Germany has one of the most concentrated and disciplined grocery markets in Europe. Market power here is not just about size. It is shaped by buying structures, range control, private label strength, and how quickly retailers can execute decisions across thousands of stores.

This ranking looks at structural influence, not popularity or short-term performance. It reflects how much control each retailer has over suppliers, pricing dynamics, and category direction inside the German market.

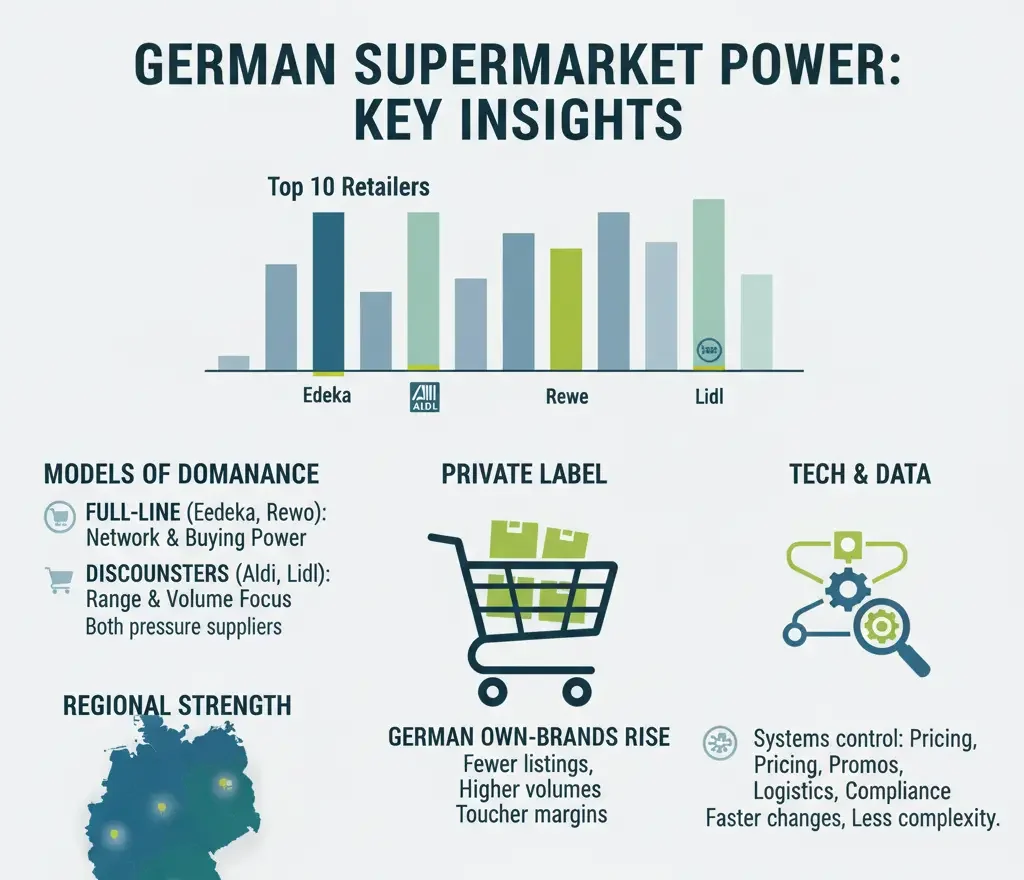

Top 10 Supermarkets in Germany

1. Edeka

Edeka ranks first by market power due to its unmatched national reach and cooperative structure. Central buying gives the group strong leverage over pricing, private label development, and supplier access, while regional operators control local execution.

For many suppliers, nationwide distribution in Germany is not realistic without Edeka listings.

Verified facts

-

Ownership: Cooperative retail group

-

Store presence: Nationwide (around 11,000 stores)

-

Main formats: Full-line supermarkets, neighbourhood stores

-

Market power driver: Central buying with regional dominance

2. Rewe Group

Rewe’s market power comes from operating across several retail formats at scale. The group controls supermarkets and discount stores, giving it influence across multiple supply channels.

Rewe plays a key role in fresh food and private label and remains a central decision-maker for suppliers.

Verified facts

-

Ownership: Retail group

-

Store presence: Nationwide (around 6,500–6,700 stores in Germany, including Penny)

-

Main formats: Supermarkets, discount

-

Market power driver: Multi-format control

3. Lidl (Schwarz Group)

Lidl’s influence is driven by highly centralised control over range, pricing, and supplier selection. Decisions are implemented quickly and consistently across the network.

Despite a limited assortment, Lidl’s scale gives it strong negotiating power.

Verified facts

-

Ownership: Schwarz Group

-

Store presence: Nationwide (around 3,200 stores)

-

Main formats: Discount

-

Market power driver: Central control and scale

4. Aldi Süd

Aldi Süd’s market power is based on strict range discipline and long-term supplier relationships. Volumes are concentrated on a very small number of SKUs, increasing leverage over pricing and specifications.

Verified facts

-

Ownership: Privately held

-

Store presence: Mainly southern and western Germany (around 1,900–2,000 stores)

-

Main formats: Discount

-

Market power driver: Limited assortment with concentrated volumes

5. Aldi Nord

Aldi Nord operates independently from Aldi Süd and holds a strong position in northern Germany. While its structure differs slightly, its scale still delivers significant supplier influence.

Verified facts

-

Ownership: Privately held

-

Store presence: Mainly northern Germany (around 2,200 stores)

-

Main formats: Discount

-

Market power driver: Scale within a limited-assortment model

6. Kaufland (Schwarz Group)

Kaufland combines hypermarket scale with discount-style pricing logic. Its large-format stores give it strong local dominance, particularly in bulk food and non-food categories.

Verified facts

-

Ownership: Schwarz Group

-

Store presence: Nationwide (around 770 stores)

-

Main formats: Hypermarket

-

Market power driver: Large-format buying power

7. Netto Marken-Discount

Netto benefits from being part of the Edeka Group, strengthening its sourcing position. However, it operates mainly as a value-focused discount chain rather than a strategic market leader.

Verified facts

-

Ownership: Edeka Group

-

Store presence: Nationwide (around 4,300 stores)

-

Main formats: Discount

-

Market power driver: Group-backed sourcing

8. Penny (Rewe Group)

Penny plays a supporting role within the Rewe Group. While it has national coverage, it does not lead pricing or category strategy in the German market.

Verified facts

-

Ownership: Rewe Group

-

Store presence: Nationwide (around 2,100 stores)

-

Main formats: Discount

-

Market power driver: Group-supported distribution

9. Globus

Globus is a family-owned retailer with strong regional loyalty and high operational standards. Its influence is concentrated in specific regions rather than nationwide.

Verified facts

-

Ownership: Family-owned

-

Store presence: Regional (around 60–65 stores)

-

Main formats: Hypermarket

-

Market power driver: Regional strength

10. Norma

Norma operates a strict discount model with a smaller footprint than major national players. Its influence is mainly local, particularly in parts of southern Germany.

Verified facts

-

Ownership: Privately held

-

Store presence: Regional to national (around 1,400–1,500 stores)

-

Main formats: Discount

-

Market power driver: Localised discount scale

What This Ranking Reveals About German Supermarkets

The top ten shows a clear pattern. Market power in Germany is not evenly distributed, and it does not follow a single model.

Full-line retailers like Edeka and Rewe dominate through network reach and buying structures, while discounters such as Aldi and Lidl exert power through range discipline and volume concentration. Both models are effective, but they pressure suppliers in very different ways.

One of the strongest outcomes of this structure is the dominance of Germany private label. Retailers with tight assortments and central buying are able to move volume quickly into own-brand lines, often at the expense of secondary branded SKUs. For suppliers, this means fewer listings, higher volumes per product, and tougher margin negotiations.

At the same time, power is increasingly shaped by how retailers use systems and data. Investment in Germany retail tech is allowing leading groups to control pricing, promotions, logistics, and supplier compliance more tightly than before. Retailers with strong digital infrastructure can execute changes faster, reduce complexity, and enforce standards across their networks.

Another key insight is that regional strength still matters. Chains like Globus and Norma may lack national scale, but their regional dominance gives them local leverage that suppliers cannot ignore.

Overall, Germany remains one of the most demanding supermarket markets in Europe. Retailers reward efficiency, scale, and reliability — and penalise complexity and weak execution.

What This Means for Suppliers Entering Germany

For suppliers, this ranking underlines a hard reality. Access to Germany supermarkets is controlled by a small number of buying desks with very different expectations. There is no single route to market.

Full-line retailers expect range discipline, consistent supply, and long-term collaboration. Discounters expect extreme efficiency, cost transparency, and the ability to scale quickly. In both cases, flexibility is limited once terms are set.

Suppliers that succeed in Germany tend to simplify. They reduce SKU counts, standardise packaging, and focus on a narrow set of customers rather than chasing broad distribution. Those that try to serve every retailer in the same way often struggle to maintain margins.

Germany is not a market that rewards experimentation at scale. It rewards precision.

Why Market Power in Germany Is Unlikely to Change Quickly

Despite cost pressure, regulation, and shifting consumer behaviour, the balance of power in Germany supermarkets is relatively stable. The leading groups benefit from scale, logistics depth, and long-established supplier relationships that are difficult to replicate.

New entrants face high barriers. Store networks are dense, price expectations are low, and shoppers are highly disciplined. Even digital channels have reinforced existing power structures rather than disrupting them.

As a result, change in Germany tends to be incremental rather than dramatic. Market power shifts slowly, through format evolution, private label expansion, and operational efficiency — not sudden competitive shocks.

For suppliers and partners, this makes Germany predictable, but demanding. Success comes from understanding the structure, not trying to fight it.

Conclusion

Germany remains the most structurally disciplined grocery market in Europe. Power is concentrated, buying is centralised, and execution is fast. The result is a retail environment where scale and control matter more than brand visibility.

For suppliers, understanding German FMCG dynamics is essential. Access is shaped by a small number of powerful buying organisations that prioritise efficiency, cost clarity, and operational reliability. Distribution is not fragmented — it is structured and tightly managed.

At the same time, the strength of German private label continues to define competitive pressure inside stores. Discounters and full-line retailers alike use own-brand strategy to protect margins, control pricing architecture, and reduce supplier complexity. Private label is not an add-on in Germany. It is a core strategic lever.

This structure is unlikely to shift quickly. The leading groups benefit from long-standing logistics depth, strong digital systems, and entrenched supplier relationships. Market entry barriers remain high, and pricing expectations remain disciplined.

Germany rewards suppliers that simplify, scale, and execute precisely. It does not reward those who rely on broad distribution without structural alignment.

For companies operating in this market — or planning to enter — the lesson is clear: success comes from understanding concentration, respecting buying power, and aligning closely with retailer strategy rather than challenging it.

Editor’s Note

Store counts are based on company disclosures and trade reporting and are stated as approximate, as store networks change regularly. This ranking is based on ownership structures, store networks, and observed market influence.