Germany’s supermarkets depend on one of the most advanced food supply systems in Europe.

From dairy and bakery goods to ready meals and plant-based products, a small number of strong producers keep shelves stocked every day.

Understanding supermarket suppliers Germany helps retailers, exporters, and new market entrants see how the country’s food system really works.

The main suppliers include Müller, DMK Group, Dr. Oetker, Rügenwalder Mühle, Zentis, Theo Müller Group, and Homann Feinkost — alongside a wide network of international exporters who send goods into the country every week.

Editor’s Note:

This article is based on verified information from company reports, trade updates, and retail industry sources.

It covers key food producers, private-label manufacturers, and logistics partners supplying the German supermarket sector in 2025.

Major Supermarket Suppliers Germany In 2025

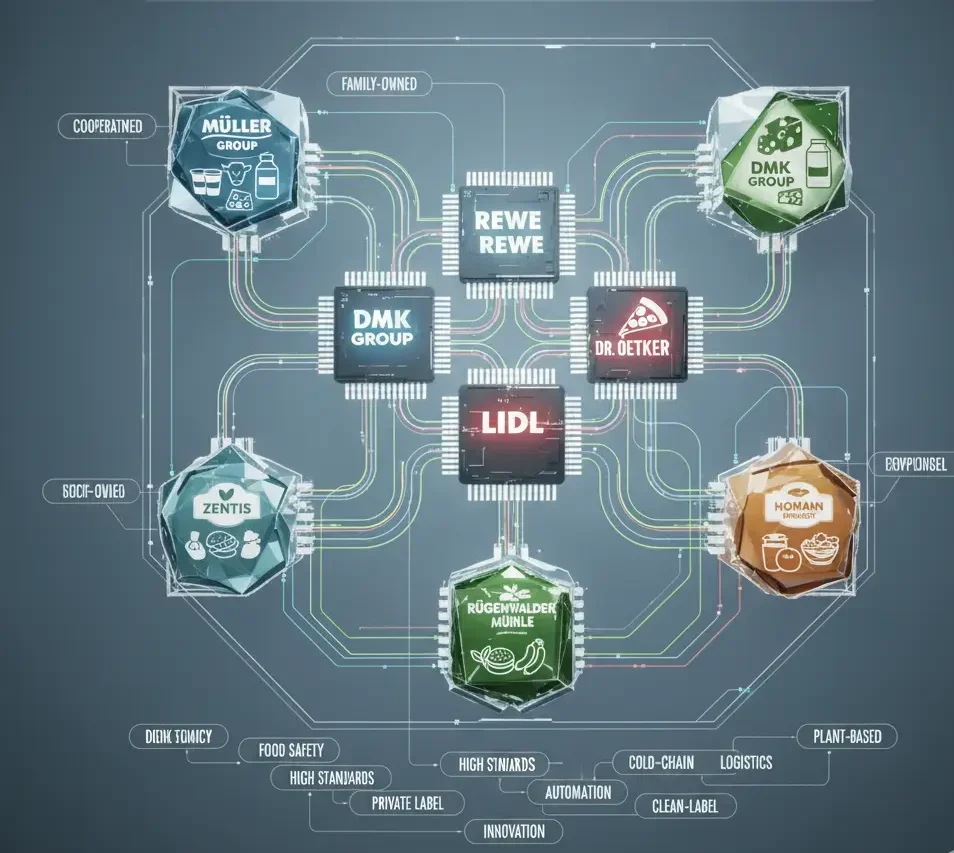

Germany’s grocery supply base is built around family-owned and cooperative companies that have grown over decades.

They make both big consumer brands and private-label products for EDEKA, REWE, Aldi, Lidl, and Kaufland.

These suppliers are well known for efficiency, food safety, and high production standards.

Müller and Theo Müller Group

The Theo Müller Group is one of Europe’s largest dairy companies.

Its product range includes yogurt, milk drinks, desserts, and snacks.

In Germany, Müller supplies its own brands as well as private-label dairy lines for supermarket chains.

The company has several factories across Germany and the UK, with advanced cold-chain logistics that allow daily deliveries to distribution centers.

Müller also exports dairy products to other European markets.

Its long-term contracts with retailers make it one of the most reliable names in supermarket suppliers Germany.

DMK Group

DMK Group is another major dairy producer, owned by German farmers through a cooperative system.

It supplies milk, cheese, butter, and baby food under brands such as Milram and Humana.

Because it is farmer-owned, DMK can keep close control over milk quality and costs.

That makes it a preferred partner for supermarkets looking for sustainable, stable supply chains.

In 2025, DMK continues to invest in more energy-efficient production and local sourcing.

Its strong relationship with EDEKA and REWE helps both sides plan product development and promotions together.

Dr. Oetker

Dr. Oetker is a family company that has become a global food group.

It produces baking ingredients, desserts, and frozen pizzas sold under its own brand, but also manufactures private-label lines for German and international retailers.

Dr. Oetker’s factories are known for high automation and consistent quality.

The company’s long experience in recipe development and packaging innovation keeps it an important player in supermarket suppliers Germany.

Rügenwalder Mühle

Rügenwalder Mühle began as a traditional meat processor in northern Germany.

Today it is one of the leading producers of vegetarian and vegan foods.

Its success in plant-based burgers and sausages has made it a model for other food companies.

Rügenwalder supplies both its own brand and retailer private labels, showing how old family firms can adapt to new consumer trends.

Zentis

Zentis specializes in fruit preparations, jams, and nut spreads.

It supplies both branded and private-label products to nearly every large retailer in Germany.

The company also provides fruit fillings and pastes for bakeries and confectionery factories.

Zentis has built its reputation on natural ingredients and clean-label production, which fits well with current shopper preferences.

Homann Feinkost

Homann Feinkost produces chilled salads, dressings, and ready meals.

It serves supermarket chains, convenience stores, and food-service partners.

Its main factories are located in northern Germany and deliver fresh products daily to regional warehouses.

Homann’s flexibility and reliable supply make it a strong link between manufacturers and retail buyers.

Private Label And Contract Manufacturers

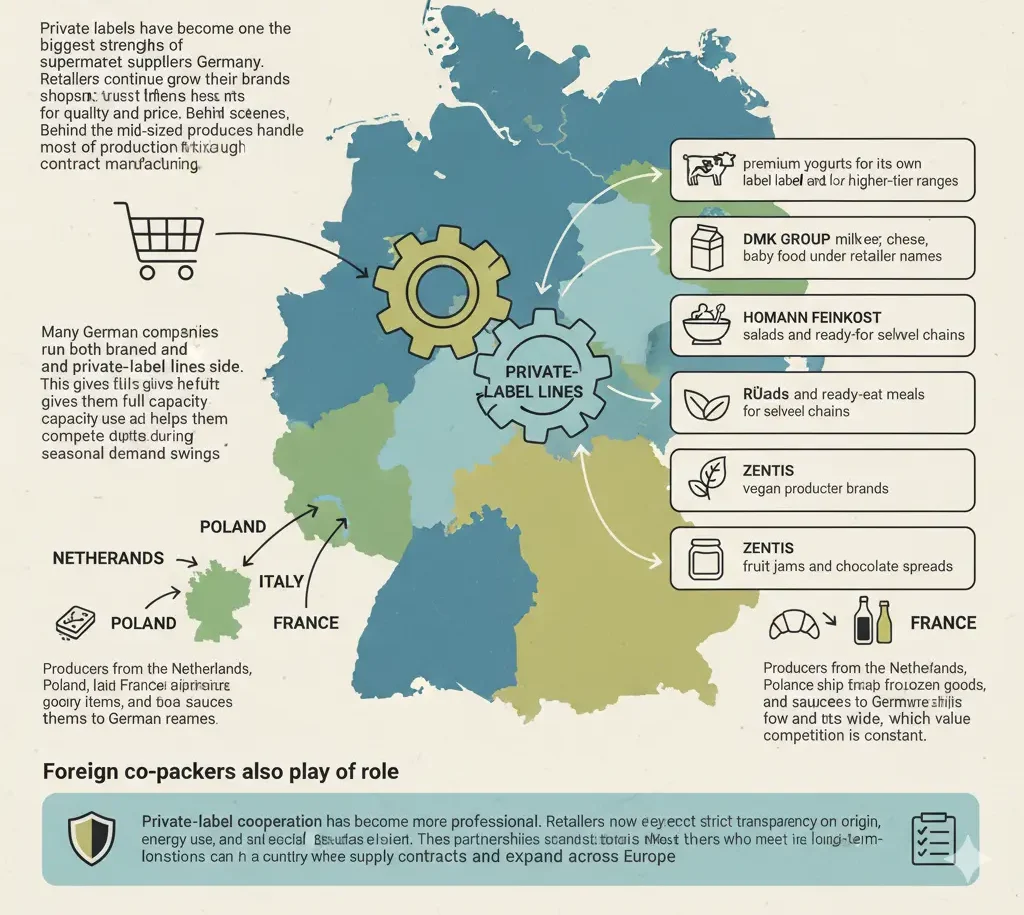

Private labels have become one of the biggest strengths of supermarket suppliers Germany.

Retailers continue to grow their own brands because shoppers trust them for quality and price.

Behind the scenes, large and mid-sized producers handle most of the production through contract manufacturing.

Many German companies run both branded and private-label lines side by side.

This gives them full capacity use and helps them compete during seasonal demand swings.

-

Müller makes premium yogurts for its own label and for supermarkets’ higher-tier ranges.

-

DMK Group supplies milk powder, cheese, and baby food under retailer names.

-

Homann Feinkost produces salads and ready-to-eat meals for several chains.

-

Rügenwalder Mühle manufactures vegan products for supermarket brands.

-

Zentis fills retailer jars with fruit jams and chocolate spreads.

Foreign co-packers also play a role.

Producers from the Netherlands, Poland, Italy, and France ship frozen goods, bakery items, and sauces to German retailers.

These partnerships help keep prices low and assortments wide, which is essential in a country where value competition is constant.

Private-label cooperation has become more professional.

Retailers now expect strict transparency on origin, energy use, and social standards.

Manufacturers who meet these conditions can win long-term supply contracts and expand across Europe.

Distribution And Logistics Networks

Behind every product on a German shelf is an advanced logistics system.

Suppliers depend on fast, accurate, and sustainable transport to meet retailer needs.

Germany’s main grocery groups — EDEKA, REWE, Aldi, Lidl, and Kaufland — all run their own regional distribution centers.

Suppliers deliver directly to these hubs under fixed schedules.

From there, goods are sorted and sent to stores daily or several times per week.

Small and medium producers often use third-party logistics companies that specialize in chilled or frozen transport.

Many of these service providers now operate electric or hybrid trucks to cut emissions.

Digital tools make coordination easier.

Most large chains use electronic data interchange (EDI) to share order forecasts with suppliers.

This helps factories plan production and reduce waste.

Some manufacturers, such as DMK Group and Dr. Oetker, also run their own distribution arms to control quality from factory to store.

Automation and robotics in warehouses are growing quickly, saving time and labour.

By 2025, sustainability is central to logistics.

Recycled packaging, reusable crates, and route-optimization software all help reduce environmental impact.

These systems make supermarket suppliers Germany more efficient and more sustainable.

The Role Of International Exporters

Germany imports a wide range of foods that cannot be produced locally all year.

Fruits, seafood, olive oil, rice, coffee, and specialty goods arrive daily through ports in Hamburg and Bremen or via land routes from neighbouring countries.

Exporters from the Netherlands, Italy, France, and Spain supply much of the fresh produce, dairy ingredients, and pasta sold in German supermarkets.

Suppliers from Turkey, South America, and Asia handle nuts, spices, sauces, and tropical fruits.

Many foreign companies work with German distributors who understand local rules and retailer systems.

They handle labeling, barcoding, and logistics so that imported products fit smoothly into store supply chains.

Germany’s central location in Europe makes it a major hub for re-exports too.

Products that enter through German ports often move on to Austria, Denmark, and Eastern Europe.

For international producers, joining the supermarket suppliers Germany network can open access to multiple regional markets through one contract.

Why Private Label Keeps Growing

Private label in Germany has moved far beyond budget lines.

Supermarkets now sell premium organic, free-from, and gourmet products under their own names.

This shift is driven by consumer trust in national retailers and by continued inflation pressure on branded goods.

German producers are skilled at meeting these changing needs.

Many factories now run flexible lines that can switch between different recipes or packaging designs for each retailer.

Private-label sales are also growing online, especially through REWE and EDEKA delivery services.

Discounters like Aldi and Lidl are improving product presentation with more modern packaging and in-store displays.

They use private label to prove that low price can still mean high quality.

This strategy continues to shape competition across the supermarket suppliers Germany network.

Sustainability And Innovation In Production

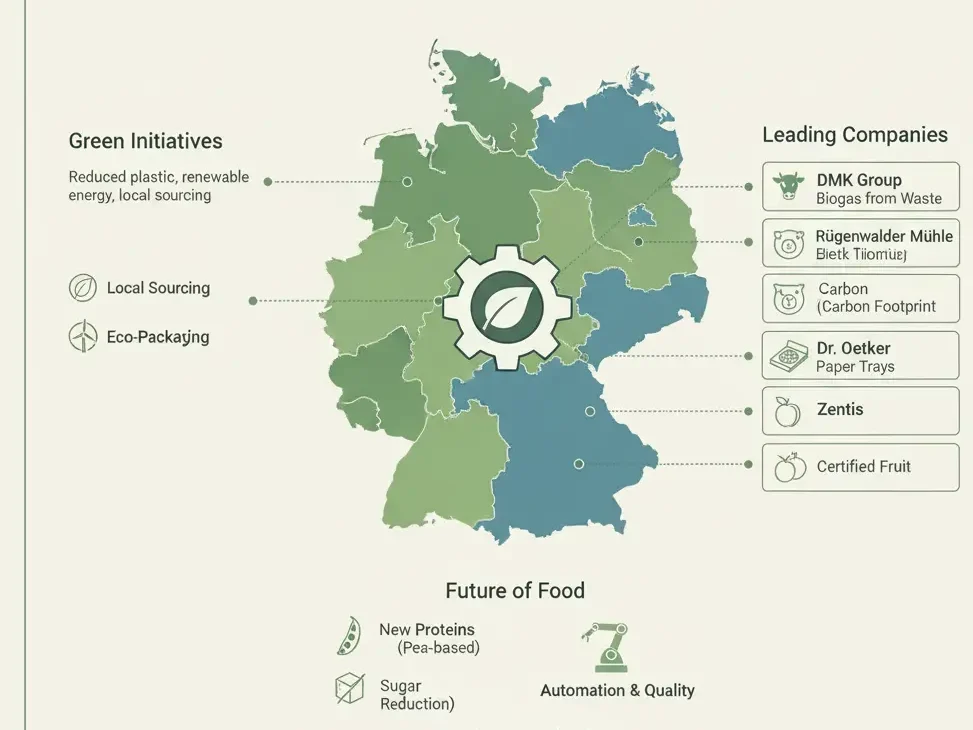

Environmental responsibility is now part of every supplier’s business plan.

Companies are reducing plastic use, investing in renewable energy, and sourcing ingredients locally where possible.

-

DMK Group runs biogas systems powered by dairy waste.

-

Rügenwalder Mühle measures its carbon footprint for each product line.

-

Dr. Oetker is switching to recyclable paper trays for pizzas.

-

Zentis sources certified fruit to support fair farming.

Innovation goes beyond packaging.

Suppliers are investing in new protein sources, such as pea-based ingredients, and in sugar-reduction technology for confectionery and dairy.

Automation helps reduce labour shortages and ensures consistent quality across large volumes.

German retailers now reward suppliers who can show clear sustainability results.

Certification labels, energy audits, and social compliance reports have become part of every annual supplier review.

Market Challenges And Opportunities

The German food market is large but mature.

Growth in 2025 mainly comes from value improvement, not from higher volumes.

That means efficiency and differentiation are critical for suppliers.

Price pressure remains strong because discounters control nearly half of all grocery spending.

Producers must deliver reliable quality at very low cost while still meeting sustainability goals.

At the same time, changing consumer habits create opportunity.

Demand for high-protein, low-sugar, and plant-based options keeps rising.

Suppliers who innovate in these areas can win new listings even in crowded categories.

Labour shortages and higher energy costs remain key risks.

Automation, energy recovery systems, and digital planning tools are helping offset these challenges.

Outlook For 2026

The outlook for supermarket suppliers Germany is stable but demanding.

Retailers want closer partnerships and more data transparency from their suppliers.

Contract manufacturing will continue to grow, especially for premium private-label products.

Sustainability and digital traceability will become mandatory rather than optional.

Consumers expect clear information on origin, packaging, and carbon impact.

Suppliers who can prove progress in these areas will have a competitive edge.

Germany’s supplier base remains a model for Europe — efficient, innovative, and built on trust.

From Müller’s dairy strength to Rügenwalder Mühle’s plant-based leadership, these companies show how traditional expertise and new technology can work together.

By 2026, supermarket supply in Germany will be even more connected, automated, and sustainable — setting a high standard for the rest of the continent.