottles that can be washed and reused up to 50 times.

This trend supports both circular economy goals and cost efficiency in the long term.

Even beyond beverages, refill thinking is entering new sectors.

Gerresheimer has partnered with FMCG customers to develop stackable refill jars for food and cosmetic ranges.

The company reports that each refillable jar can replace ten single-use containers, reducing emissions across logistics and waste treatment.

Why It Matters

The transformation in packaging is reshaping German retail strategy.

Packaging is no longer just a container — it is a message about sustainability, innovation, and compliance.

For supermarkets, the benefits go beyond meeting regulations: lighter and circular packaging reduces transport costs, improves shelf efficiency, and builds trust with environmentally aware consumers.

Suppliers, in turn, are developing entire product families based on recyclability.

Companies like ALPLA, Gerresheimer, SIG, and SCHOTT AG are proving that sustainable packaging can be both technically advanced and commercially viable.

For private-label brands, this shift has strategic value.

Retailers can use innovative packaging to differentiate their own-brand products from A-brands, strengthening consumer loyalty while meeting environmental goals.

This links directly with broader developments in, Supermarket Sustainability in Germany, and Retail Technology in German Supermarkets, all of which support the same long-term goal: sustainable growth through smarter design.

Conclusion

By 2025, packaging innovation Germany 2025 has evolved from a sustainability slogan into an operational standard.

Circular design, refill models, smart materials, and digital traceability are becoming normal practice.

Germany’s packaging ecosystem — from manufacturers to supermarkets — is showing how a coordinated, regulated, and innovation-driven approach can make packaging both responsible and profitable.

The next stage will be about scale: integrating these innovations across all product lines and ensuring consumers adopt reuse systems as part of daily shopping habits.

For now, Germany stands as Europe’s benchmark for packaging transformation — built not only on policy, but on continuous innovation.

Editor’s Note:

This article is based on verified data and official publications from:

-

ALPLA Group – Sustainability Reports 2024–2025 and company innovation pages.

-

SIG Group – Packaging Development Centre Linnich news release 2024.

-

Gerresheimer AG – Sustainability Updates and partnerships with 4peoplewhocare GmbH.

-

SCHOTT AG – Sustainability strategy and Product Carbon Footprint guideline 2025.

-

REWE Group and EDEKA – Sustainability Reports 2024–2025.

-

Aldi Nord, Aldi Süd, and Lidl Germany – Circular packaging commitments and PreZero recycling initiatives.

-

Central Packaging Register (ZSVR) – German Packaging Act (VerpackG) 2025 updates.

-

Environmental Action Germany (DUH) – Reusable packaging market data 2024–2025.

-

dm Drogerie Markt – Refill station pilot reports.

All data and statements reflect updates available up to November 2025.