Swiss supermarkets are not loud adopters of retail technology. They are careful, selective, and highly disciplined. In 2025, retail technology Switzerland supermarkets reflects a mature market where digital tools are already embedded, and new systems are judged strictly on reliability, data security, and long-term return.

Unlike fast-moving markets where pilots and experimentation dominate, Swiss retailers focus on stability. Technology is expected to work quietly in the background, improving efficiency, reducing waste, and strengthening customer relationships without disrupting trust. This approach shapes how digitalisation unfolds across grocery retail in Switzerland.

Switzerland as a mature retail technology market

Switzerland entered the digital retail phase earlier than many European markets. High internet penetration, strong banking infrastructure, and digitally confident consumers created the foundation for early adoption of loyalty apps, self-checkout, and online grocery services.

However, high operating costs also shaped behaviour across the Switzerland FMCG market. Labour, logistics, and real estate costs force retailers to be precise with investment decisions. Technology is not deployed for visibility or marketing impact. It must clearly improve productivity, reduce complexity, or support private-label and fresh food strategies.

This explains why retail technology in Swiss supermarkets often looks less experimental than in neighbouring countries, but more stable and deeply integrated once systems are adopted.

E-commerce and online grocery evolution

Online grocery in Switzerland continues to grow, but at a controlled pace. Home delivery is well established, yet it has not replaced physical stores. Instead, it complements them.

Migros Online remains the most advanced online grocery operation in the country. Built as part of a broader ecosystem rather than a standalone platform, it benefits from shared logistics, integrated loyalty systems, and strong private-label penetration. The focus is on accuracy, delivery reliability, and product quality rather than rapid assortment expansion.

Coop has followed a similar path, integrating online ordering into its wider digital infrastructure. Rather than pushing aggressive growth targets, Swiss retailers prioritise service consistency and customer retention.

Click & Collect plays a growing role, especially in suburban and commuter regions. It reduces last-mile delivery costs while offering convenience to shoppers who already trust their local store. For many Swiss households, hybrid shopping journeys — part online, part in-store — are becoming the norm.

Compared to larger European markets, growth is slower, but churn is lower. This reflects the cautious but loyal nature of Swiss consumers.

In-store technology and checkout systems

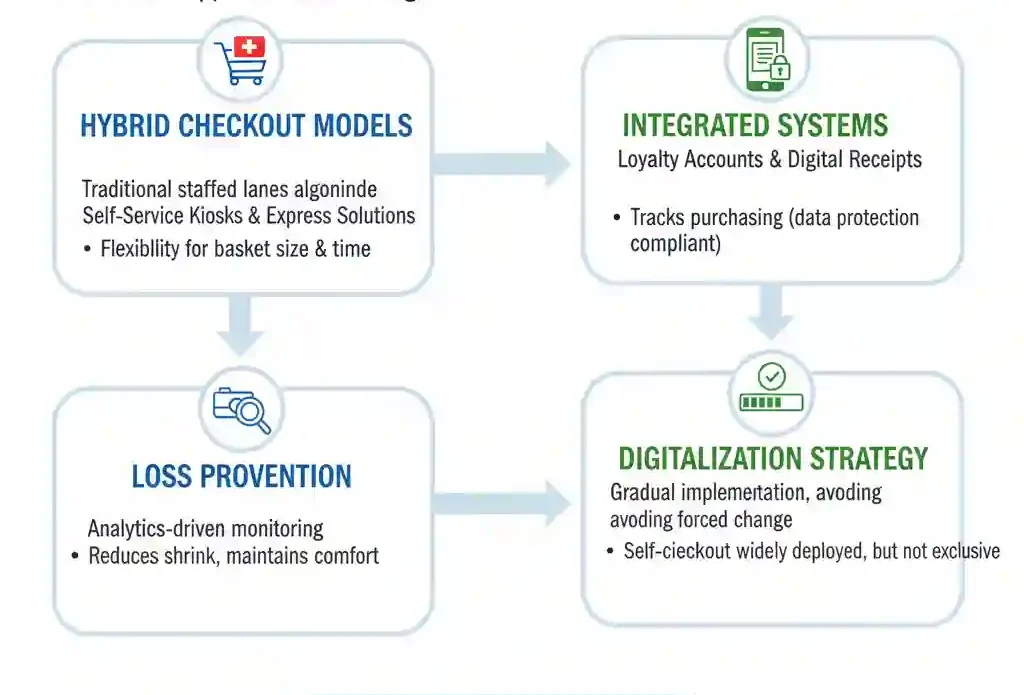

Checkout technology remains one of the most visible areas of digitalisation. Self-checkout is widely deployed across supermarkets in Switzerland, but almost always alongside staffed lanes. Retailers avoid forcing behaviour change too quickly.

Hybrid checkout models dominate. Customers can choose between traditional checkouts, self-service kiosks, and smaller express solutions depending on basket size and time pressure. The goal is flexibility rather than full automation.

Behind the checkout, systems are tightly linked to loyalty accounts and digital receipts. This allows retailers to track purchasing behaviour accurately while complying with strict data protection rules.

Loss prevention is a major concern. Swiss retailers invest heavily in analytics-driven monitoring rather than intrusive controls. Technology is used to reduce shrink while maintaining a comfortable shopping environment.

Loyalty apps, digital coupons, and data integration

Loyalty programmes in Switzerland are highly digital, but not aggressively promotional. Apps serve multiple roles at once: identification, payment integration, digital coupons, and personalised offers.

Retailers focus on relevance over frequency. Discounts are targeted, often linked to private-label ranges or seasonal fresh products. This supports margin protection while reinforcing customer trust.

Data integration is advanced, but carefully governed. Swiss supermarkets operate under strict privacy expectations, both regulatory and cultural. Systems are designed to anonymise insights where possible and limit unnecessary data exposure.

This cautious approach slows rapid innovation but strengthens long-term customer confidence, which is critical in a high-trust retail environment.

Analytics and data-led planning

One of the most important areas of Swiss supermarket retail technology is data-led planning. Demand forecasting, assortment optimisation, and waste reduction are key priorities.

Advanced analytics are used to fine-tune fresh food ordering, particularly in produce, bakery, and ready meals. Small forecasting improvements can generate meaningful savings in a market with high disposal and labour costs.

Pricing analytics are also widely used, but not for aggressive dynamic pricing. Instead, retailers focus on maintaining consistent price perception while protecting margins across private-label and branded ranges.

Technology supports decisions rather than replacing human judgment. Store managers still play an important role, supported by better tools rather than overridden by algorithms.

Convenience technology and omnichannel tools

Convenience is growing steadily in Swiss grocery retail, driven by urbanisation and changing work patterns. Technology supports this shift through apps, digital shelf information, and faster in-store journeys.

Mobile apps increasingly act as the central customer interface. They combine shopping lists, promotions, loyalty benefits, and store information. Some retailers experiment with navigation tools and personalised reminders, but adoption remains cautious.

Click & Collect integration continues to improve, with better slot management and inventory synchronisation. This reduces order cancellations and improves customer satisfaction.

Automated inventory processes are becoming more common, especially in larger stores and distribution centres. RFID, shelf monitoring, and predictive replenishment tools help reduce out-of-stocks without increasing safety stock.

Automation in supply chain and operations

Automation is most visible behind the scenes. Swiss retailers invest heavily in distribution centre technology, where automation delivers clear efficiency gains.

Warehouse robotics, automated picking systems, and improved route planning are essential to manage online and store replenishment together. Given Switzerland’s geography and infrastructure constraints, logistics precision is critical.

In-store automation is more limited. Fully unmanned formats remain niche. Retailers prefer incremental improvements that fit existing store layouts and customer habits.

Energy management systems are also part of the technology landscape. Monitoring tools help manage refrigeration, lighting, and heating costs while supporting sustainability targets.

Retail media and digital monetisation

Retail media is emerging, but cautiously. Swiss supermarkets recognise the revenue potential of advertising within digital ecosystems, but they avoid cluttering customer experiences.

Retail media offerings focus on relevance and brand fit. Private-label promotion remains dominant, while selected brand partners gain access to targeted campaigns within apps and online platforms.

Growth is expected, but slower than in larger European markets. Swiss retailers prioritise long-term brand trust over short-term advertising revenue.

Vendor perspective: what Swiss retailers look for

For technology vendors, Switzerland is a demanding market.

Swiss supermarkets look first for reliability. Systems must work consistently, integrate smoothly, and scale without disruption. Pilots are limited, and proof of value is expected early.

Data security and compliance are non-negotiable. Vendors must demonstrate strong governance, local support capabilities, and clear data-handling processes.

Long-term partnerships matter more than feature breadth. Retailers prefer fewer suppliers with deep integration rather than fragmented toolsets.

Flexibility also matters. Swiss retailers often customise systems to fit cooperative structures, multi-format operations, and regional differences. Vendors that can adapt without overcomplicating implementations are better positioned.

The role of private label and fresh categories

Technology investment in Switzerland strongly supports private label and fresh food strategies. Systems that accelerate product development, improve traceability, or support quality control are highly valued.

Private-label innovation relies on fast data feedback, supplier coordination, and packaging and compliance tracking. Retail technology plays a central role in making this work at scale.

Fresh categories benefit from demand forecasting, waste analytics, and quality monitoring tools. Given the importance of fresh food in Swiss consumer perception, technology investment here delivers both financial and reputational returns.

Challenges slowing transformation

Despite high digital maturity, several factors slow transformation.

High implementation costs limit experimentation. Labour regulations and store layout constraints make rapid change difficult. Cultural resistance to intrusive technology also plays a role.

AI adoption remains selective. While advanced analytics are widely used, fully autonomous decision-making systems are rare. Retailers prefer explainable models and human oversight.

This results in steady progress rather than dramatic shifts.

What comes next for retail technology in Switzerland

In the next few years, digital systems used by Swiss grocers will continue to evolve quietly.

Expect deeper integration between online and offline platforms, more advanced forecasting for fresh and convenience foods, and gradual expansion of retail media.

AI will grow, but mostly in support roles: planning, optimisation, and operational efficiency. Customer-facing innovation will remain subtle.

For suppliers and technology partners, success in Switzerland depends on patience, credibility, and alignment with retailer values. This is not a market for rapid disruption, but for long-term contribution.

Conclusion

Swiss supermarkets in 2025 show what mature retail technology looks like when trust, efficiency, and stability matter more than speed. Digital tools are already embedded, and innovation focuses on refinement rather than reinvention.

Retail technology Switzerland supermarkets will continue to support precision retailing: better planning, smoother journeys, and stronger private-label performance. Progress may look slow from the outside, but inside the system, it is deliberate and deeply strategic.