Which FMCG brand has highest revenue in Denmark? As of early 2026, Arla Foods remains the clear market leader among Denmark-headquartered FMCG companies, followed by Carlsberg Group and Danish Crown. These three companies form the backbone of Denmark’s FMCG economy. Together, they control a large share of export value, supplier capacity, retail shelf influence, and category pricing power across Northern Europe.

This ranking is designed to give a clear picture of Denmark’s FMCG market power structure. It focuses on revenue scale, retail presence, export strength, supplier influence, and category leadership. The list includes well-known consumer brands as well as major “behind-the-shelf” producers whose products and ingredients quietly shape what shoppers see, buy, and pay for in supermarkets.

FMCG Brand Overview (Denmark Headquarters)

| Rank | Brand | Revenue (Latest Direction) | Employees | Global Presence |

|---|---|---|---|---|

| 1 | Arla Foods | €13.8 billion | 23,000+ | Operations in 35+ countries |

| 2 | Carlsberg Group | DKK 82+ billion | 37,000+ | Sales in 120+ markets |

| 3 | Danish Crown | DKK 65.4 billion | 23,000+ | Export to 130+ markets |

| 4 | Royal Unibrew | DKK 15.0 billion | 4,200+ | Strong Nordic and European footprint |

| 5 | Novonesis | €5.0+ billion target | 10,000+ | 40+ countries |

| 6 | Scandinavian Tobacco Group | DKK 9.7 billion | 9,300+ | Global regulated FMCG footprint |

| 7 | ESS-FOOD | DKK 6.1 billion | 140+ | International B2B trading network |

| 8 | Palsgaard | DKK 2.4 billion | 800+ | Production and offices in 20+ countries |

| 9 | Goodvalley | DKK 2.3 billion | 1,700+ | Integrated European meat operations |

| 10 | Toms Group | DKK 1.6 billion | 1,200+ | Nordic core with export markets |

Revenue Momentum and Category Influence

| Brand | Market Direction (2026) | Dominant Categories |

|---|---|---|

| Arla Foods | Stable growth, record farmer payouts | Dairy, butter, cheese, ingredients |

| Carlsberg Group | Expansion driven by beverage portfolio | Beer, soft drinks, RTD |

| Danish Crown | Restructuring for margin recovery | Fresh meat, processed foods |

| Royal Unibrew | Consistent organic growth | Beer, soft drinks |

| Novonesis | Post-merger expansion phase | Enzymes, cultures, biosolutions |

| Scandinavian Tobacco Group | Stable regulated revenues | Tobacco and cigars |

| ESS-FOOD | Export-driven turnover | Meat trading, foodservice supply |

| Palsgaard | Ingredient demand growth | Emulsifiers, stabilisers |

| Goodvalley | Vertical integration expansion | Protein production |

| Toms Group | Seasonal FMCG cycles | Chocolate, confectionery |

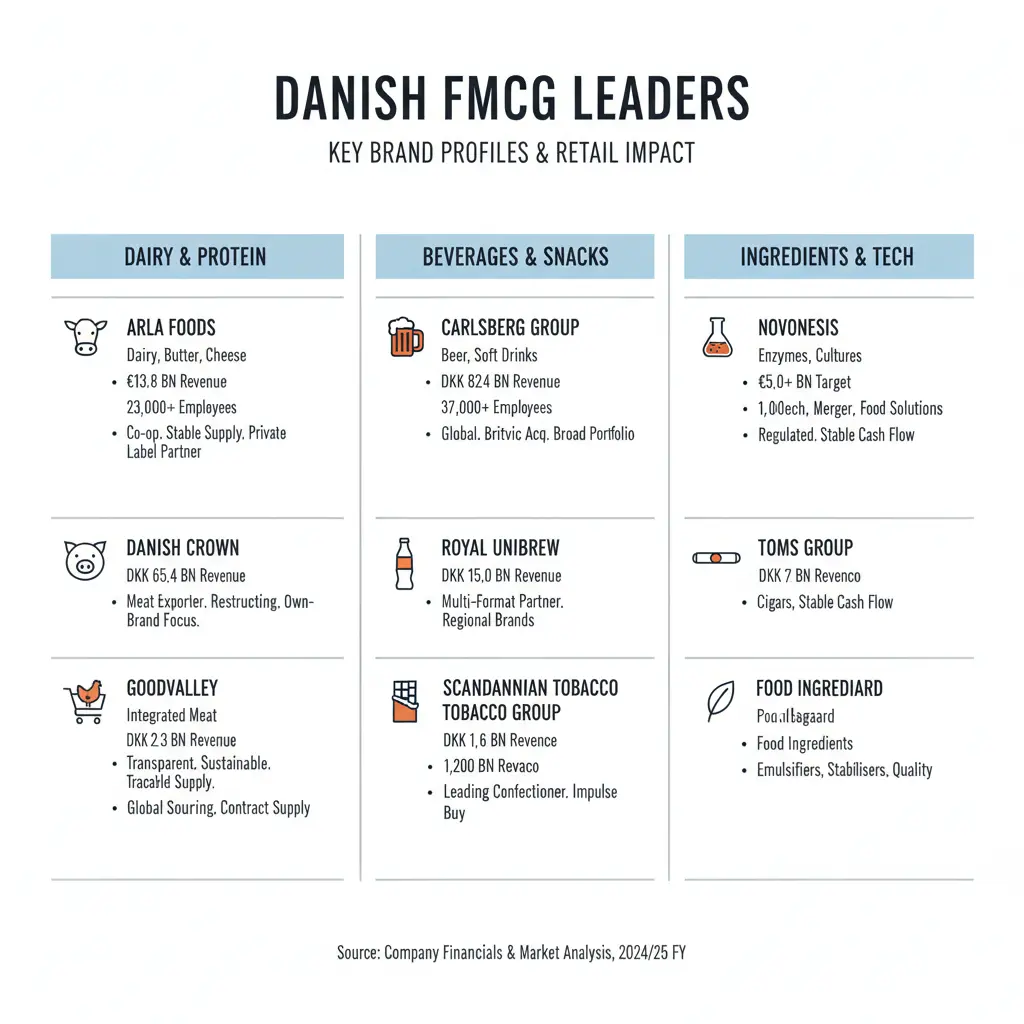

Brand Profiles

1) Arla Foods

Arla Foods remains Denmark’s largest FMCG company and the most influential supplier across Northern European retail dairy categories. Its cooperative structure gives it direct control over farm-level supply while maintaining strong processing, export, and brand infrastructure.

The 2024/25 financial year marked a milestone for Arla. The company delivered its highest-ever dividend payout to farmer-owners, strengthening supplier loyalty and reinforcing long-term milk supply stability. For retailers, this stability is critical. It supports long-term contracts, predictable pricing frameworks, and volume guarantees.

Arla’s scale also allows heavy investment in automation, packaging optimisation, energy efficiency, and sustainability reporting systems.

Revenue: €13.8 billion

Employees: 23,000+

Core categories: Dairy, butter, cheese, milk powders

Private label relevance

Arla is deeply involved in contract manufacturing for retailer own brands. Many European private label dairy ranges depend on Arla-operated production facilities, making the company a core partner behind supermarket shelves.

2) Carlsberg Group

Carlsberg is Denmark’s most globally visible FMCG exporter. While beer remains its foundation, the group’s profile changed significantly following the Britvic acquisition completed in 2025. This move strengthened Carlsberg’s non-alcoholic and soft drink portfolio, giving it broader leverage across supermarket beverage aisles.

By early 2026, group revenue has trended above DKK 82 billion, supported by price adjustments, premiumisation strategies, and strong performance in Asian markets.

Carlsberg’s retail importance goes beyond volume. Beverage suppliers shape promotional calendars, multipack strategies, cooler placement, and seasonal merchandising.

Revenue direction: DKK 82+ billion

Employees: 37,000+

Core categories: Beer, soft drinks, RTD beverages

Retail leverage

Carlsberg’s multi-category beverage reach allows retailers to consolidate suppliers while expanding assortment depth across alcoholic and non-alcoholic segments.

3) Danish Crown

Danish Crown remains Denmark’s largest protein supplier and one of Europe’s most powerful meat exporters. While revenue remains high at DKK 65.4 billion, the company is currently undergoing a strategic restructuring phase.

This includes reducing slaughter capacity in Denmark and shifting focus toward higher-margin processed and value-added products. The aim is to improve profitability while maintaining export competitiveness.

From a B2B perspective, Danish Crown is essential to retail protein supply chains. It influences packaging standards, traceability systems, animal welfare compliance, and price benchmarks across fresh and processed meat categories.

Revenue: DKK 65.4 billion

Employees: 23,000+

Core categories: Pork, beef, processed foods

Private label overlap

Retailers rely heavily on Danish Crown for own-brand meat ranges, particularly in chilled and ready-to-cook segments.

4) Royal Unibrew

Royal Unibrew operates as a flexible beverage supplier with strong regional brands and diversified product portfolios. Unlike Carlsberg’s global beer dominance, Royal Unibrew positions itself as a multi-format beverage partner for retailers.

This structure allows supermarkets to simplify supplier management while expanding beverage assortment coverage.

Revenue: DKK 15.0 billion

Employees: 4,200+

Core categories: Beer, soft drinks, regional beverages

Retail advantage

Retailers value Royal Unibrew’s ability to supply multiple beverage segments through one procurement relationship.

5) Novonesis

Novonesis represents one of Denmark’s most strategically important FMCG enablers. Formed through the merger of Novozymes and Chr. Hansen, the company operates at the core of food biotechnology.

While 2024 revenue stood near €3.8 billion, the company is now targeting €5.0+ billion annual revenue as post-merger synergies fully materialise. These synergies are driven by combined R&D platforms, expanded customer integration, and growing demand for fermentation-based solutions.

Novonesis products influence shelf life, texture, flavour stability, and ingredient efficiency across thousands of FMCG SKUs.

Revenue target: €5.0+ billion

Employees: 10,000+

Core categories: Enzymes, cultures, biosolutions

Supplier relevance

Private label manufacturers increasingly depend on biosolutions suppliers to meet cost targets while maintaining product quality.

6) Scandinavian Tobacco Group

Scandinavian Tobacco Group remains Denmark’s largest regulated FMCG operator. Tobacco products operate under strict regulatory frameworks, but the category still generates stable cash flows and structured retail partnerships.

Revenue has now moved closer to DKK 9.7 billion, reflecting steady category performance despite regulatory pressure.

Revenue: DKK 9.7 billion

Employees: 9,300+

Core categories: Cigars, tobacco products

Retail structure impact

Tobacco categories influence store compliance systems, licensing processes, and restricted merchandising zones.

7) ESS-FOOD

ESS-FOOD plays a specialised role within Denmark’s export-oriented FMCG supply ecosystem. The company focuses on sourcing, trading, and supplying protein products to retail and foodservice buyers across international markets.

Despite a relatively small workforce, ESS-FOOD manages high-volume international trade flows.

Revenue: DKK 6.1 billion

Employees: 140+

Core categories: Meat trading, contract supply

Private label relevance

ESS-FOOD supports custom retail programs and specification-based supply contracts.

8) Palsgaard

Palsgaard is a critical supplier to Denmark’s confectionery, bakery, dairy, and plant-based food industries. Its emulsifiers and stabilisers directly influence texture, shelf stability, and cost efficiency across FMCG products.

Revenue: DKK 2.4 billion

Employees: 800+

Core categories: Food ingredients

Retail connection

Ingredient suppliers like Palsgaard allow private label products to match branded quality while protecting margins.

9) Goodvalley

Goodvalley operates a vertically integrated protein production model. It controls farming, processing, and distribution operations under one supply chain structure. This approach aligns closely with retailer demands for transparency, sustainability documentation, and traceable sourcing.

Revenue: DKK 2.3 billion

Employees: 1,700+

Core categories: Integrated meat supply

Retail relevance

Vertically integrated suppliers reduce compliance risk and supply volatility for large supermarket groups.

10) Toms Group

Toms Group remains Denmark’s leading confectionery producer. Its portfolio is strongest in chocolate, liquorice, and seasonal gift products. While smaller in revenue scale compared to the top three, Toms remains strategically important for impulse-driven FMCG categories.

Revenue: DKK 1.6 billion

Employees: 1,200+

Core categories: Chocolate and confectionery

Private label pressure

Confectionery faces strong competition from retailer own brands, making innovation and brand positioning critical.

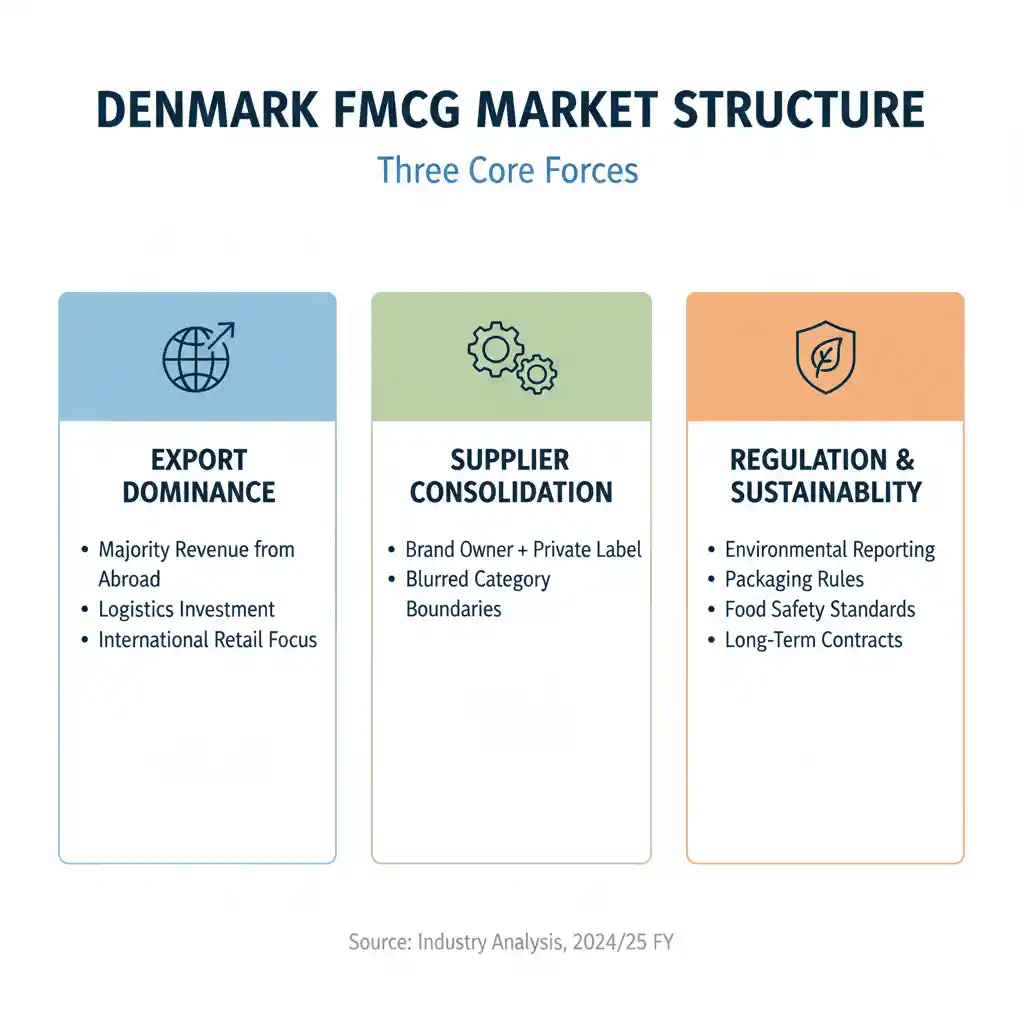

FMCG Market Structure in Denmark

Denmark’s FMCG sector is shaped by three core forces.

Export dominance

Most top FMCG companies generate the majority of revenue outside Denmark. This drives logistics investment and international retail partnerships.

Supplier consolidation

Large manufacturers increasingly operate as both brand owners and private label suppliers, blurring traditional category boundaries.

Regulation and sustainability pressure

Environmental reporting, packaging rules, and food safety standards influence supplier selection and long-term retail contracts.

Why This Ranking Matters For B2B Buyers

Retail buyers and sourcing managers use rankings like this to:

Identify long-term supply partners

Compare category leverage

Anticipate pricing pressure

Evaluate consolidation risks

Plan private label sourcing strategies

For manufacturers, the ranking highlights which competitors control shelf-critical categories.

Final Outlook

Denmark’s FMCG market remains highly concentrated. Arla, Carlsberg, and Danish Crown continue to dominate revenue and infrastructure. At the same time, ingredient and biosolution suppliers such as Novonesis and Palsgaard quietly shape how FMCG products are formulated and priced.

The balance between brand power and private label expansion will define the next phase of the Danish FMCG market.

For retailers, the challenge remains the same. Protect margins. Secure stable supply. And adapt to rising regulatory and sustainability demands.