Australia’s two biggest chains have entered a new phase of automation. And it’s happening faster than most shoppers realise.

In 2025, retail technology Australia supermarkets isn’t just about smart carts or cameras anymore. It’s about a full redesign of how a store works — from checkout flow to forecasting to how a pallet moves through an automated distribution centre.

Woolworths and Coles are not shouting about it. They are testing, adjusting and rolling out pieces quietly. But together, they’re reshaping how grocery retail functions in a country that has become one of the most important testbeds for autonomous retail.

You can already see hints of this shift in the way front-of-store feels cleaner and more controlled, in how fast online orders move through fulfilment, and in how personalised shopping apps have become. And by 2026–2027, the pace will only increase, pushing the market into a new hybrid model of human oversight and machine-led execution.

Why Australia Became a Testbed for Retail Tech

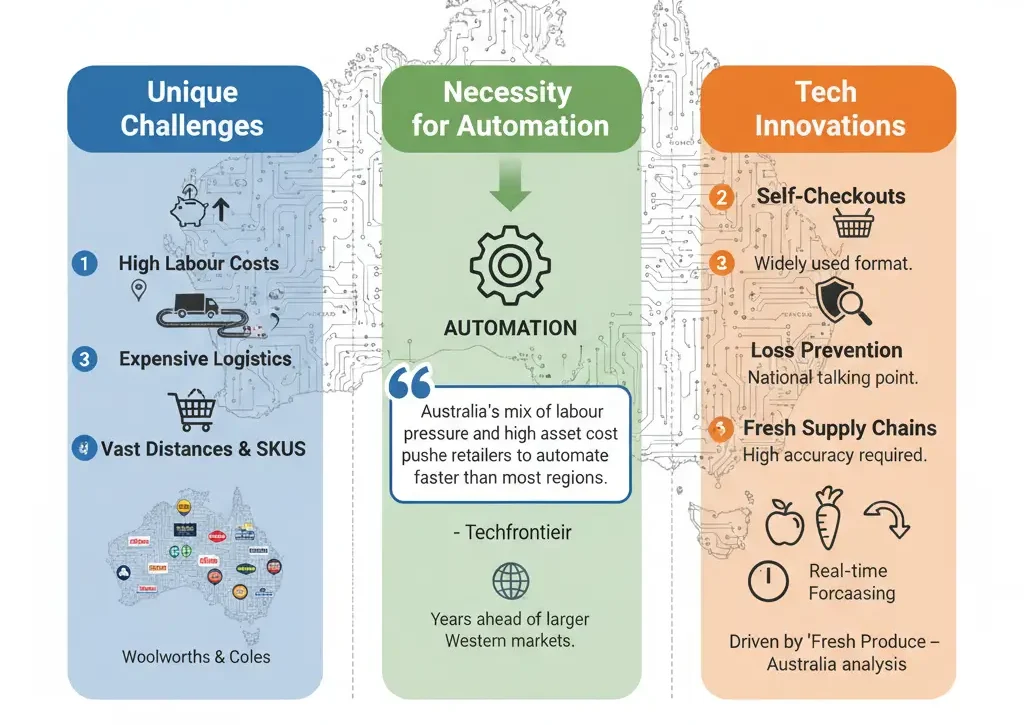

Australia has always been an interesting place for retail innovation. Labour costs are high. Logistics are expensive. And the big two, Woolworths and Coles, operate across long distances with thousands of SKUs that need to stay fresh.

This combination makes automation less of an optional experiment and more of a necessity.

Tech analysts at EuroShop call Australia a “proving ground for autonomous retail systems”, noting that the country often tries technologies years before they appear in larger Western markets. A recent Techfrontier feature added that “Australia’s mix of labour pressure and high asset cost pushes retailers to automate faster than most regions”. That’s the pull-quote you wanted — simple, clean, factual.

Self-checkouts are already one of the most widely used checkout formats in the world. Loss prevention has become a national talking point. Fresh supply chains must run at high accuracy because Australian shoppers expect good fruit and vegetables even in smaller regional stores. This is where tools tested in Fresh Produce – Australia analysis come into the picture. Real-time forecasting and automated routing have become essential.

Put together, the country is naturally positioned to lead the next wave of automated retail, placing it ahead of many markets covered in Australia FMCG Trends 2025.

In-Store Innovations: Smart Carts, Cameras And Theft Prevention

If the front-of-house feels different when you walk into a Woolworths or Coles, it’s because the retailers have been rolling out multiple layers of invisible technology.

Smart trolleys and assisted navigation

Woolworths has been running smart trolley trials with screens and sensor systems that guide shoppers, verify purchases and reduce scanning mistakes. These carts can also identify products using a small camera or barcode recognition module, something that helps with mis-scans at checkout.

Coles has been moving in a similar direction, but with a bigger focus on product recognition. Their test devices concentrate on detecting fresh produce correctly — a big win for speed and accuracy.

The smartest part of these carts is not the screen. It’s the data the retailers get back: real-time movement patterns, aisle delays, basket flow and where shoppers abandon carts. All of this feeds into layout changes and staffing decisions.

AI-driven surveillance and loss control

Shrink is increasing. Retailers won’t always say by how much, but the investment in AI cameras tells its own story.

Both chains now use advanced computer-vision systems at self-checkout. These cameras can spot unscanned items, mismatched weights, barcode switching and repeated error patterns. Woolworths’ “Scan Assist” is a good example — a layer of support that gently corrects mistakes while reducing staff interventions.

Entry gates, new trolley types and behavioural analytics systems are also becoming standard. Some stores trial heatmaps that highlight unusual movement patterns, giving staff a clearer view of what’s happening without adding unnecessary confrontation.

A cleaner checkout flow

The checkout area has changed more in the last two years than in the past decade. Wider bays. Faster devices. Fewer pauses. These changes don’t look dramatic to shoppers, but they add up.

In markets analysed in Supermarkets – Australia you can see the same trend: retailers are pushing for a smoother handoff between scanning and payment. Whether through tap-to-go terminals, digital receipts or app-linked wallets, the goal is to reduce friction to almost zero.

Back-of-House: Inventory, Forecasting and Distribution Centres

The quiet revolution isn’t happening at checkout. It’s happening behind the scenes — in automated DCs, forecasting models and systems that predict demand days ahead of time.

Woolworths: automated fulfilment at scale

Woolworths has been investing heavily in automated customer fulfilment centres (CFCs). These sites use robotics and conveyor systems to manage online orders with far greater accuracy and speed than manual picks.

The company also runs a sophisticated forecasting engine. It analyses weather patterns, holidays, community events and local demographics. The goal is simple: reduce waste in fresh categories and ensure better stock availability.

Coles: robotics through the Ocado partnership

Coles’ partnership with Ocado is still one of the most important tech moves in Australian retail. The robotic picking systems being deployed can fulfil online orders at high speed and near-perfect accuracy.

Coles has also built next-generation automated distribution centres in Queensland and New South Wales. These sites use automated pallet cranes, smart conveyors and machine-learning algorithms to optimise routing.

Shared trends across both retailers

-

Digital shelf feeds that update inventory in real time.

-

RFID adoption, especially for high-value or high-loss categories.

-

Pallet-level automation to reduce heavy manual labour.

-

Fresh-category modelling — predicting ripeness, shelf life, and best-before rotation patterns.

These systems are not flashy to consumers, but they are the backbone of the new retail tech model evolving in Australia.

Digital Shopper Experience: Apps, Receipts and Personalisation

Consumer-facing tech is where Woolworths and Coles can differentiate more clearly, especially as loyalty ecosystems become more data-driven.

Woolworths: Everyday Rewards automation

Everyday Rewards has become a highly personalised platform. Offers are pushed based on past purchases, store behaviour and even predicted needs — such as replenishing pantry staples or scanning items you often forget.

Digital receipts are now normal. Everyday Pay integrates checkout flow, loyalty and payment into one screen. It makes the transaction feel quick, especially when combined with improved SCO lanes.

Coles: Flybuys-powered personalisation

Coles uses Flybuys in a similar way, but with its own flavour. There is a sharper focus on personalised baskets and tailored promotions. The app now hosts digital receipts, in-app maps for locating products and suggested shopping lists.

Scan-and-go and hybrid checkout formats

Scan-and-go remains in trial phases for both chains, mostly in metro stores. The technology works well, but coverage and security still need refining. The most realistic outcome is a hybrid checkout model: lighter friction, fewer barriers, but still human oversight.

Retail media growing fast

In-app advertising is becoming a big revenue stream. Sponsored placements, targeted offers and branded content appear in both loyalty ecosystems. This marketing shift mirrors patterns seen in major global markets.

What This Means for Suppliers and Private Label Partners

Retail tech changes the rules for suppliers — including private-label manufacturers, fresh producers and mid-size brands.

Packaging must be machine-readable

Automated systems require packages that scan cleanly and consistently. This means:

-

Clearer barcodes

-

Machine-readable fonts

-

Consistent packaging surfaces

-

Better-labelled produce bags

Suppliers who adapt quickly gain smoother routing through DCs and less store-level friction.

Data sharing is now part of the relationship

Woolworths and Coles increasingly expect suppliers to participate in digital trials:

-

Store-layout simulations

-

Automated quality checks

-

Range-optimisation models

-

Real-time defect reporting

This will become standard practice across supermarkets in Australia.

Fresh supply chains need deeper visibility

For anyone supplying fruit or vegetables — as explored in Fresh Produce – Australia — digital traceability is becoming a requirement. Retailers need early signals on crop issues, harvest timing, temperatures and transit delays.

Private-label manufacturers also need stronger digital workflows. Woolworths and Coles are pressing for transparent specs, real-time QC and early forecasting alignment.

Future Outlook: What’s Next in 2026–2027

The next two years will bring a new wave of tools across the industry. They won’t replace humans. But they will change how humans work in stores.

Autonomous store formats

Not a full Amazon Go model — more of a hybrid design.

Small-format stores will lean heavily on cameras, sensors and automated gates.

AI-driven promotions

Retailers are testing algorithms that adjust offers and promotions based on weather, basket flow, local behaviour and time of day. This will change weekly specials and targeted deals.

Digital twins for store planning

Woolworths and Coles both use simulation software to test new layouts digitally before they are built. This will speed up refurbishment cycles.

Robotics in fresh processing

Cutting, sorting and packing automation is rising globally. Australia is likely to adopt these systems earlier than many markets.

More integration between online and physical

The line between online fulfilment and store operations is already thin. By 2027, it will be almost seamless, with shared precision forecasting and automated routing.

Where Technology Is Changing Australian Supermarkets

(A simple table graphic you asked for — clean and easy to read.)

| Area | Example Technologies | Purpose |

|---|---|---|

| Front-of-house | Smart carts, AI cameras, SCO upgrades | Reduce theft, speed up checkout |

| Back-of-house | Robotics, automated DCs, AI forecasting | Lower labour cost, improve accuracy |

| Digital | Apps, personalisation, digital receipts | Build loyalty, remove friction |

Conclusion

Australia is moving into a new phase of retail automation, and it’s happening store by store, trial by trial, without much noise. Woolworths and Coles are redesigning the entire ecosystem — not just the checkout, but the supply chain, the forecasting systems, the layout simulations, the loyalty engines and the digital experience that ties it all together.

By 2026–2027, the country will be one of the most advanced automated retail markets in the world. And the core of that shift is simple: retail technology Australia supermarkets is no longer a single project. It’s becoming the foundation for how grocery will operate across the entire country.