Greece’s FMCG market in 2026 reflects a structural shift that has been building for several years. Inflation pressure has eased compared to the 2022–2023 peak, but price sensitivity remains high. Private label continues to expand. At the same time, tourism-driven demand is reshaping seasonal sales patterns, especially in beverages and impulse categories.

Against this background, supplier power is increasingly defined by three factors: category dependency, operational scale inside Greece, and export-driven growth strategies. This ranking reflects those realities, combining reported Greece turnover where available with verified local operating performance and in-store category dominance.

Where brands do not publish Greece-only revenue, market presence and subsidiary performance have been used as structured proxies.

Top 10 FMCG Brands in Greece — Revenue and Category Position

| Rank | Brand | Revenue reference (latest available) | Core category strength | Origin |

|---|---|---|---|---|

| 1 | Coca-Cola HBC (Coca-Cola portfolio) | Estimated Greece retail turnover range €450m–€600m (FY2024 operational range) | Soft drinks, water, RTD beverages | Multinational |

| 2 | Athenian Brewery | Approx. €500m sales (FY2024) | Beer, alcoholic beverages | Multinational |

| 3 | Nestlé | Greece revenue not separately disclosed | Coffee, confectionery, food, petcare | Multinational |

| 4 | Unilever | Greece revenue not separately disclosed | Home care, personal care, foods | Multinational |

| 5 | PepsiCo (PepsiCo Hellas) | €234m turnover (FY2023) | Snacks, soft drinks | Multinational |

| 6 | E.J. Papadopoulos | €233.8m sales (FY2023) | Biscuits, bakery snacks | Greek |

| 7 | Kri-Kri | €207.5m turnover (9M 2024) | Yogurt, ice cream | Greek |

| 8 | Procter & Gamble | Greece revenue not separately disclosed | Laundry, baby care, grooming | Multinational |

| 9 | Sarantis Group | €170.6m Greece sales (FY2024) | Home care, personal care | Greek |

| 10 | Papoutsanis | €79.9m turnover (FY2025) | Personal care, private label | Greek |

1. Coca-Cola HBC (Coca-Cola portfolio)

Founded: Coca-Cola bottling operations in Greece expanded in the late 1960s

Parent group: Coca-Cola HBC

Core categories

Carbonated soft drinks

Bottled water

Energy drinks

Ready-to-drink coffee and tea

Market position

Coca-Cola remains the most structurally dominant FMCG supplier in Greece. While Coca-Cola HBC reports multi-billion euro revenue figures at segment level, the Greece-only retail and foodservice turnover is estimated in the €450 million to €600 million range. Even at this level, no other branded supplier matches Coca-Cola’s combination of volume, shelf presence and cold-chain coverage.

Operational relevance

The company’s direct distribution network, cooler infrastructure and national merchandising footprint shape promotional execution across supermarkets, convenience stores and tourist zones.

Strategic direction

Portfolio expansion into zero-sugar formats, energy drinks and premium hydration products continues to drive incremental shelf space while defending core cola volumes.

2. Athenian Brewery (Heineken Group)

Founded: 1963

Parent group: Heineken

Core categories

Beer

Alcoholic beverages

Retail and on-trade formats

Market position

Athenian Brewery delivered one of the strongest FMCG performances in Greece during 2024 and 2025. Turnover approaching €500 million was supported by record tourism volumes and extended summer demand. The company controls the country’s most valuable beer portfolio.

Operational relevance

Beer is highly seasonal in Greece. Retailers depend on Athenian Brewery for volume stability, promotional execution and category traffic during peak months.

Strategic direction

Investment continues in premium brands, low-alcohol variants and sustainability upgrades across production sites.

3. Nestlé

Founded: 1866

Parent group: Nestlé Group

Core categories

Coffee and beverages

Confectionery

Culinary products

Pet food

Infant nutrition

Market position

Nestlé Hellas remains one of the largest FMCG operators in Greece, even though standalone revenue is not disclosed. Its presence in coffee, confectionery and petcare makes it a multi-category anchor supplier.

Operational relevance

Coffee remains one of Greece’s most habitual consumption categories. Nestlé’s brand portfolio ensures constant shelf rotation and high promotional activity.

Strategic direction

Growth continues to focus on premium coffee systems, functional nutrition and packaging sustainability initiatives.

4. Unilever

Founded: 1929

Parent group: Unilever PLC

Core categories

Laundry and cleaning products

Personal care

Packaged foods

Market position

Unilever remains one of the strongest household suppliers in Greece. The company’s brands dominate detergent and personal care shelves and maintain strong consumer loyalty.

Operational relevance

Household care categories generate frequent repeat purchases. Unilever’s scale influences shelf allocation and promotional mechanics across the country’s largest supermarket groups.

Strategic direction

Portfolio rationalisation and increased focus on higher-margin personal care segments continue to reshape the company’s local mix.

5. PepsiCo (PepsiCo Hellas)

Founded: Local operations expanded in the 1990s

Parent group: PepsiCo

Core categories

Salty snacks

Carbonated beverages

Ready-to-drink formats

Market position

With €234 million in reported turnover, PepsiCo Hellas is the clear leader in salty snacks. Its snack portfolio delivers strong impulse sales and consistent margin performance for retailers.

Operational relevance

Secondary displays, seasonal promotions and impulse placement strategies are heavily influenced by PepsiCo’s activity.

Strategic direction

Local production investment and healthier product reformulation continue to strengthen long-term competitiveness.

6. E.J. Papadopoulos

Founded: 1922

Ownership: Greek family-owned

Core categories

Biscuits

Bakery snacks

Breakfast products

Market position

Papadopoulos remains the strongest Greek-owned branded food company. With sales close to €234 million, it dominates the biscuit category and holds strong national brand loyalty.

Operational relevance

Retailers use Papadopoulos as a domestic counterbalance to multinational suppliers while maintaining strong category performance.

Strategic direction

Export expansion and health-focused product innovation remain long-term priorities.

7. Kri-Kri Milk Industry

Founded: 1954

Ownership: Greek public company

Core categories

Yogurt

Ice cream

Dairy desserts

Market position

Kri-Kri has become one of Greece’s fastest-growing FMCG exporters. Turnover growth of more than 25% in 2025 strengthened its international position, with exports now representing close to 70% of yogurt sales.

Operational relevance

Kri-Kri supports retailer local sourcing strategies while reinforcing premium dairy positioning.

Strategic direction

Capacity expansion and branded export development remain central to growth planning.

8. Procter & Gamble

Founded: 1837

Parent group: Procter & Gamble

Core categories

Laundry detergents

Baby care

Grooming

Feminine hygiene

Market position

P&G’s strength in Greece comes from category penetration rather than public revenue disclosure. Brands such as Ariel and Pampers remain essential basket drivers.

Operational relevance

Laundry and hygiene products generate high shopping frequency, giving P&G strong shelf leverage.

Strategic direction

Efficiency improvements and premium product extensions continue to shape portfolio strategy.

9. Sarantis Group

Founded: 1930

Ownership: Greek multinational group

Core categories

Home care

Personal care

Beauty products

Market position

Sarantis combines domestic leadership with strong regional expansion. Greece sales above €170 million reflect consistent shelf presence and growing export activity.

Operational relevance

Retailers often use Sarantis brands to balance multinational pricing power.

Strategic direction

Portfolio expansion and Southeast European consolidation remain growth drivers.

10. Papoutsanis

Founded: 1870

Ownership: Greek public company

Core categories

Soap and personal care

Private label manufacturing

Hotel amenities

Market position

Papoutsanis recorded €79.9 million turnover in 2025, representing more than 20% annual growth. Expansion has been driven by private label manufacturing and hospitality channel recovery.

Operational relevance

The company plays a growing role in domestic private label sourcing and contract manufacturing.

Strategic direction

Production capacity investment and export partnerships continue to accelerate.

Market Structure Impact

The Greek FMCG market remains moderately concentrated. Beverages and alcoholic drinks are dominated by two suppliers, while household care remains multinational-led. Food categories show stronger domestic brand representation.

This dual structure allows retailers to manage supplier negotiations by combining international scale with local sourcing strategies.

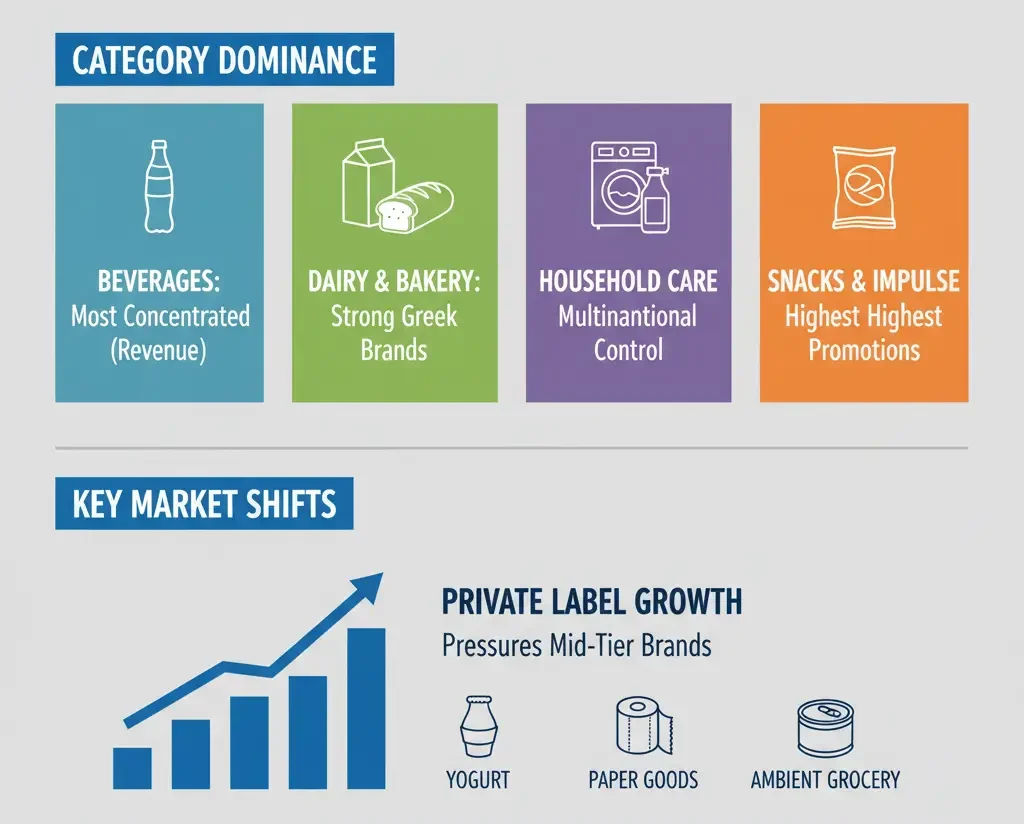

Category Dominance Trends

Several patterns now define shelf strategy:

Beverages remain the most concentrated category by revenue

Dairy and bakery maintain strong domestic brand leadership

Household care remains multinational-controlled

Snacks and impulse categories show the highest promotional intensity

Private label growth continues to pressure mid-tier branded suppliers, particularly in yogurt, paper goods and ambient grocery.

Industry Direction Outlook

Looking beyond 2026, three trends are likely to shape FMCG competition in Greece:

Continued premiumisation in beverages and coffee

Export-driven expansion by Greek producers

Increased retailer focus on margin protection through private label

Supply chain efficiency, packaging compliance and logistics optimisation are becoming central factors in supplier selection.

Conclusion

Greece’s FMCG market remains balanced between multinational scale and domestic brand strength. While global groups dominate beverages and household care, Greek producers increasingly control growth momentum in food and personal care.

As inflation stabilises, competition is shifting toward operational performance, category productivity and export capability rather than pure price leadership.

Editor’s Note: This article is based on publicly available company financial reports, investor disclosures and official corporate statements. Where Greece-only revenue was not published, local operating performance and market presence indicators were used. No currency conversions were applied.