Every grocery item on a British shelf — from a fresh sandwich to a Sunday roast — owes its place to a vast network of supermarket suppliers UK.

These companies plan, produce, and deliver millions of products daily.

They connect farmers, manufacturers, and retailers in one of Europe’s most advanced supply systems.

Without them, even the biggest chains would struggle to keep stores stocked and customers loyal.

Here’s a closer look at who they are, how they operate, and what’s changing across the industry.

Major Supermarket Suppliers UK

The UK’s food manufacturing base is led by a few large suppliers with long-standing retail partnerships and national production networks.

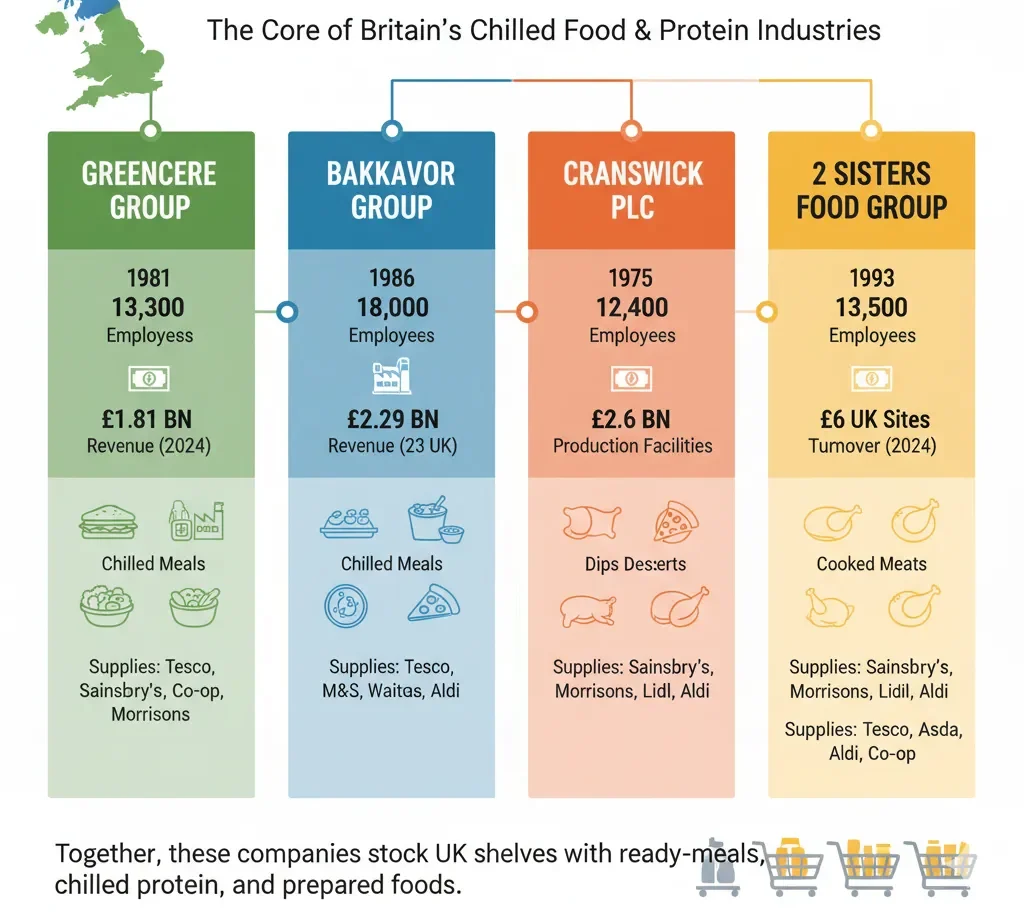

Among them, Greencore Group, Bakkavor Group, Cranswick plc, and 2 Sisters Food Group form the core of Britain’s chilled-food and protein industries.

Greencore, founded in 1981, employs around 13,300 people across 16 sites, producing sandwiches, salads, sushi, and ready meals for Tesco, Sainsbury’s, Co-op, and Morrisons.

In the financial year ending September 2024, it reported £1.81 billion in revenue.

Bakkavor, established in 1986, operates 43 sites globally (including 23 in the UK) and employs about 18,000 staff.

With £2.29 billion in 2024 revenue, it supplies chilled meals, dips, desserts, and pizzas to Tesco, M&S, Waitrose, and Aldi.

Cranswick, founded in 1975, runs 23 production facilities and employs over 12,400 people.

It reported £2.6 billion in revenue for the year ending March 2024, supplying pork, poultry, and cooked meats to Sainsbury’s, Morrisons, Lidl, and Aldi.

Finally, 2 Sisters Food Group — established in 1993 and employing roughly 13,500 people across 16 UK sites — recorded £3.05 billion turnover for the year ending July 2024.

It remains one of Britain’s largest poultry processors and a key supplier to Tesco, Asda, Aldi, and Co-op.

Together, these four companies account for much of the ready-meal, chilled-protein, and prepared-food capacity that keeps supermarket shelves stocked year-round.

Greencore: The Chilled-Food Powerhouse

Greencore Group plc began in Ireland in 1981 as a sugar producer.

Over time, it transformed into a leader in chilled convenience foods, supplying sandwiches, salads, sushi, and ready meals for most of the UK’s major supermarket chains.

The company now runs 16 manufacturing sites across England and Wales and employs about 13,000 people.

In its financial year ending September 2024, Greencore reported revenue of £1.81 billion.

Its strength lies in close retailer partnerships and advanced forecasting systems.

By using digital planning and predictive analytics, the company aligns production with supermarket demand, minimising waste and stock issues.

Over the past five years, Greencore has cut food waste by more than 30 percent and invested heavily in automation across its Northampton, Kiveton, and Manton Wood hubs.

These sites supply major clients including Tesco, Sainsbury’s, Co-op, and Morrisons, making Greencore a core pillar of the UK’s chilled-food ecosystem.

Bakkavor: From Lincolnshire To Global Reach

Founded in 1986 by Icelandic brothers Agust and Lydur Gudmundsson, Bakkavor Group started small — producing fresh dips and salads for UK grocers.

Today, it operates 43 sites worldwide, including 23 in Britain, and employs around 18,000 people.

Bakkavor’s growth mirrors the rise of private-label convenience foods in the UK.

It supplies ready meals, bakery products, desserts, and dips to retailers such as Tesco, M&S, Waitrose, and Aldi.

In 2024, its reported revenue reached £2.29 billion, according to its annual report.

Recent years have seen Bakkavor invest in automation, energy efficiency, and sustainable packaging.

Solar installations now power several factories, while lightweight trays and recyclable materials reduce its environmental footprint.

The company’s strength lies in its ability to innovate quickly — launching new recipes and formats to match consumer tastes for fresh, convenient meals.

Cranswick: British Meat, Locally Sourced

Yorkshire-based Cranswick plc started in 1975 as a small pig-feed collective.

It later expanded into pork and poultry production, evolving into one of Britain’s leading meat processors.

Today, Cranswick operates 23 production facilities across the UK and employs around 12,400 people.

For the year ending March 2024, it reported £2.6 billion in revenue.

Cranswick’s strategy is based on British sourcing, animal welfare, and sustainable production.

The company supplies pork, poultry, cooked meats, and snacking products to retailers such as Sainsbury’s, Morrisons, Lidl, and Aldi.

Its investments include renewable energy systems, packaging made from recycled materials, and a commitment to full supply-chain traceability.

Cranswick has become a symbol of British meat manufacturing — combining local farming partnerships with industrial-scale production while maintaining transparency and welfare standards.

2 Sisters Food Group: Scale And Scope

Founded by Ranjit Singh Boparan in 1993, 2 Sisters Food Group has grown into one of the UK’s largest privately owned food companies.

Through acquisitions, including the well-known Northern Foods portfolio, it built a presence across poultry, bakery, and ready meals.

The company employs around 13,500 people, operates 16 UK manufacturing sites, and achieved £3.05 billion in turnover for the year ending July 2024.

2 Sisters supplies poultry and convenience foods to Tesco, Asda, Aldi, and Co-op.

It produces about 10 million chickens each week, working closely with local farmers nationwide.

Recent investments in automation and energy recovery have strengthened efficiency while reducing emissions.

The company’s scale makes it essential to UK food security — providing a steady supply of fresh protein to major retailers throughout the year.

Fresh Produce Suppliers And Importers

Beyond manufacturing, supermarket suppliers UK depend heavily on fruit and vegetable producers.

Fresh produce is one of the most complex parts of the food chain, requiring speed, storage precision, and seasonal flexibility.

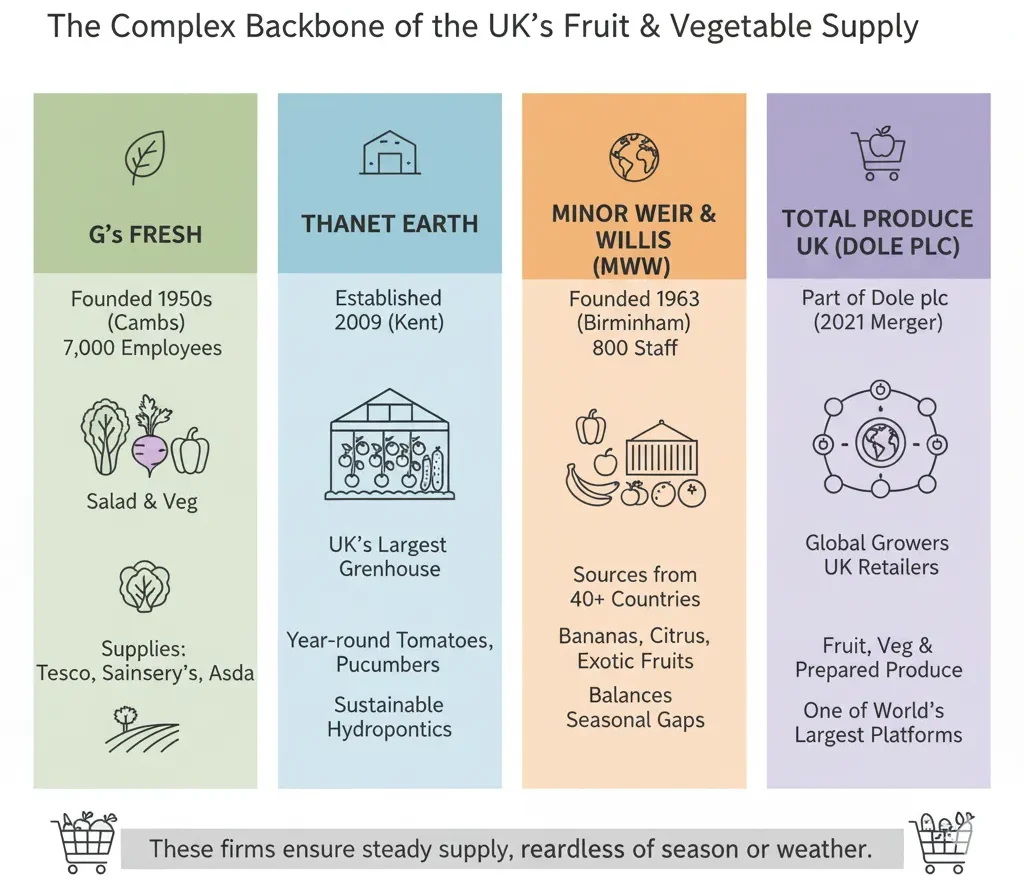

G’s Fresh

Founded in the 1950s in Cambridgeshire, G’s Fresh has become one of Europe’s largest salad and vegetable growers.

It employs around 7,000 people across the UK and Europe and supplies lettuce, celery, beetroot, and onions to Tesco, Sainsbury’s, and Asda.

The company focuses on vertical integration — controlling growing, harvesting, and packaging to ensure consistency and freshness.

Thanet Earth

Based in Kent since 2009, Thanet Earth is the UK’s largest greenhouse complex, producing tomatoes, peppers, and cucumbers year-round.

Its operations use hydroponic systems, recycled heat, and low-energy lighting, helping reduce import dependence during winter months.

Thanet Earth has become a key symbol of sustainable British horticulture.

Minor Weir & Willis

Founded in Birmingham in 1963, Minor Weir & Willis (MWW) is a major fruit and vegetable importer and distributor.

It sources produce from over 40 countries, employs around 800 staff, and supplies national supermarkets with bananas, citrus, and exotic fruits.

The company plays a vital role in balancing seasonal gaps between UK harvests and overseas crops.

Total Produce UK (Dole plc)

Total Produce UK, part of Dole plc, connects global growers to British retailers.

It manages a wide distribution network across the country, importing fruit, vegetables, and prepared produce for major chains.

Following the 2021 merger with Dole, the group now operates under one of the largest fresh-produce supply platforms in the world.

These firms collectively underpin the UK’s fruit and vegetable availability — ensuring steady supply regardless of season or weather.

Private Label Manufacturing Partners

Private label products account for nearly half of all grocery sales in the UK, and their success relies on a dedicated network of manufacturing partners.

These suppliers develop and produce supermarket-owned ranges across every food category.

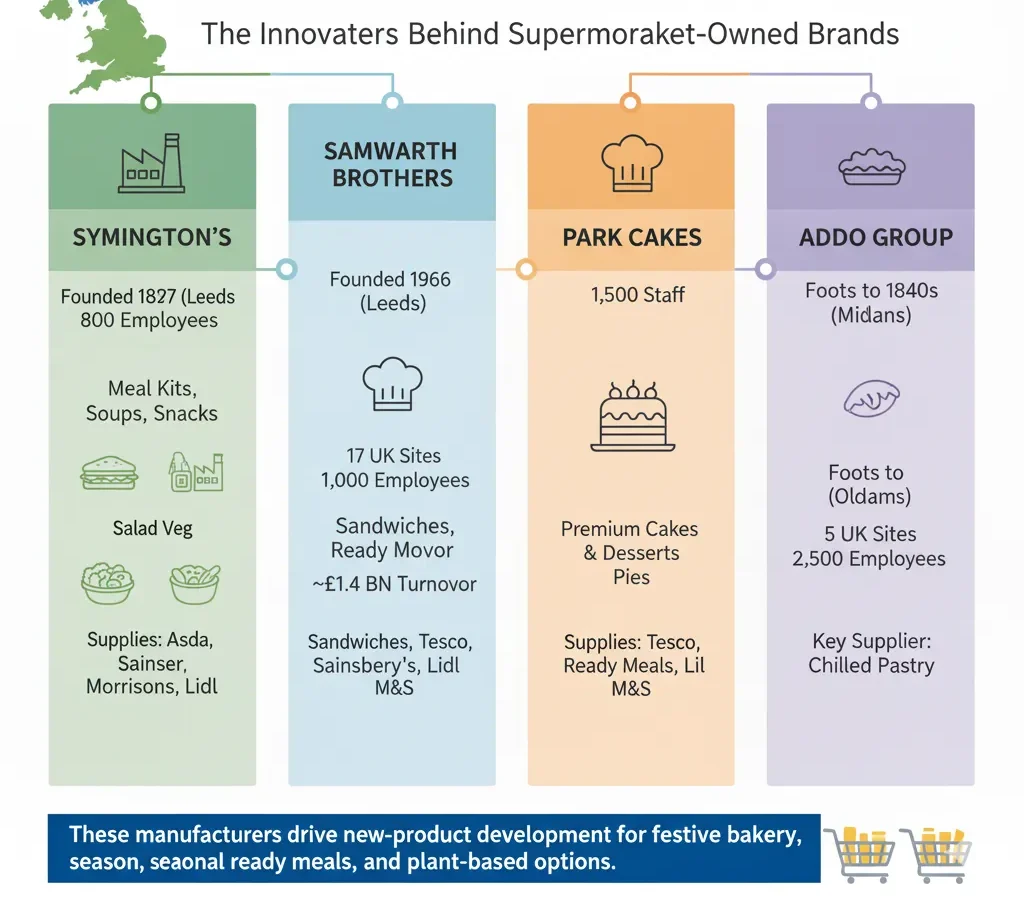

Symington’s

Based in Leeds and dating back to 1827, Symington’s manufactures meal kits, soups, and snacks for retailers such as Asda, Morrisons, and Lidl.

It employs around 800 people and remains known for its innovation in dry and ambient meals.

Samworth Brothers

Samworth Brothers, a family-owned business established in 1896, operates 17 UK sites and employs around 10,000 people.

With annual turnover close to £1.4 billion, it produces sandwiches, ready meals, and pies for Tesco, Sainsbury’s, and M&S.

The company continues to invest in automation and new product development within its chilled-food facilities.

Park Cakes

Operating from Oldham since 1937, Park Cakes produces premium cakes and desserts for M&S and Aldi.

It employs about 1,500 staff and is known for its consistent quality in bakery products that underpin many supermarket seasonal ranges.

Addo Food Group

Based in the Midlands, Addo Food Group traces its roots back to the 1840s.

It produces pastries and snack brands such as Wall’s and Pork Farms and employs about 2,500 people across five UK sites.

The company is a core supplier for chilled pastry and savoury snacks.

These manufacturers drive much of the supermarket sector’s new-product development — creating festive bakery items, seasonal ready meals, and plant-based options that define retail trends.

Logistics and Distribution Partners

After manufacturing comes the challenge of moving food efficiently.

The UK’s cold-chain logistics sector ensures that perishable goods reach stores safely and on time.

This part of the supply network includes transport, warehousing, and temperature-controlled systems managed by national operators.

Wincanton plc

Established in 1925, Wincanton plc is one of the UK’s oldest logistics providers.

It employs around 20,000 people across more than 200 sites and records revenue of approximately £1.5 billion.

Wincanton handles chilled and ambient distribution for Sainsbury’s, Waitrose, and Asda, using advanced route optimisation and warehouse automation.

Culina Group

Founded in 1994, Culina Group has grown into a major European logistics player with around 22,000 employees and over 100 depots.

It provides chilled transport and warehousing for Tesco, Aldi, and Co-op, specialising in food-sector logistics and just-in-time deliveries.

GXO (NFT Distribution)

GXO Logistics, which acquired NFT Distribution, operates key depots in Daventry, Tamworth, and London.

It focuses on chilled and frozen goods and uses automated warehouse management and AI-based forecasting to improve delivery accuracy.

These companies collectively sustain the UK’s cold chain — one of the most reliable in Europe — keeping products safe, fresh, and traceable from factory to store.

The Wider Supply Ecosystem

Beyond the visible brands and hauliers, supermarket suppliers UK rely on a broader ecosystem of partners that make modern food retail possible.

Packaging companies such as DS Smith, Graphic Packaging International, and Berry Global provide recyclable and lightweight packaging solutions.

Cold storage specialists like Lineage Logistics and Magnavale manage vast freezer and ambient warehouses nationwide.

Ingredient producers including Kerry Group and Tate & Lyle supply flavour systems, starches, and nutritional components used across categories.

Technology firms bring in robotics, data tracking, and IoT monitoring tools that support efficiency and compliance.

This combined ecosystem represents thousands of smaller suppliers feeding into the major supermarket chains.

Trends Shaping The UK Supermarket Supply System

Automation and Robotics

Automation has become essential across food manufacturing and logistics.

From robotic packing arms to AI-driven demand forecasting, suppliers are using technology to speed up production, cut waste, and improve quality consistency.

Sustainability

Nearly every leading supplier has set targets for net-zero operations between 2030 and 2040, reflecting the wider retail commitments outlined in our supermarket sustainability strategy.

Renewable energy use, electric fleets, and recyclable packaging have become industry standards.

Investments in solar power, heat recovery, and food-waste reduction continue to expand.

Domestic Sourcing

Retailers increasingly prefer British-grown and produced goods.

This trend helps reduce transport emissions and strengthens local economies.

Meat, dairy, and fresh-produce suppliers that can guarantee UK origin have become central to procurement strategies.

Data and Transparency

Modern supply chains depend on data sharing.

Systems such as GS1 barcoding, blockchain, and digital traceability platforms allow instant recall management and transparency from farm to shelf.

Workforce Development

Food manufacturing employs around 400,000 people in the UK, making it one of the country’s largest private sectors.

Training initiatives now focus on engineering, food science, and automation — skills that are increasingly critical to factory efficiency.

Why It Matters

Understanding supermarket suppliers UK reveals how the country’s food system stays reliable and sustainable.

For retailers, these suppliers provide continuity, innovation, and resilience in an unpredictable market.

For manufacturers, partnerships with supermarkets ensure long-term contracts and stable investment.

And for consumers, this network guarantees choice, freshness, and affordability — even under economic pressure.

The Future Of UK Supermarket Supply

The story of supermarket suppliers UK is one of continuous adaptation.

Automation will expand further, reducing manual handling and improving safety.

Sustainability will remain central to strategy, influencing packaging, sourcing, and logistics design.

Domestic sourcing is likely to grow in importance as carbon reduction and food security dominate national policy.

As eating habits evolve — from convenience foods to plant-based meals — these suppliers will continue to lead the transformation.

They’ve survived recessions, pandemics, and global supply disruptions.

Their ability to innovate while maintaining everyday reliability defines the strength of the UK grocery sector.

Supermarket suppliers UK are not just the factories and trucks behind the scenes — they are the reason Britain’s food system runs on time, every day.

Note: All data in this report were verified using official company filings (FY2024–FY2025 results), investor reports, and publicly available corporate updates from Greencore Group, Bakkavor Group, Cranswick plc, 2 Sisters Food Group, G’s Fresh, Thanet Earth, Minor Weir & Willis, Total Produce (Dole), Wincanton, Culina Group, and GXO Logistics.

Figures have been cross-checked against 2025 results announcements and annual reports.