Germany’s grocery market looks very mature from the outside.

But behind the shelves, a small group of big wholesale and logistics players do most of the heavy lifting.

When buyers think about the top FMCG distributors Germany depends on, five names keep coming back: Metro, Lekkerland, Transgourmet, Bartels-Langness (Bela), and CHEFS CULINAR.

They do not all serve the same channels.

Some focus on supermarkets and independents, others on petrol stations and foodservice.

Together, they form a backbone for German retailers, convenience operators, and out-of-home caterers.

Editor’s note: This blog uses information from company reports, trade media, and logistics case studies. Figures are rounded and based on the latest available public data. Always check direct company sources if you need exact numbers for tenders or contracts.

Top FMCG Distributors Germany: 2025 Leaders

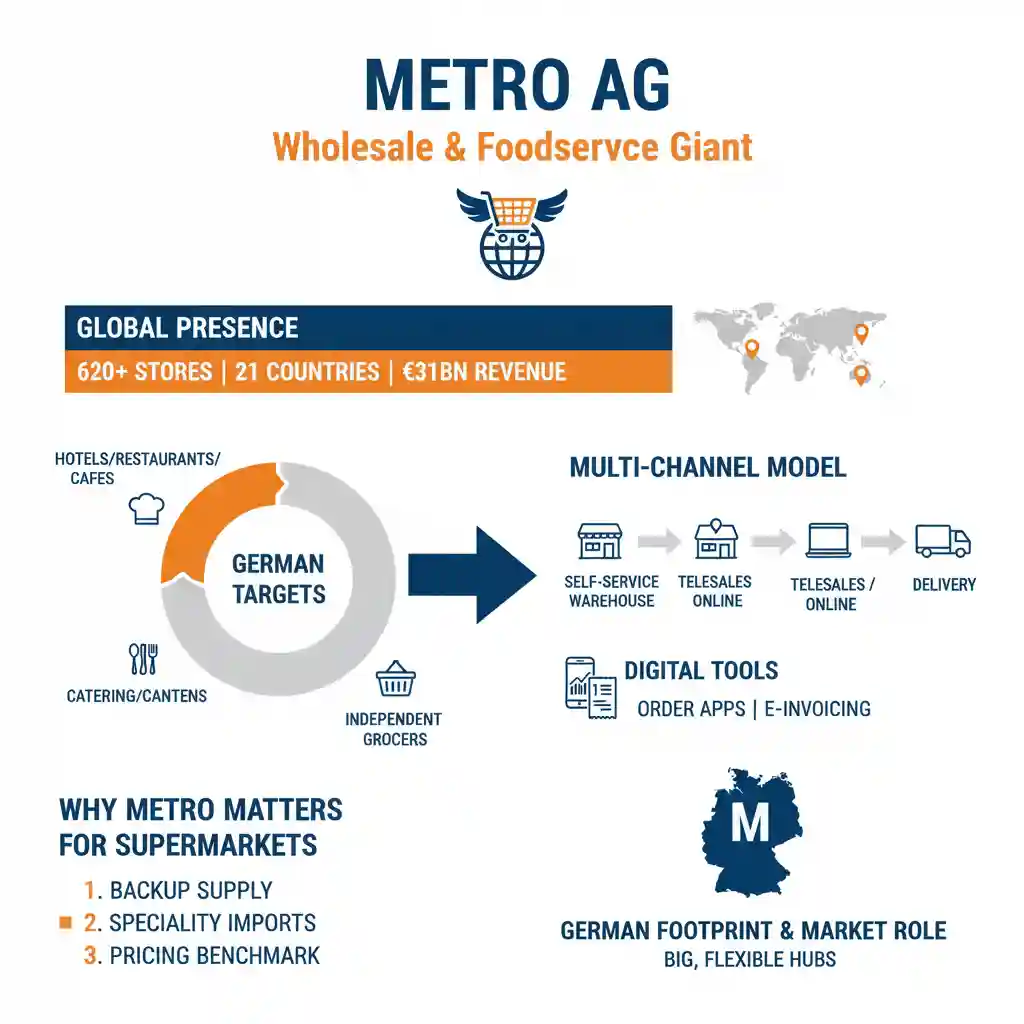

Metro: the national cash-and-carry and delivery giant

Metro AG is still the most visible wholesale brand in the market.

The group runs a network of cash-and-carry stores across Germany, combined with a strong delivery offer for professional customers. Globally, Metro operates more than 620 wholesale stores in 21 countries and generates around €31 billion in annual revenue, with wholesale and foodservice distribution at its core.

In Germany, Metro targets:

-

Hotels, restaurants, and cafés

-

Catering and canteen operators

-

Independent grocers and small supermarket formats

Metro’s model is now clearly multi-channel.

Customers can shop in self-service warehouses, order via telesales or online, and receive delivery to store or kitchen.

Digital tools, such as order apps and electronic invoicing, have become a standard part of the service, especially for HoReCa customers who need fast repeat orders and clear price visibility.

For supermarket buyers, Metro matters in three ways:

-

As a backup supply partner for independents and small chains.

-

As a route to specialist or imported lines that are hard to stock through traditional DCs.

-

As a benchmark for wholesale pricing and promotions in fresh, frozen, and non-food.

Metro’s German footprint also overlaps with topics you may already follow in German Grocery Market Share 2025, where discounters dominate in retail, but full-range wholesale still needs big, flexible hubs.

Lekkerland: REWE Group’s Convenience And On-The-Go Engine

Lekkerland is the specialist for “on-the-go” consumption and one of the key top FMCG distributors Germany relies on for convenience formats.

Since 2020 it has been part of REWE Group, giving the cooperative a powerful tool in petrol forecourt retail, kiosks, and small convenience stores.

According to REWE and company information:

-

Lekkerland supplies around 61,000 points of sale across Europe.

-

It employs roughly 5,700–5,800 people.

-

It generates over €9–15 billion in sales depending on how the wider group is counted.

Customers include:

-

Petrol station shops

-

Highway service areas

-

Kiosks and independent convenience stores

-

Charging parks and quick-service restaurants

Lekkerland’s offer is broader than just cigarettes and confectionery.

The company has pushed hard into hot drinks, chilled snacks, fresh bakery, and ready-to-eat food for drivers and commuters. It also provides category management, planograms, and digital ordering tools so that small outlets can behave like mini chains.

For grocery and FMCG buyers, Lekkerland is important in three ways:

-

It sets the standard for convenience distribution quality in Germany.

-

It gives REWE Group a direct lever in fuel-related retail, separate from classic supermarkets.

-

It can be a key route-to-market for brands that are more impulse-driven than “big trolley” grocery.

When you map Supermarket Suppliers Germany, Lekkerland sits at the border between retail and on-the-go catering – an increasingly strategic space.

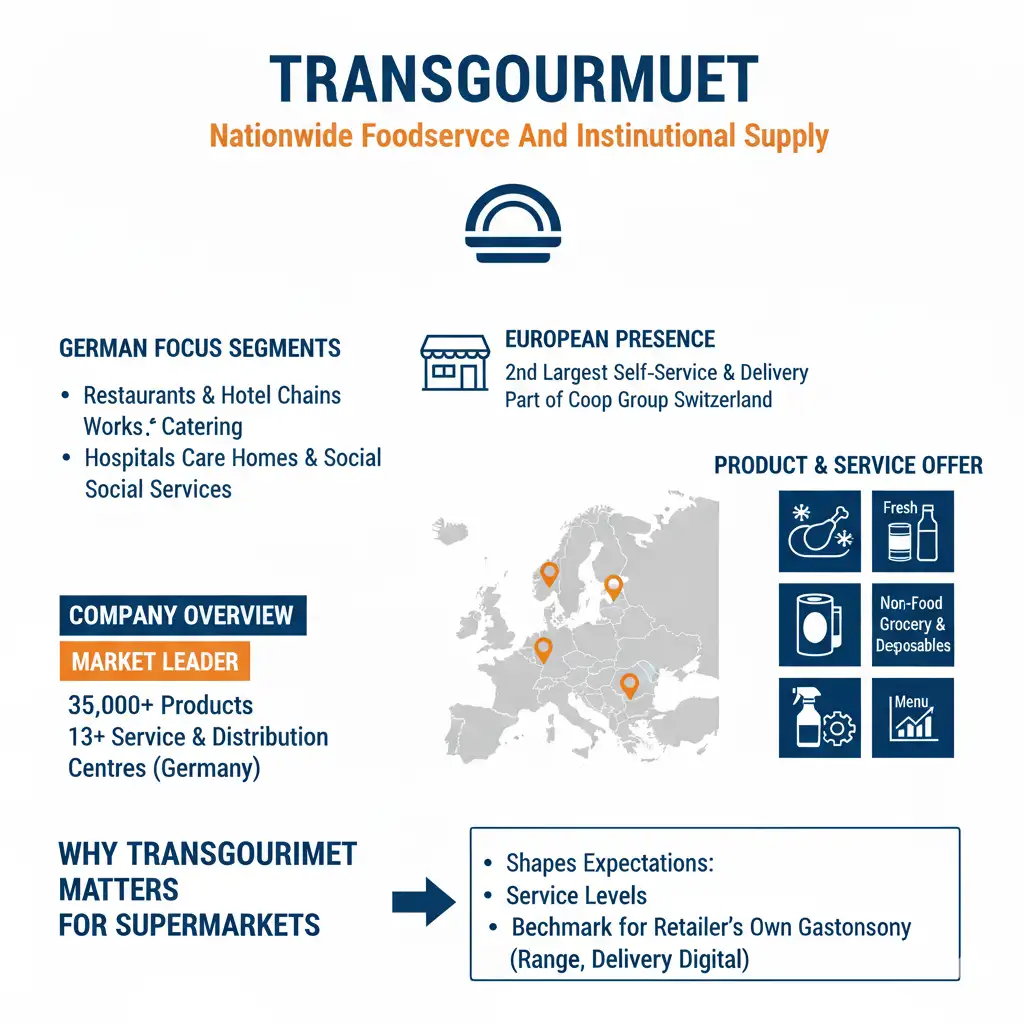

Transgourmet: Nationwide Foodservice And Institutional Supply

Transgourmet focuses on large out-of-home customers rather than classic retail.

In Germany it is one of the leading wholesalers for:

-

Restaurants and hotel chains

-

Works canteens and staff catering

-

Hospitals, care homes, and social service providers

Company information and logistics case studies describe Transgourmet as market leader in the wholesale supplies business to these segments, offering more than 35,000 products and delivering via around 13 service and distribution centres across Germany.

At European level, Transgourmet is seen as the second-largest self-service and wholesale delivery company, with operations in several countries and owned by Coop Group Switzerland.

The offer covers:

-

Fresh and frozen food

-

Ambient grocery and beverages

-

Non-food like cleaning products and disposables

-

Menu planning, nutrition tools, and cost control support

From a supermarket buyer’s point of view, Transgourmet matters because it shapes expectations around service levels and assortment depth in foodservice.

Retailers that run their own canteens, in-store gastronomy, or hospitality concepts frequently benchmark against Transgourmet’s range, delivery times, and digital tools.

Bartels-Langness (Bela): Regional Backbone For North Germany

Bartels-Langness, usually shortened to Bela, is both a wholesaler and a retailer.

The company is headquartered in northern Germany and is still owner-managed. It operates around 130 retail stores under the famila and Markant banners while also running a strong wholesale business supplying independent supermarkets and other customers.

Bela’s core activities include:

-

Food wholesale and retail

-

Bakery activities

-

Pet food specialism

-

Service to bulk consumers and institutional kitchens

Because of this mixed model, Bela is often described as one of the top 10 food retailers/wholesalers in Germany by market observers.

In practice, Bela’s role in the top FMCG distributors Germany landscape is to give regional retailers in the north a strong partner that:

-

Understands local tastes and seasonal patterns.

-

Can combine central warehousing with flexible regional logistics.

-

Offers private-label and branded ranges tuned to family-owned supermarkets.

For buyers working on Buyer Contacts Germany or regional sourcing strategies, Bela is often high on the list when they look for distribution partners north of the main metro areas.

CHEFS CULINAR: Full-Range Specialist For Professional kitchens

CHEFS CULINAR is another major foodservice-focused distributor with deep German roots.

The company has been supplying commercial kitchens in catering, hotel, and large-scale gastronomy for more than 90 years, offering around 25,000 items from fresh food and frozen products to non-food such as kitchen equipment and hygiene products.

Its logistics network includes around 15 distribution centres in six European countries and 18 branches with numerous logistics bases across Europe, ensuring daily temperature-controlled deliveries.

For the German market, CHEFS CULINAR positions itself as a one-stop shop for professional kitchens, adding:

-

Route-optimised logistics

-

Menu and business consulting

-

Kitchen-technology support

-

Quality and hygiene management services

This mix of product and service puts it in the same strategic bucket as Transgourmet, but with different strengths and regional focus.

If you manage sourcing for a retailer that also runs canteen services or in-store restaurants, CHEFS CULINAR is likely to appear in tenders or benchmarking.

Regional Wholesale Networks And Logistics Innovation

The top FMCG distributors Germany uses are not all national in the same way.

Their strength often depends on region, channel, and the type of customer.

National versus regional reach

-

Metro has broad national coverage through cash-and-carry branches and delivery hubs, with a footprint matched by very few competitors.

-

Transgourmet and CHEFS CULINAR both run nationwide foodservice networks, but their specific branch locations and historical strengths differ by federal state.

-

Lekkerland covers Germany and several neighbouring countries, but focuses on certain formats: petrol stations, kiosks, convenience, and quick-service. Its density near motorways and urban transport hubs is particularly important.

-

Bela is clearly more regional, with a strong base in northern Germany around Schleswig-Holstein and nearby areas, where it supports its own famila and Markant stores plus wholesale clients.

For buyers, this means the “best” partner depends on geography and channel.

A supermarket group with heavy presence in the north may lean more on Bela.

A national foodservice chain needs the combination of Transgourmet, Metro, or CHEFS CULINAR.

Petrol retail and travel hubs will almost always involve Lekkerland in tenders.

When you combine this with the market structure outlined in German Grocery Market Share 2025, you see how regional wholesaler strength often sits underneath national retail brands.

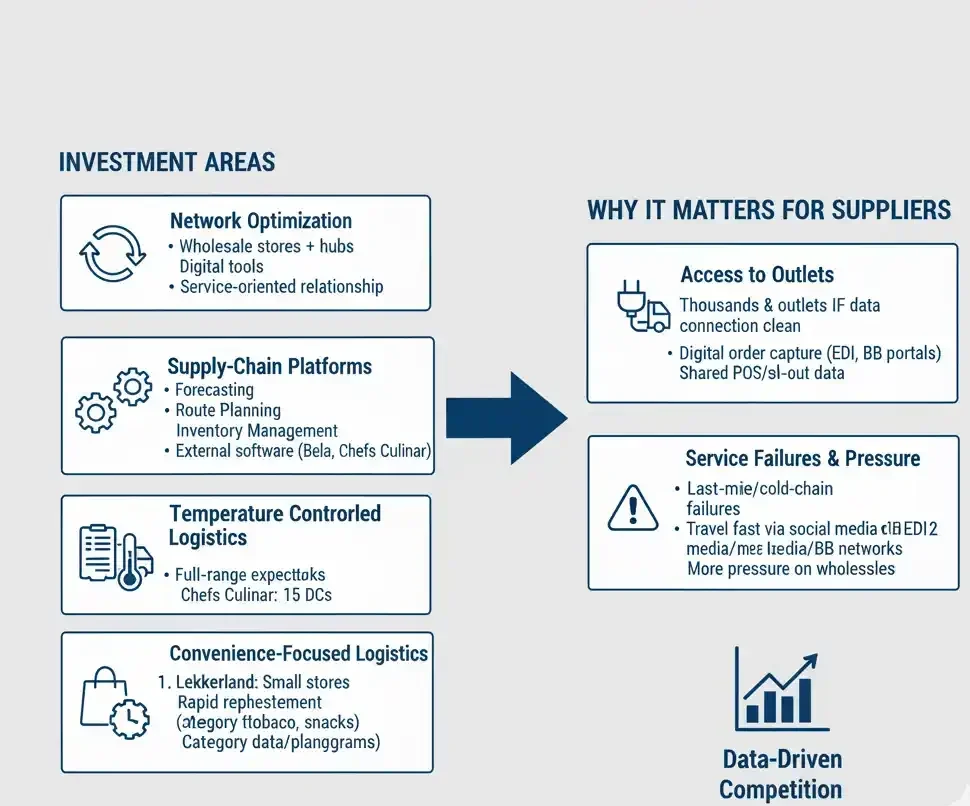

Logistics Innovation And Digitalisation

All of these distributors now compete as much on logistics and data as on price.

Recent updates and case studies show how they are investing in:

-

Network optimisation – Metro’s strategy highlights the role of its wholesale stores plus delivery hubs, supported by digital tools that move the relationship from purely transactional to service-oriented.

-

Supply-chain platforms – Bela and CHEFS CULINAR use external software providers to streamline forecasting, route planning, and inventory management across multi-temperature networks.

-

Temperature-controlled logistics – CHEFS CULINAR’s network of 15 distribution centres and multiple bases is built around tightly scheduled, multi-temperature deliveries, which is now an expectation for any full-range foodservice distributor.

-

Convenience-focused logistics – Lekkerland runs highly customised flows for small stores, from very rapid tobacco and confectionery replenishment to chilled snack and coffee solutions, often supported by category data and planograms.

For FMCG and private-label suppliers, this matters in a practical way:

-

Listing with one of the top FMCG distributors Germany counts on may give access to thousands of outlets, but only if the logistics and data connection is clean.

-

Digital order capture (EDI, B2B portals, apps) and shared POS or sell-out data are increasingly part of the commercial discussion.

-

Service failures in last-mile or cold-chain now travel fast through social media and B2B networks, putting more pressure on these wholesalers.

E-Commerce And Foodservice Expansion

The next phase for Germany’s big distributors is a blend of e-commerce and out-of-home growth.

B2B e-commerce and online assortments

Most leading wholesale groups now run full online catalogues with customer-specific pricing and promotions.

-

Metro offers digital solutions that allow customers to order online and choose between delivery or in-store collection, often combined with invoice and budget tools for business accounts.

-

Transgourmet and CHEFS CULINAR provide online ordering for thousands of SKUs, including menu planning, allergen information, and specification downloads for institutional buyers.

-

Lekkerland uses digital platforms to help small retailers manage complex ranges – for example, tobacco regulations, promotions, and seasonal confectionery – while also testing new formats like unattended solutions at charging parks.

For a buyer or export manager, this means product content has to be ready for B2B e-commerce: correct data sheets, images, allergen lists, and GS1-aligned information.

Distributors are less willing to “fix” that data themselves.

This is also where internal linking back to Supermarket Suppliers Germany and Buyer Contacts Germany helps: the same people who manage retail listings often now own B2B portal content as well.

Growing Overlap With Retail And Out-Of-Home

The line between retail and foodservice keeps blurring.

-

Supermarkets open in-store cafés and hot food counters.

-

Petrol stations add seating and extended menus.

-

Discounters experiment with bakery, snack, and coffee solutions near the entrance.

Distributors sit in the middle of this shift:

-

Bela and Metro increasingly serve both classic stores and “food-to-go” concepts in the same network.

-

Transgourmet and CHEFS CULINAR serve large caterers that also bring shoppers back into hypermarkets and shopping centres.

-

Lekkerland connects petrol retail with new mobility patterns, such as charging parks, where on-the-go food and drink are central to the offer.

For FMCG brands that already work with the big German grocery groups, these distributors are a natural second step.

They can extend reach into canteens, forecourts, and travel hubs without creating totally separate supply chains.

What This Means For Buyers And Suppliers

If you are mapping the top FMCG distributors Germany for a 2025–2026 strategy, three questions help structure your shortlist:

-

Channel focus

Are you mainly targeting supermarkets and regional grocers, or is your growth more in convenience and foodservice?

-

Geographic focus

Do you need national coverage, or is a strong regional player in the north, west, or south more realistic for the first phase?

-

Service and data needs

Do you need menu development, category management, and digital reporting, or is “case on pallet” enough at this stage?

Metro, Lekkerland, Transgourmet, Bela, and CHEFS CULINAR all have different answers to those questions.

The right mix is rarely one partner.

Most successful suppliers work with a small group of distributors that cover different pieces of the map.

Conclusion: A Concentrated But Evolving Backbone

Germany’s retail shelves may look fragmented to shoppers, but the wholesale networks behind them are surprisingly concentrated.

Metro sets the tone in national cash-and-carry and delivery.

Lekkerland dominates on-the-go convenience.

Transgourmet and CHEFS CULINAR shape foodservice expectations in catering and institutions.

Bela holds a powerful regional position in the north with a unique mix of wholesale and own retail.

For FMCG and private-label suppliers, understanding these networks is now just as important as understanding the headline retail market shares.

It decides how your product reaches forecourts, canteens, quick-service sites, and regional supermarkets – not just the big hypermarkets.

As e-commerce, sustainability, and food-to-go formats grow, the top FMCG distributors Germany relies on will keep investing in data, logistics, and service.

For buyers and commercial teams, staying close to these changes is now part of the job, not an optional extra.