Denmark’s fresh produce sector is driven by a mix of established importers, growers, processors, and distributors that supply supermarkets, foodservice operators, and export partners across Northern Europe. While the market is smaller than Germany or France, Denmark has become a high-value, quality-focused sourcing destination with strong logistics integration and strict retail compliance standards.

This ranking highlights the country’s leading fresh produce companies based on revenue scale, operational footprint, supply chain reach, and relevance for professional B2B buyers.

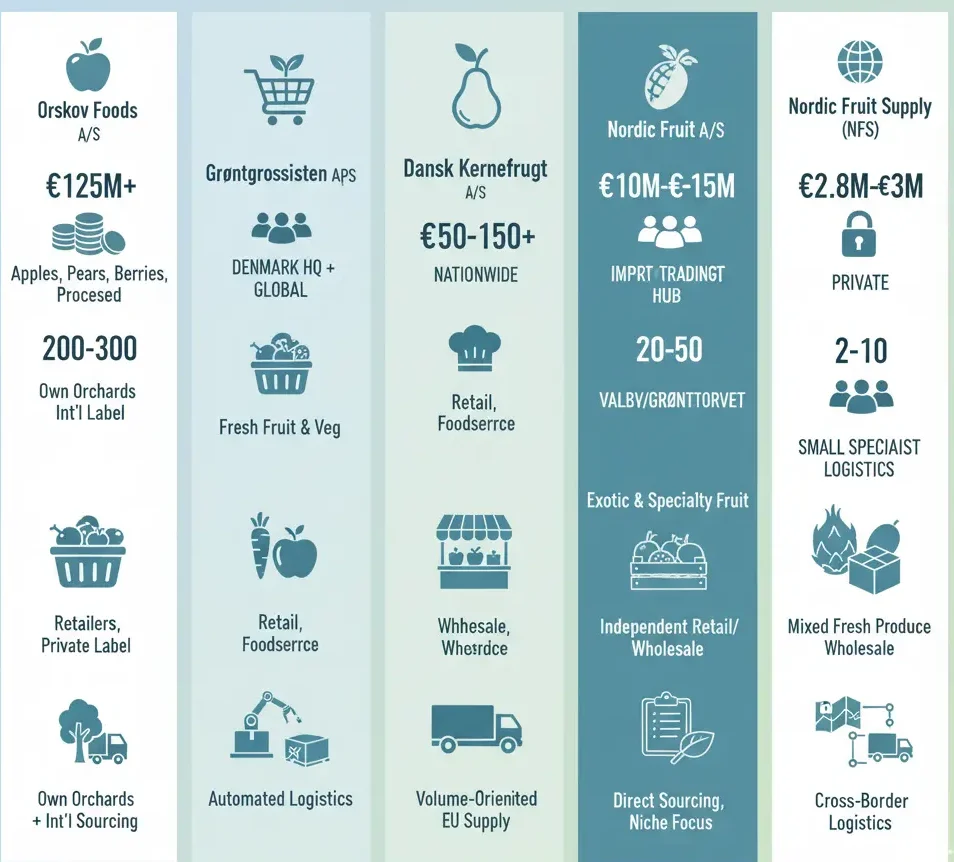

Company Overview (2025/26 Estimates)

| Rank | Company | Revenue | Employees | Primary Operations |

|---|---|---|---|---|

| 1 | Orskov Foods A/S | €125M+ | 200–300 | Production, processing, retail supply |

| 2 | Grøntgrossisten ApS | €35M+ | 50–150 | Nationwide distribution |

| 3 | Dansk Kernefrugt A/S | €10M–€15M | 20–50 | Wholesale & import/export |

| 4 | Nordic Fruit A/S | €2.8M–€3M | 2–10 | Specialty imports |

| 5 | Nordic Fruit Supply (NFS) | Private | Small team | EU logistics sourcing |

Top Product Categories & Market Coverage

| Company | Main Categories | Supply & Export Reach |

|---|---|---|

| Orskov Foods A/S | Apples, pears, berries, processed fruit | Scandinavia, EU |

| Grøntgrossisten ApS | Fruit and vegetables | Denmark-wide retail & foodservice |

| Dansk Kernefrugt A/S | Imported fruit categories | Copenhagen wholesale & national distribution |

| Nordic Fruit A/S | Exotic and specialty produce | Danish wholesale |

| Nordic Fruit Supply | Mixed seasonal produce | Nordic region and EU hubs |

Orskov Foods A/S

Orskov Foods is Denmark’s largest fresh produce company by revenue and one of the strongest Nordic fruit suppliers. The company operates across production, sourcing, processing, and distribution, with core strengths in apples and pears.

In recent years, Orskov Foods has expanded into fruit processing and value-added production, including juices and puree applications. This vertical integration strategy helps reduce food waste, stabilise margins, and improve supply chain efficiency. The company supplies both branded and private label programs to major Nordic retailers and wholesale buyers.

Revenue: €125M+

Employees: 200–300

Branches: Denmark headquarters with overseas growing operations

Category coverage: Apples, pears, berries, processed fruit

Buyer relevance: Supermarket chains and private label supply contracts

Production scale: Own orchards combined with international sourcing

Grøntgrossisten ApS

Grøntgrossisten is one of Denmark’s most important fresh fruit and vegetable distributors. The company operates a nationwide supply network serving supermarkets, catering suppliers, and professional kitchens.

To address labour shortages and efficiency demands, Grøntgrossisten has invested heavily in automated cold storage systems and warehouse robotics. These upgrades allow faster order picking, improved cold chain stability, and higher daily throughput.

Its ability to consolidate multi-origin sourcing into one supply channel makes it a key partner for retail buyers seeking simplified procurement.

Revenue: €35M+

Employees: 50–150

Branches: Nationwide distribution footprint

Category coverage: Fresh fruit and vegetables

Buyer relevance: Retail chains, foodservice operators

Supply scale: Multi-origin sourcing with automated logistics

Dansk Kernefrugt A/S

Dansk Kernefrugt remains a stable mid-sized produce wholesaler with strong positioning at Copenhagen’s wholesale produce market (Grønttorvet). The company specialises in fruit import, redistribution, and wholesale trade.

Its location and market integration allow it to serve independent retailers, foodservice distributors, and regional wholesalers efficiently. Dansk Kernefrugt continues to operate as a volume-oriented supplier with strong supplier relationships across European growing regions.

Revenue: €10M–€15M

Employees: 20–50

Branches: Valby operations base

Category coverage: Imported fruit categories

Buyer relevance: Wholesale buyers and foodservice supply

Supply scale: National distribution reach

Nordic Fruit A/S

Nordic Fruit operates as a specialist importer focused on exotic and premium produce categories. Although smaller in workforce size, the company plays an important role supplying niche fruit products to wholesalers and selected retail partners.

Its lean structure allows flexibility in sourcing, fast reaction to seasonal changes, and closer cooperation with international growers. Nordic Fruit is positioned for buyers that prioritise category specialisation over mass-volume sourcing.

Revenue: €2.8M–€3M

Employees: 2–10

Branches: Import trading hub in Denmark

Category coverage: Exotic and specialty fruit

Buyer relevance: Independent retail and wholesale buyers

Supply scale: Direct sourcing partnerships

Nordic Fruit Supply (NFS)

Nordic Fruit Supply operates as a specialised sourcing and logistics partner focused on EU produce flows. The company works across Denmark and major European logistics corridors to coordinate seasonal supply programs.

Its strength lies in cross-border sourcing coordination, quality compliance support, and flexible delivery planning. NFS supports retailers and wholesalers that require adaptable supply chains rather than fixed-volume contracts.

Revenue: Private

Employees: Small specialist team

Branches: Denmark with EU logistics integration

Category coverage: Mixed fresh produce portfolio

Buyer relevance: Retail sourcing programs and wholesale distribution

Supply scale: Cross-border logistics coordination

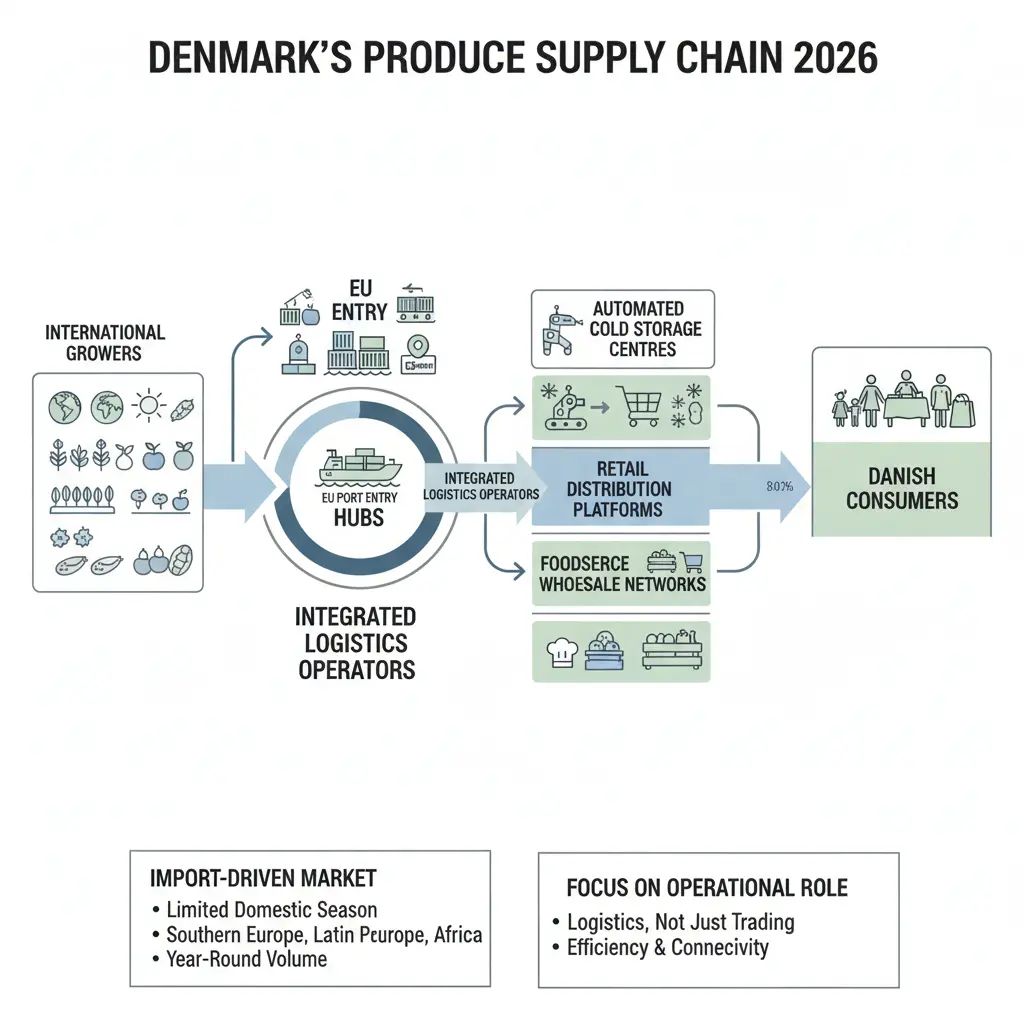

How Denmark’s Produce Supply Chain Operates in 2026

Denmark’s produce market remains heavily import-driven due to limited domestic growing seasons. Southern Europe, Latin America, and African growing regions supply much of the year-round fruit and vegetable volume.

Fresh produce companies now function as integrated logistics operators connecting:

International growers

EU port entry hubs

Automated cold storage centres

Retail distribution platforms

Foodservice wholesale networks

This operational role has become more important than simple trading activity.

Retail Contract Requirements

Danish supermarket groups now require suppliers to meet advanced compliance standards, including:

SKU-level ESG documentation

Carbon footprint reporting

Full product traceability

Packaging sustainability reporting

Major buyers increasingly favour suppliers that operate digital traceability platforms capable of integrating production, logistics, and environmental reporting in real time.

Sustainability and Reporting Pressure

Sustainability compliance is no longer optional. Produce suppliers must document:

Transport emissions

Packaging material usage

Food waste handling

Supplier audit compliance

Companies that invested early in traceability software and reporting infrastructure now hold competitive advantage during retail tender processes.

Automation and Cold Chain Investment

Denmark has emerged as a regional hub for automated cold storage solutions. Distribution companies continue investing in:

Robotics-based picking systems

Smart temperature monitoring

AI-assisted inventory forecasting

These upgrades improve delivery reliability while addressing labour availability challenges.

Market Outlook

Denmark’s fresh produce market will remain stable and premium-focused. Retailers are strengthening control over supply standards while maintaining high demand for year-round product availability.

For growers and exporters, Denmark offers:

Stable purchasing volumes

High-quality retail demand

Strong payment reliability

Structured long-term contracts

Final Takeaway

The leading fresh produce companies in Denmark are no longer simple traders. They now operate as logistics platforms, sustainability compliance partners, and retail integration specialists serving both Denmark supermarket buying systems and international sourcing networks.

For suppliers, exporters, and buyers, these companies form the backbone of Denmark’s modern produce supply chain, supporting private label programs, fresh food brands, and high-volume retail distribution. Their role will continue shaping how fruit and vegetables move through the Nordic grocery market in the years ahead.

Editor’s Note: This ranking is based on publicly available company filings, industry disclosures, and market information available at the time of publication. Revenue figures are indicative estimates where full financial data is not publicly disclosed. The list reflects relative market scale and operational presence rather than exact audited financial performance.