Belgium has become one of Europe’s quiet testing grounds for retail technology. Not because the market is loud or experimental, but because it is small, dense, regulated, and extremely competitive. That combination makes retail technology Belgium supermarkets an ideal environment for controlled pilots, rule-driven innovation, and scalable formats that can later move across borders.

Belgian grocery retail sits between France, the Netherlands, and Germany, but it does not copy any of them directly. Retailers here adopt technology cautiously. They test in real stores, not labs. They measure shrink, labour impact, energy cost, and customer behaviour before committing at scale.

What emerges is a market where smart formats work quietly in the background, improving efficiency without changing how stores feel to shoppers.

Why Belgium Is Good For Testing Retail Technology

Belgium’s grocery market is compact but highly concentrated. A small number of major chains dominate national coverage, often operating multiple formats under the same banner. Store networks are dense. Logistics routes are short. Consumer expectations are high.

That structure allows retailers to test technology across urban, suburban, and commuter locations without changing country or regulation. A pilot launched in Brussels can quickly be adapted for Antwerp, Ghent, or Liège.

Regulation also plays a role. Belgium has clear rules around payments, data, labour, and store access. Technology must fit inside those rules. That constraint filters out gimmicks early and favours systems that are reliable, compliant, and cost-effective.

This is why international vendors increasingly watch Belgium closely before rolling out solutions elsewhere in Europe.

Autonomous Stores And Micro-Formats

One of the most visible areas of experimentation in Belgium is autonomous retail. Not large flagship stores, but small, focused formats designed around access, convenience, and limited assortments.

These stores are typically:

-

Open 24/7

-

Located in transport hubs, office parks, campuses, or residential developments

-

Designed for quick missions rather than full weekly shops

Access is usually app-based or card-based. Customers enter, shop, and leave without traditional checkout. Behind the scenes, systems combine cameras, sensors, and transaction logic to track purchases.

Belgium’s advantage here is location density. Autonomous formats work best where footfall is predictable and repeat visits are common. That includes railway stations, mixed-use buildings, and corporate sites.

Retailers are not positioning these stores as replacements for supermarkets. They are extensions. A way to reach consumers outside standard opening hours, or in places where staffing a full store would not be economical.

Importantly, most Belgian trials remain limited in size. Retailers are still measuring cost, maintenance, shrink exposure, and customer acceptance before committing to roll-outs.

The Reality Behind Self-Checkout Expansion

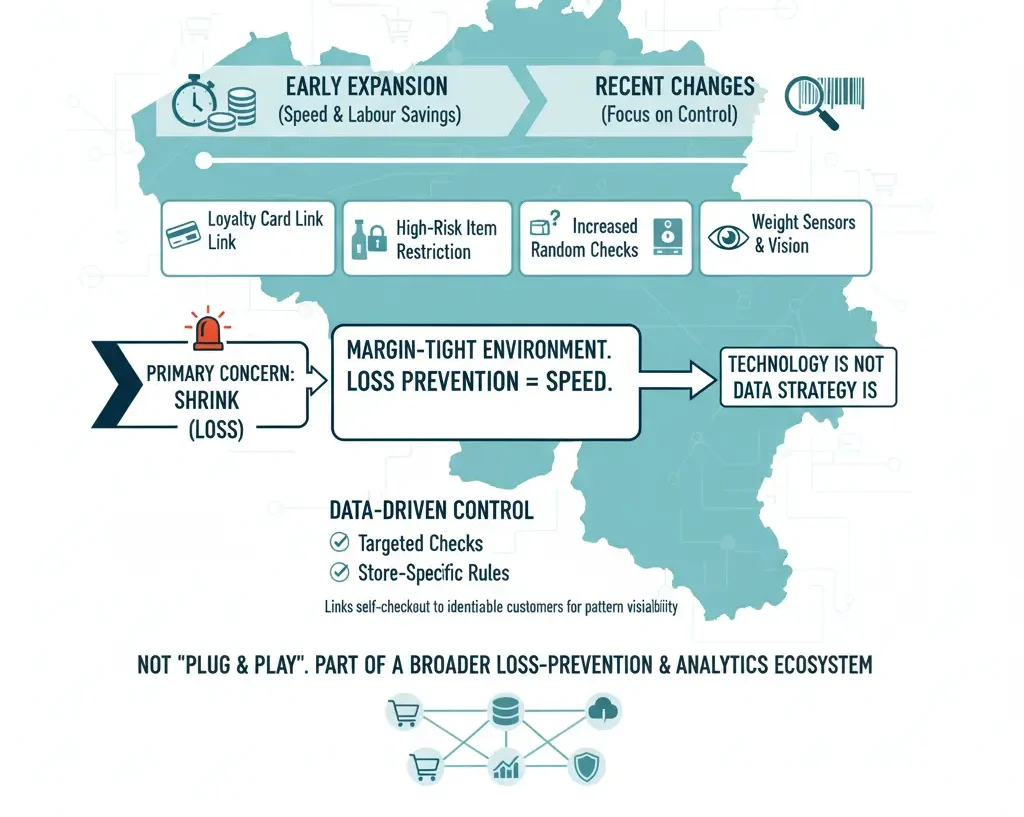

Self-checkout is not new in Belgium, but the way it is being managed has changed. Early expansion focused on speed and labour savings. More recent changes focus on control.

Several retailers have tightened self-scan rules, including:

-

Linking self-checkout use to loyalty cards

-

Restricting self-scan for high-risk items

-

Increasing random checks

-

Combining weight sensors with vision systems

This shift reflects one clear concern: shrink.

Belgian retailers operate in a margin-tight environment. Self-checkout only works if loss prevention keeps pace with speed. The technology itself is no longer the challenge. The data strategy is.

By linking self-checkout to identifiable customers, retailers gain visibility into patterns. That data supports targeted checks, store-specific rules, and better training.

What Belgium shows clearly is that self-checkout is no longer a “plug and play” solution. It is part of a broader loss-prevention and analytics ecosystem.

Apps, loyalty, And Personalisation

Belgian grocers have invested heavily in apps and loyalty platforms, but not to chase novelty. The focus is practical.

Most major retailers now use apps to:

-

Deliver digital coupons

-

Push personalised offers

-

Support digital receipts

-

Integrate payment and identification

These tools are designed to reduce friction and increase basket size, not to replace in-store experience. Personalisation tends to be conservative. Offers are relevant but not aggressive.

Retail media is also emerging as part of this ecosystem. Brands can buy placement within apps, digital leaflets, and in-store screens. For retailers, this creates a new revenue stream tied directly to shopper data.

This is where technology, data, and supplier relationships intersect. It also links closely to wider FMCG Belgium dynamics, where manufacturers increasingly expect measurable return on promotional spend.

Smart Shelves And Back-Of-Store Systems

Some of the most impactful technology in Belgium is the least visible to shoppers.

Back-of-store innovation focuses on efficiency, compliance, and cost reduction. Key areas include:

-

Energy-efficient refrigeration systems

-

Predictive maintenance tools

-

Inventory analytics

-

Shelf sensors for availability and planogram compliance

Energy costs matter in Belgium. Refrigeration upgrades and smart energy management systems are often justified on savings alone, without needing customer-facing benefits.

Shelf analytics help reduce out-of-stocks, especially in fresh and high-turn categories. These systems are rarely fully automated. Staff still play a role, supported by alerts and dashboards rather than constant manual checks.

This operational focus also connects with regulatory pressure, including sustainability targets and packaging compliance, areas already shaping Belgian packaging strategies across grocery retail.

What Technology Adoption looks like In Belgian Supermarkets

Belgian retailers do not chase “first mover” status. They prefer controlled pilots, clear KPIs, and gradual scaling.

Typical adoption patterns include:

-

One or two pilot stores

-

Limited category or format scope

-

Measured results over several months

-

Expansion only after operational proof

This approach reduces risk but can frustrate vendors expecting rapid roll-outs. Success in Belgium often depends more on patience than persuasion.

Retailers expect technology partners to understand store operations, labour realities, and local regulation. Solutions must fit existing systems rather than replace them entirely.

This is especially true for suppliers working with large supermarkets in Belgium, where legacy infrastructure and national coverage require careful integration.

The Role Of Regulation And Trust

Consumer trust matters in Belgian retail. Shoppers expect transparency around data use, pricing, and access. Technology that feels intrusive or unclear tends to face resistance.

This is one reason why facial recognition and aggressive tracking remain limited. Retailers prefer anonymised data, opt-in systems, and loyalty-based identification.

Regulation reinforces this mindset. Compliance is not optional, and penalties can be costly. As a result, technology choices are filtered through legal, IT, and operational teams long before reaching store level.

The upside is stability. Once a system is approved and rolled out, it tends to stay in place for years.

What This Means For Tech Suppliers

Belgium rewards suppliers who think long-term.

To succeed, technology vendors should:

-

Focus on clear operational benefits

-

Prepare for extended pilot phases

-

Offer strong local support

-

Demonstrate compliance readiness

-

Be realistic about scale and timelines

Sales cycles are not fast, but wins are sticky. A successful deployment in Belgium often becomes a reference point for neighbouring markets.

Suppliers should also understand that Belgian retailers value partnership over hype. Proof matters more than promises.

Looking Ahead

Belgium’s grocery sector will continue to adopt technology steadily rather than dramatically. Autonomous formats will grow, but selectively. Self-checkout will remain, but under tighter control. Data will shape decisions, but within clear boundaries.

What makes the market interesting is not speed, but discipline.

For suppliers, innovators, and FMCG partners, Belgium offers something rare: a place where retail technology is tested in real conditions, measured carefully, and scaled only when it truly works.

In that sense, retail technology Belgium supermarkets may be quiet — but it is influential.