Belgium plays a quiet but strategically important role in the European food and retail trade-show circuit.

It is not Europe’s largest exhibition market.

But it sits at the heart of the Benelux region, with direct commercial links into France, Germany, the Netherlands, and Luxembourg. For exporters, FMCG suppliers, packaging firms, and retail technology providers, Belgium functions as a high-signal meeting point rather than a volume-driven showcase.

Belgian trade shows are also known for a very specific “vibe”.

They are typically more compact, easier to navigate, and more business-focused than the mega-events in Germany or France. Buyers attend with clearer agendas, meetings are easier to secure, and post-show follow-up tends to move faster.

For suppliers targeting Belgian supermarkets, or using Belgium as a gateway into wider Benelux retail, this difference matters. It often determines whether a show produces real commercial leads or just brand exposure.

This guide maps the most relevant food trade shows Belgium 2025 and 2026, explains which events truly matter for supermarkets and FMCG, and shows how Belgian fairs fit into a wider European sourcing calendar.

Belgium’s Position In The Benelux Trade-Show landscape

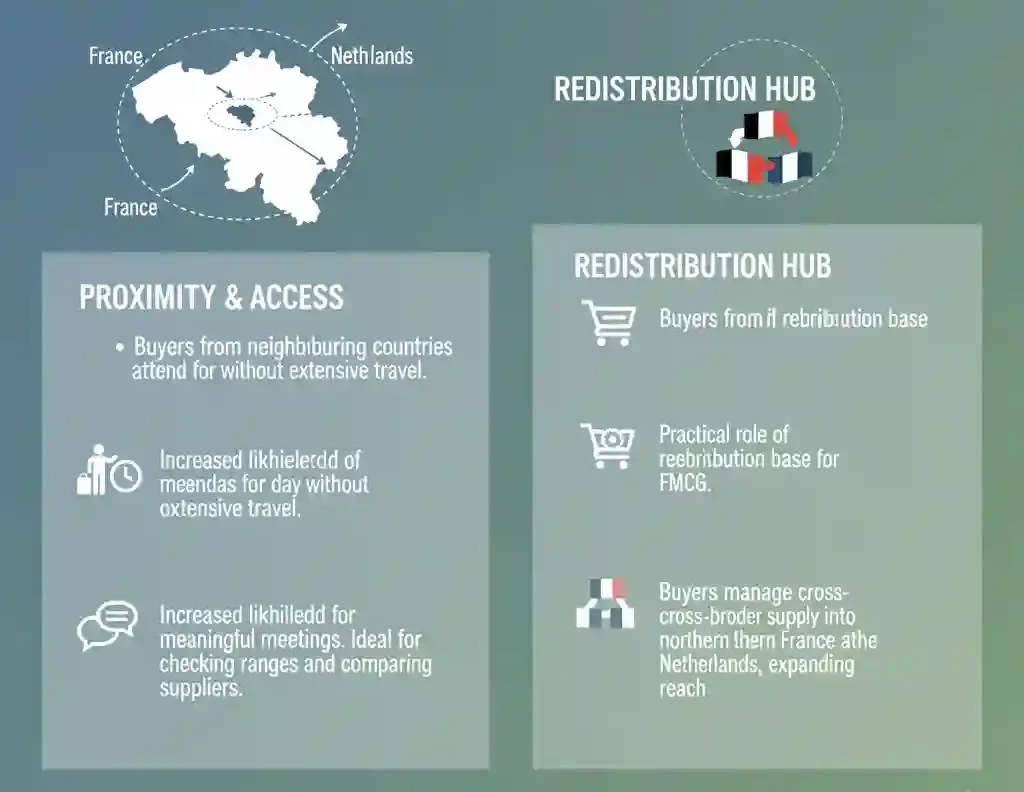

Belgium’s strength lies in access rather than scale.

While Germany and France dominate in terms of sheer exhibition size, Belgian shows benefit from proximity. Buyers from neighbouring countries can attend for one day without extensive travel, which increases the likelihood of meaningful meetings.

This matters most for suppliers operating across Belgian FMCG — from ambient grocery and chilled foods to frozen, confectionery, and beverages. Category managers often use Belgian trade shows between larger European fairs to check ranges, compare suppliers, and pick up conversations already in progress.

Belgium also plays a practical role as a redistribution base.

Many buyers responsible for Belgian fresh produce and protein also manage cross-border supply into northern France and the Netherlands. That gives Belgian trade shows a reach that goes well beyond the domestic market.

Key Food And Retail Trade Shows In Belgium (2025–2026)

The table below forms the backbone of the Belgian trade-event calendar.

It reflects verified editions, realistic buyer attendance, and practical relevance for exhibitors planning 2025 and 2026.

| Event name | City | Time of year | Type | Best suited for |

|---|---|---|---|---|

| Horeca Expo | Ghent | November | Foodservice & hospitality | Horeca buyers, wholesalers, foodservice brands |

| ISM Benelux (regional format) | Antwerp | January | Confectionery & snacks | Benelux distributors, impulse specialists |

| Tavola | Kortrijk | March (biennial) | Fine food & premium | Premium retail, speciality buyers |

| Seafood Expo Global | Brussels | April / May | Seafood | Retail seafood buyers, importers, exporters |

| BioXpo | Wallonia | June | Organic food | Organic producers, specialist retail |

| Empack Belgium | Mechelen | October | Packaging & logistics | Packaging suppliers, FMCG operations |

| RetailDetail Night / Congress | Antwerp | November | Retail strategy | Retail executives, FMCG brand leaders |

While Brussels remains the capital, many high-impact B2B fairs take place in Ghent (Flanders Expo) and Mechelen (Nekkerhal). These venues are often preferred for professional trade events due to better logistics, access, and exhibitor layouts.

Major B2B Food And Retail Fairs

These are the Belgian shows most likely to justify a serious exhibition budget and dedicated sales teams.

Horeca Expo (Ghent)

Horeca Expo is Belgium’s flagship foodservice exhibition and a long-standing fixture in the national calendar.

The next confirmed edition runs November 16–19, 2025.

Attendance is heavily domestic, with strong representation from horeca operators, catering wholesalers, and foodservice distributors. Supermarket sourcing teams are not the main audience, but many Belgian supermarket groups operate foodservice, convenience, or hybrid formats, making Horeca Expo relevant for crossover suppliers.

For brands supplying ready meals, beverages, bakery, frozen, or ingredients that work across channels, Horeca Expo often supports later retail conversations.

Seafood Expo Global (Brussels)

Seafood Expo Global is Belgium’s most internationally significant food trade show.

Confirmed dates include May 6–8, 2025 and April 21–23, 2026.

It is the world’s largest seafood event, with a strong focus on retail sourcing. Buyers attend from across Europe, the UK, Asia, and North America. Private label talks are common, alongside discussions around frozen and chilled formats and longer-term supply agreements.

For suppliers working across seafood, fresh produce, and protein in Belgium, this show is essential rather than optional.

Tavola (Kortrijk)

Tavola is a premium, curated exhibition focused on fine food and value-added products.

It is a biennial show, with the next confirmed edition taking place March 15–17, 2026.

Scale is limited, but quality is high. Buyers attend with time to talk, which is rare at larger European fairs. Tavola works particularly well for exporters targeting premium positioning, artisanal products, or differentiated concepts suited to specialty and upmarket retail.

Specialist And Regionally Focused Events

These shows are more targeted and work best with clear expectations.

ISM Benelux (regional format)

ISM Benelux is a regional extension of the wider confectionery trade network.

It should not be confused with ISM Cologne in terms of scale.

Its value lies in access to Benelux distributors, wholesalers, and impulse specialists, rather than global category managers. For suppliers testing the region or building distributor relationships, the local focus can be an advantage.

BioXpo (Wallonia)

BioXpo serves the organic and natural food segment, with a strong regional audience.

Scale is modest, but relevance is high for organic producers targeting independent retailers, specialist chains, and alternative distribution models.

For exporters, BioXpo is more about positioning and early discussions than immediate volume placement.

Empack Belgium (Mechelen)

Empack Belgium is not a food show, but it is highly relevant to food and FMCG suppliers.

The October 22–23, 2025 edition in Mechelen will again focus on packaging, logistics, automation, and sustainability. Retailers and manufacturers attend to address recyclability targets, cost pressures, and efficiency challenges.

For suppliers active in Belgian packaging solutions, Empack often delivers more qualified leads than broader packaging exhibitions.

Which Shows Matter Most For Supermarkets And FMCG

Not every Belgian event delivers equal value for supermarket-focused suppliers.

Based on buyer behaviour and sourcing patterns, the following events matter most for Belgian FMCG and retail programmes:

Seafood Expo Global

The most important sourcing event for seafood, frozen, and chilled categories. Retail buyers attend with structured agendas and decision-making authority.

Tavola

Highly effective for premium, differentiated food concepts. Buyers use Tavola to refresh ranges and test products that can justify higher shelf prices.

Empack Belgium

Increasingly critical as packaging becomes a strategic lever for cost, sustainability, and compliance. Retailers attend with specific operational challenges.

Horeca Expo

Secondary for core grocery, but relevant for suppliers operating across retail and foodservice channels, especially in convenience-led formats.

Practical tips for exhibitors in Belgium

Belgian trade shows reward clarity and preparation more than scale.

Language

English is widely accepted, but providing materials in French and Dutch is a clear competitive advantage. Buyers notice localisation.

Samples and documentation

Belgian buyers expect quick evaluation. Clear ingredient lists, certifications, shelf-life data, and logistics information are often more important than brand storytelling.

Stand design

Simple, professional, and open works best. Over-designed stands rarely add value in Belgium’s pragmatic trade-show culture.

Targeting buyers

Know who you are there to meet. National chains, regional groups, wholesalers, and importers attend different events for different reasons.

Follow-up discipline

Belgian buyers move fast after shows. Pricing, specifications, and samples sent within days materially increase the chance of conversion.

How Belgian shows fit into the wider European calendar

Belgian trade shows do not replace Europe’s largest exhibitions.

They complement them.

Most experienced suppliers use Belgian events between Anuga, SIAL, and PLMA to maintain momentum, deepen relationships, or advance discussions already started elsewhere. Their strength lies in access, focus, and efficiency rather than scale.

For exporters planning a European calendar, Belgium works best as a precision market, not a broadcast one.

Used correctly, Belgian shows deliver strong returns with lower cost, less noise, and better buyer access.