US grocery retail technology 2025 is pushing the whole market into a new phase of automation, data use and store redesign. Retailers are moving faster because the pressure on costs, labour and in-store efficiency keeps rising. The change is visible on the shop floor, but the bigger shift is happening behind the scenes, where forecasting and supply systems are becoming more digital.

Technology is now treated as long-term infrastructure, not an experiment. Some of this comes from years of trial and error, and some from global retail trends already seen in Retail Technology 2025. But in the US, the pace feels sharper because retailers are trying to solve several problems at once: rising wages, unpredictable demand, and higher expectations from shoppers who want convenience without paying extra.

Why Tech is Now Core to US Grocery Strategy

Grocery has always been a low-margin business, and the last few years pushed those margins even tighter. Labour costs climbed, store operations became harder to staff, and inflation forced retailers to handle inventory with extreme accuracy. Technology stepped in as the one lever that could improve efficiency without cutting service.

Retailers now rely on digital tools to forecast demand better and reduce the gaps between ordering and sales. Without accurate forecasting, grocers face lost sales, empty shelves or excess stock. With it, they gain smoother replenishment, fewer errors and better control over food waste. This becomes even more important as stores run larger assortments and faster product rotations.

Automation also helps stabilise labour needs. Routine tasks — scanning, checking inventory, monitoring shelves, processing returns — are slowly shifting to sensors, cameras and software. The goal is not to remove staff entirely, but to free them from repetitive work so more time can be spent on service, fresh food and merchandising.

The strategic mindset has shifted. Technology is no longer about testing single tools. It is about building a connected system where front-of-store activity, back-of-store data and digital shopper behaviour all feed into one retail engine.

Front-of-Store Technology

Front-of-store innovation is the most visible part of the transformation. Shoppers notice it immediately — the smart carts, the self-checkout layouts, the new camera systems above aisles, the digital screens. But behind the scenes, each of these tools is linked to the retailer’s larger push for speed and accuracy.

Smart Carts

Smart carts are moving from early trials to wider rollout. They recognise items as they go into the basket, show running totals and allow checkout in the cart itself. For shoppers, the benefit is speed — no queue, no unloading, no scanning. For retailers, the carts provide detailed data about movement patterns, basket building and product discovery inside stores.

These systems also reduce friction for quick-trip customers. In dense urban stores, they help control congestion and give staff more time for fresh-food tasks instead of gatekeeping checkout lines.

Self-Checkout Optimisation

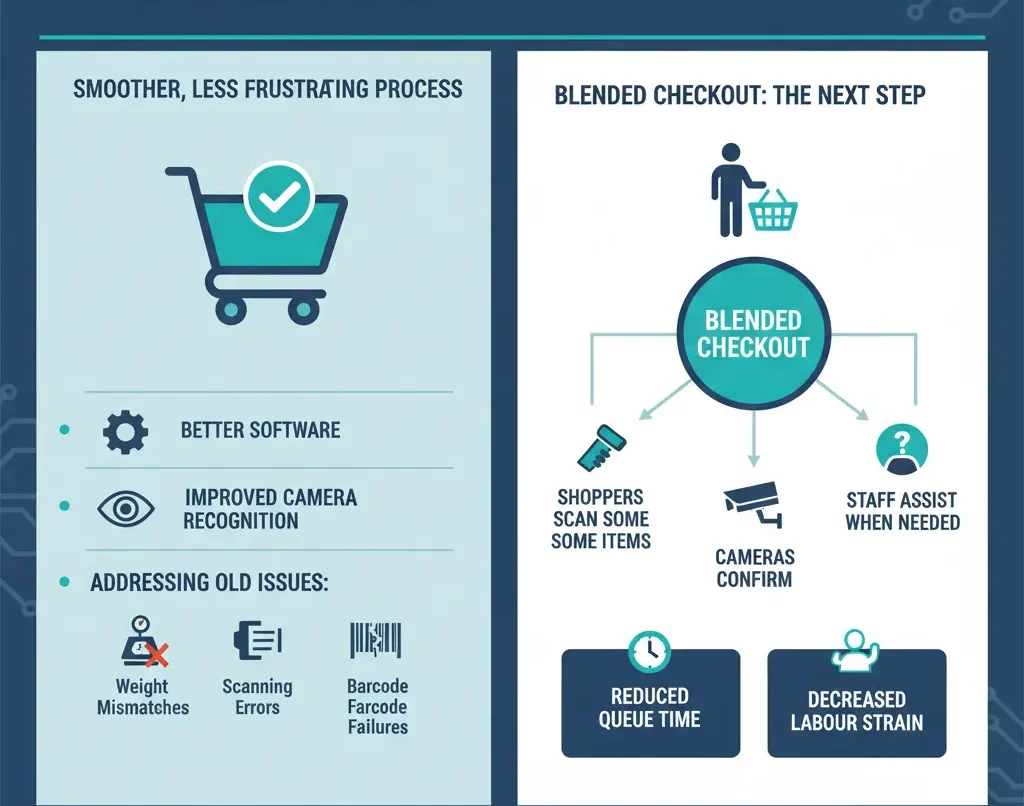

Self-checkout has been around for years, but 2025 is the year retailers finally redesign it. Instead of adding more machines, the focus is on making the process smoother and less frustrating. Weight mismatches, scanning errors, barcode failures — all the old issues — are being addressed through better software and improved camera recognition.

The next step is blended checkout: shoppers scan some items, cameras confirm others, and staff step in only when needed. This cuts down queue time and reduces labour strain without forcing customers into a single method.

AI Cameras and Computer Vision

AI-powered cameras are becoming common across aisles, produce sections and checkout zones. They detect misplaced items, low stock, spills, shrink risks and shelf gaps. They also support semi-autonomous checkout, ensuring items are recognised even when barcodes fail or packaging bends.

For produce, AI cameras help identify fruit or vegetables without manual entry. For staff, they signal when restocking is needed. And for retailers, they provide a continuous flow of operational data that used to require manual checks.

Back-of-Store and Supply Chain

Most of the real transformation in US grocery happens out of sight. Back rooms, distribution centres and data hubs are becoming more automated every year. These areas decide how well a store stays stocked, how quickly orders flow and how much waste a retailer carries.

Inventory Systems

Inventory work used to mean manual counts and constant adjustments. Now retailers rely on connected sensors, digital shelf systems, better barcode capture and AI models that predict when items will run low.

These tools help reduce the “blind spots” that used to cause empty shelves or unexpected overstock.

More stores are using real-time dashboards that highlight exactly where they are short. It removes the guesswork. Staff are sent directly to the right aisle, instead of searching half the store.

This shift also supports fresher assortments. Produce and chilled categories benefit the most because forecasting errors show up quickly in those departments. The better the data, the better the freshness cycle.

DC Automation

Distribution centres are getting more automated, though not every retailer is moving at the same pace. Some are adding robotic pallet loaders, automated storage systems and goods-to-person technology. Others are focusing on digital visibility first — knowing exactly where inventory sits before adding heavy automation.

Even with different strategies, the direction is consistent: fewer manual touches, faster movement through facilities and more accurate routing between warehouses and stores. Cost pressure is a major driver here. Every unnecessary step in the supply chain eats into margins.

Retailers also want more resilience. Smarter routing, predictive maintenance for warehouse equipment and centralised data systems help keep operations stable even when labour shortages or delays happen.

Forecasting

Forecast accuracy is now a competitive differentiator. Grocers that predict demand well can plan promotions cleanly, maintain stable pricing and avoid the “boom-and-bust” inventory swings that frustrate both suppliers and customers.

Forecasting tools today combine sales history, store patterns, seasonality and environmental signals. They update continuously rather than weekly.

This allows replenishment teams to adjust orders faster and avoid the “too late to fix it” scenarios that used to be common.

Better forecasting links directly to retail performance — smoother shelf conditions, fewer lost sales and more profitable promotions.

It also connects naturally with digital shopper data, which is why many retailers now align forecasting models with behaviour insights seen in US FMCG shopper trends.

Digital Shopper Experience

The digital layer of grocery retail is now as important as the physical store. Even when shoppers buy in person, their journey usually begins on a phone — browsing deals, checking prices, planning meals or comparing options.

Loyalty Apps

Loyalty apps are becoming the main interface between retailers and customers. They combine rewards, digital coupons, personalised offers, order history and in-store navigation.

For retailers, these apps feed live behavioural data into forecasting systems, helping them understand trip patterns and basket composition.

For shoppers, the apps create the feeling of a personalised store — recommendations, reminders and meal ideas adjusted to their habits.

Personalisation

Personalisation has moved beyond simple discounts. Retailers now use behavioural clusters to tune promotions, change the order of products shown in apps, highlight certain categories and adjust the timing of notifications.

This creates stronger engagement but also shapes inventory needs. When apps highlight certain products, demand shifts quickly, and stores must respond with accurate stock levels.

It links digital decisions directly with store operations, making forecasting and automation even more important.

Retail Media

Retail media networks are growing quickly across the US grocery sector. Brands want to reach shoppers at the exact moment they are choosing products — inside apps, on digital shelf tags or on screens throughout the store.

For retailers, retail media is now a major revenue stream.

For suppliers, it becomes another battleground where packaging clarity, digital recognition and campaign timing matter.

And for shoppers, it creates a more integrated digital-physical experience.

The rise of retail media is also shaping the type of data retailers collect. More accurate signals mean better targeting, which then supports stronger promotional planning.

Implications For Suppliers

Suppliers face a different environment in 2025. Retailers expect products that fit a more automated, data-driven world. This affects packaging, barcodes, inventory data and the speed at which suppliers update product information.

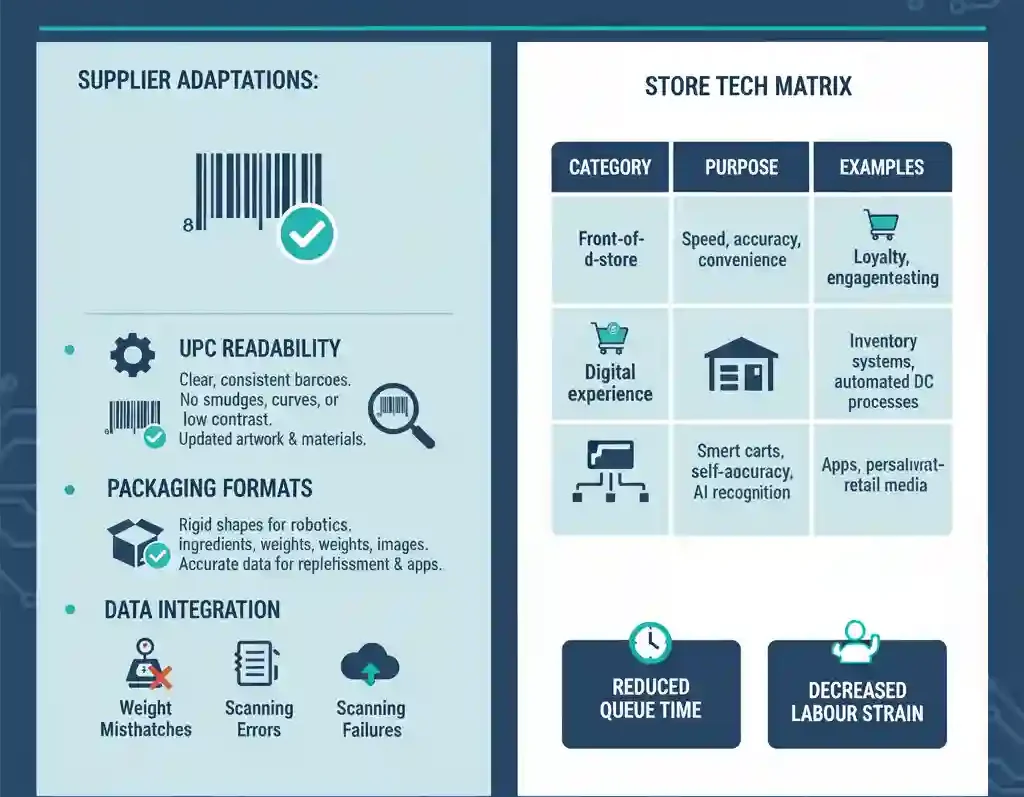

UPC Readability

Scanning quality matters more than ever. Smart carts, AI cameras and blended checkout systems depend on clear, consistent barcodes. Any smudging, curved surfaces or low contrast creates scanning errors, which slow down both shoppers and staff.

Suppliers are updating artwork and adjusting packaging materials to ensure better readability. Digital twins used inside some retail systems also rely on accurate UPC data to match shelf images with product records.

Packaging Formats

Automation influences packaging choices. Rigid shapes are easier for robotic systems, while flexible plastics often require careful design so sensors can identify them correctly.

This is where suppliers often look to insights from US packaging trends, especially when preparing new launches.

Shelf-ready packaging also gets more attention. Retailers want outer cases that open cleanly, fit automated shelving systems and reduce time spent on manual setup.

Data Integration

Retailers expect faster data flow from suppliers — ingredient updates, case sizes, weights, images, and forecasting inputs.

When suppliers share accurate data, retailers can plan smoother replenishment and adjust inventory in near real time.

This also supports digital visibility for shoppers. Apps require accurate imagery and product details for search, comparison and recommendations.

Suppliers that integrate cleanly into retail systems gain better shelf placement, fewer delays and smoother promotional execution.

Store Tech Matrix

| Category | Purpose | Examples |

|---|---|---|

| Front-of-store | Speed, accuracy, convenience | Smart carts, self-checkout, AI recognition |

| Back-of-store | Stability, stock accuracy | Inventory systems, automated DC processes |

| Digital experience | Loyalty, engagement, targeting | Apps, personalisation, retail media |

Conclusion

The US grocery retail technology 2025 landscape is moving faster than many expected. Stores are redesigning layouts, supply chains are becoming more automated, and digital behaviour is shaping everything from forecasting to promotions. Retailers are not just adopting tools — they are building integrated systems that connect store operations, warehouses and shopper journeys.

For suppliers, the message is simple: adapt to this infrastructure or risk falling behind. Clear packaging, reliable UPCs, strong data integration and flexible formats are no longer optional. As stores become smarter, the products inside them must fit the system.

Technology is now the backbone of US grocery retail, and the next phase will only grow more connected, more predictive and more automated.