Denmark is one of Northern Europe’s most important packaging hubs. The country combines advanced manufacturing, strong export links, and early adoption of sustainability standards. For supermarkets and food brands, Danish packaging suppliers play a critical role in how products reach shelves, how packaging complies with recycling rules, and how retailers communicate sustainability to shoppers.

This ranking focuses on food retail exposure, sustainability innovation, and international reach. All revenues have been standardised into EUR for consistency (using an approximate conversion rate of 1 EUR ≈ 7.45 DKK). Where multinational groups operate in Denmark, the figures reflect Danish legal entity activity, not total global turnover.

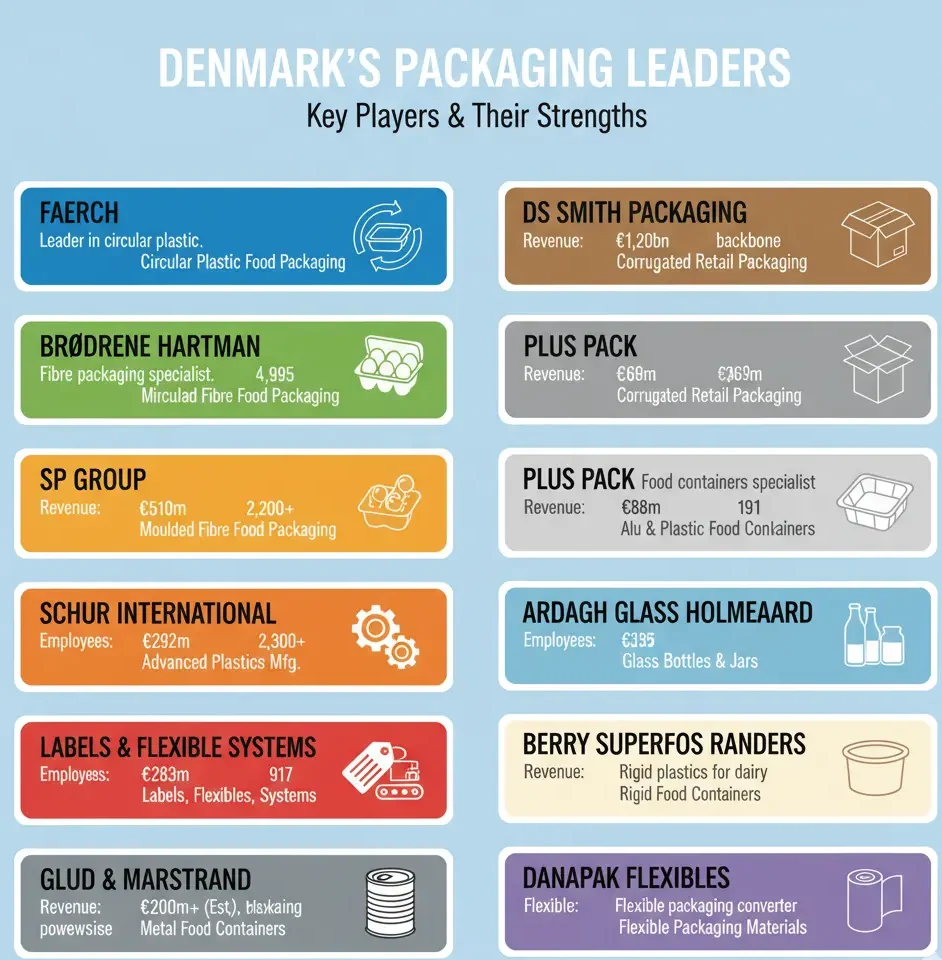

Company Overview (Standardised to EUR)

| Rank | Company | Revenue (EUR) | Employees | Branches / Footprint |

|---|---|---|---|---|

| 1 | Faerch | €1.20bn | 4,995 | Global manufacturing network incl. Denmark |

| 2 | Brødrene Hartmann | €510m | 2,200+ | Global moulded-fibre operations |

| 3 | SP Group | €392m | 2,300+ | Multi-site Nordic and European footprint |

| 4 | Schur International | €283m | 917 | International packaging group |

| 5 | Glud & Marstrand (Envases Group) | €200m+ (est.) | 1,200+ | Global metal packaging production |

| 6 | DS Smith Packaging Denmark | €169m | 669 | Danish sites + DS Smith Europe network |

| 7 | Plus Pack | €88m | 191 | Denmark base with export markets |

| 8 | Ardagh Glass Holmegaard | €87m | 335 | Danish glass manufacturing site |

| 9 | Berry Superfos Randers | €84m | 295 | Denmark plant + Berry Global network |

| 10 | Danapak Flexibles | €44m | 93 | Denmark-based flexible packaging converter |

Note: Revenues are rounded. Some companies report at group or subsidiary level. Ranking reflects packaging activity connected to Denmark.

Table 2: Product Types and Sustainability Focus

| Company | Main Product Types | Sustainability Focus |

|---|---|---|

| Faerch | Food trays, ready-meal packs, protein packaging | Circular PET, recycled content, closed-loop food packaging |

| Hartmann | Moulded fibre egg packaging | Fibre substitution, renewable raw materials |

| SP Group | Plastic components, packaging-related production | Material efficiency, industrial process optimisation |

| Schur International | Labels, flexible packaging, packaging systems | Lightweighting, recyclable materials, packaging efficiency |

| Glud & Marstrand | Metal tins and containers | Metal recyclability, long-life packaging formats |

| DS Smith Denmark | Corrugated cases, shelf-ready packaging | Fibre recycling, circular packaging design |

| Plus Pack | Aluminium and plastic food containers | Lightweight materials, recyclability improvements |

| Ardagh Glass | Glass bottles and jars | Closed-loop glass recycling |

| Berry Superfos | Rigid plastic tubs and containers | Recycled plastics integration |

| Danapak Flexibles | Flexible films and laminates | Mono-material development, downgauging |

1) Faerch — Denmark’s Packaging Leader

Faerch is the clear market leader in Danish packaging by revenue and influence. The company sits at the centre of Europe’s shift toward circular plastic packaging, especially in supermarket-ready food trays and ready-meal containers.

Following its integration into A.P. Moller Holding and the acquisition of Paccor, Faerch expanded both capacity and technological capability. Today, it supplies packaging used across fresh meat, poultry, ready meals, dairy alternatives, and chilled convenience categories.

For supermarkets, Faerch’s importance goes beyond volume. Retailers increasingly rely on Faerch’s closed-loop PET tray systems, where packaging is designed to be collected, recycled, and reused for food-grade applications.

Key facts:

Revenue: €1.20bn

Employees: 4,995

Core strength: circular plastic food packaging

2) Brødrene Hartmann — Fibre Packaging Specialist

Hartmann is one of Denmark’s most established packaging manufacturers and a global leader in moulded fibre packaging. The company is best known for egg cartons, but its fibre technology also supports protective food packaging formats.

As retailers reduce plastic usage in secondary and primary packaging, Hartmann’s fibre-based solutions have gained strong momentum. Egg packaging remains one of the highest-volume packaging categories in supermarkets, giving Hartmann a stable base of recurring demand.

Hartmann’s sustainability positioning is closely tied to renewable materials and fibre recyclability, aligning well with EU packaging regulations and retailer sustainability commitments.

Key facts:

Revenue: €510m

Employees: 2,200+

Core strength: moulded fibre food packaging

3) SP Group — Diversified Plastics with Packaging Exposure

SP Group is not a pure-play packaging company, but its scale and plastics manufacturing capabilities give it an important role in Denmark’s packaging ecosystem.

The group operates across multiple industrial sectors, including healthcare, cleantech, and packaging-related components. Within grocery supply chains, SP Group contributes to packaging parts, technical plastics, and specialised production that supports food-grade packaging systems.

Its diversified revenue base provides financial stability, while packaging-related business benefits from advanced polymer processing and quality control infrastructure.

Key facts:

Revenue: €392m

Employees: 2,300+

Core strength: advanced plastics manufacturing

4) Schur International — Labels and Flexible Packaging Systems

Schur International represents Denmark’s strongest integrated packaging systems provider. The group operates across labels, flexible packaging, and packaging automation equipment.

In supermarket environments, Schur’s influence is seen in product labelling, flexible packs for dry goods and snacks, and packaging equipment used by food manufacturers. Labelling is particularly critical as retailers expand private label ranges and introduce sustainability messaging on-pack.

Schur’s strength lies in combining packaging materials with system solutions that improve efficiency and reduce waste in production environments.

Key facts:

Revenue: €283m

Employees: 917

Core strength: labels, flexibles, and packaging systems

5) Glud & Marstrand — Metal Packaging Powerhouse

Glud & Marstrand, part of the Envases Group, is one of Denmark’s largest industrial employers in packaging and a global leader in metal containers.

Its tins and metal packaging formats are widely used for cookies, biscuits, seafood, meat products, and speciality food categories. Metal packaging remains highly relevant for supermarkets because of its long shelf life, strong barrier properties, and near-infinite recyclability.

Although metal packaging receives less attention than plastics and fibre, it continues to play a critical role in ambient grocery categories.

Key facts:

Revenue: €200m+ (estimated)

Employees: 1,200+

Core strength: metal food containers

6) DS Smith Packaging Denmark — Corrugated Backbone of Retail Logistics

DS Smith’s Danish operation forms part of one of Europe’s largest fibre-based packaging groups. In Denmark, the company focuses on corrugated cases, shelf-ready packaging, and retail transit solutions.

Corrugated packaging is essential to supermarket logistics. Every pallet movement, store delivery, and shelf replenishment cycle depends on strong secondary packaging. As retailers redesign transport packaging to reduce plastic use, fibre-based solutions remain central.

DS Smith’s Danish business benefits from access to the group’s European recycling and fibre supply network.

Key facts:

Revenue: €169m

Employees: 669

Core strength: corrugated retail packaging

7) Plus Pack — Food Containers Specialist

Plus Pack is well known in Denmark and across Europe for aluminium and plastic food containers. The company serves both retail and foodservice markets, with strong presence in ready meals, deli counters, and takeaway packaging.

For supermarkets, Plus Pack’s packaging supports chilled convenience categories and in-store prepared food sections. Aluminium packaging remains popular for hot food applications and oven-ready products.

The company continues to work on lightweighting and recyclability improvements to align with EU packaging targets.

Key facts:

Revenue: €88m

Employees: 191

Core strength: aluminium and plastic food containers

8) Ardagh Glass Holmegaard — Glass Packaging Anchor

Ardagh’s Holmegaard facility anchors Denmark’s glass packaging production. Glass remains essential for beverages, sauces, preserves, and premium food products.

From a sustainability perspective, glass benefits from closed-loop recycling systems and strong consumer acceptance. Many retailers continue to position glass packaging as a premium and environmentally favourable option for selected categories.

Although the Danish site represents only part of Ardagh’s global operations, its local production supports regional beverage and food manufacturers.

Key facts:

Revenue: €87m

Employees: 335

Core strength: glass bottles and jars

9) Berry Superfos Randers — Rigid Plastics for Dairy and Deli

Berry Superfos operates one of Denmark’s most important rigid plastics plants in Randers. The site produces tubs and containers widely used in dairy products, spreads, salads, and chilled foods.

Rigid plastic packaging remains a high-volume category in supermarkets. Berry’s strength lies in integrating recycled plastic content while maintaining food safety standards.

As private label ranges expand, demand for reliable container suppliers continues to grow.

Key facts:

Revenue: €84m

Employees: 295

Core strength: rigid food containers

10) Danapak Flexibles — Flexible Packaging Converter

Danapak focuses on flexible packaging formats such as films and laminates used across snack foods, dry goods, and processed food categories. The company is owned by Schur Flexibles but operates independently from Schur International.

Flexible packaging faces growing regulatory pressure to improve recyclability and reduce material complexity. Danapak’s role is to adapt film structures to meet these new standards while maintaining shelf performance.

Although smaller than other players, Danapak remains relevant in Denmark’s packaging supply chain.

Key facts:

Revenue: €44m

Employees: 93

Core strength: flexible packaging materials

Why Denmark’s Packaging Market Matters for Supermarkets

For retailers, packaging is no longer just a cost item. It directly affects:

Shelf appearance and brand perception

Regulatory compliance

Waste management costs

Consumer sustainability expectations

Denmark’s packaging suppliers are deeply integrated into European retail supply chains. Many of the companies on this list serve supermarket groups across Germany, Scandinavia, the Benelux region, and the UK.

The strongest growth areas remain:

Fibre-based packaging

Circular plastic systems

Recyclable mono-material formats

Shelf-ready retail packaging

These trends are reshaping procurement decisions across grocery retail.

Conclusion

Denmark’s packaging market is tightly linked to how Denmark supermarket chains build their assortments and manage in-store sustainability targets. From circular plastic trays and fibre egg cartons to corrugated transit cases and glass bottles, these suppliers shape what reaches shelves every day.

As Denmark private label ranges continue to expand, retailers are relying more on domestic and regional packaging partners that can deliver cost control, regulatory compliance, and sustainable materials at scale. This makes packaging no longer just a supply function, but a strategic tool for differentiation and brand positioning.

Looking ahead, companies that invest in recyclable materials, lightweight designs, and closed-loop systems will be best positioned to support Denmark’s grocery sector as consumer expectations and EU packaging rules continue to tighten.

Editor’s Note: This ranking is based on publicly available company reporting and the latest financial disclosures available at the time of writing. Revenues are rounded and standardised into EUR for consistency. Where companies operate as part of global groups, figures reflect Danish legal entities or Denmark-linked operations rather than total global turnover.